GBP/USD was on the back foot over Brexit and the lack of the BOE’s enthusiasm on raising interest rates. What’s next? The highlight of the upcoming week is the GDP report. Here are the key events and an updated technical analysis for GBP/USD.

Inflation reached 3% y/y in the UK and was not a surprise. Wages are looking better but retail sales are weak. Mark Carney weighed on Sterling by not really showing enthusiasm for raising rates. It will probably be a “one and done” in November. Merkel gave May a helping hand and helped the pound stabilize and not fall too deep. But can it last?

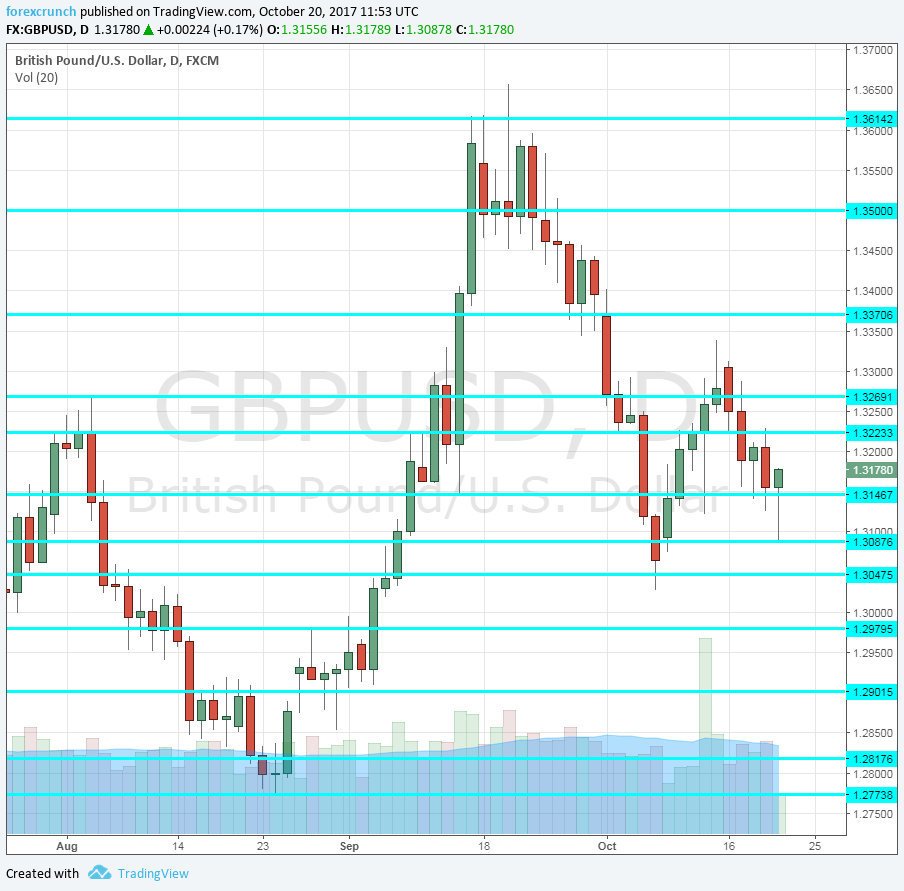

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- CBI Industrial Order Expectations: Monday, 10:00. The Confederation of British Industry has shown a drop in its diffusion index back in September: from 13 to 7 points. Nevertheless, the positive number represents expectations for increased order volume.

- GDP (first release): Wednesday, 8:30. The British economy grew at a slow pace in the first half of 2017, a quarterly rate of 0.3% in both Q1 and Q2. This is very different from 2016, which saw a much quicker growth rate. Brexit began biting, but a recession seems unlikely. Has the economy picked up in Q3? year over year growth, which was cruising above 2%, is now under this level. Another increase of 0.3% is forecast.

- High Street Lending: Wednesday, 8:30. The number of mortgages ticked up to 41.8K in August, among the banks associated. A similar level is likely now. The housing sector has seen growth stalling. A similar level of 41.9K is on the cards.

- CBI Realized Sales: Thursday, 10:00. CBI began the week and also closes it. The level of realized sales among wholesalers and retailers jumped to 42 points in September, far better than expected. This volatile indicator could point downwards now. A level of 14 is predicted.

GBP/USD Technical Analysis

Pound/dollar was under pressure from the outset, dropping to 1.3180 (mentioned last week).

Technical lines from top to bottom:

The recent cycle high of 1.3620 serves as strong resistance. 1.35 was the post-Brexit high and remains the top level.

It is followed by 1.3370 which capped the pair several times in 2016. The previous 2017 high of 1.3270 is the next barrier. 1.3225 was the high point of September.

It is followed by 1.3180, which capped the pair in July. 1.3120 served as resistance twice in the summer of 2017 and remains important.

Below, 1.3050 is a double top as seen during the spring of 2017. 1.2975 awaits on the lower side of 1.30.

Further below, 1.2890 separated ranges on the way down. It is followed by 1.2820 and 1.2775.

I remain bearish on GBP/USD

With unimpressive economic data and no prospects for a tightening cycle, the pound continues struggling, especially as Brexit talks are going nowhere fast.

Our latest podcast is titled Black gold shining and comparing QEs

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!