GBP/USD continues to slide and dropped 270 points last week. The pair closed at 1.2174. There are 10 events on the schedule. Here is an outlook on the major market-movers and an updated technical analysis for GBP/USD.

In the US, jobless claims again dropped and beat expectations. Retail sales were mixed but the Fed meeting minutes indicated that a December hike is a strong possibility. There were no major releases out of the UK.

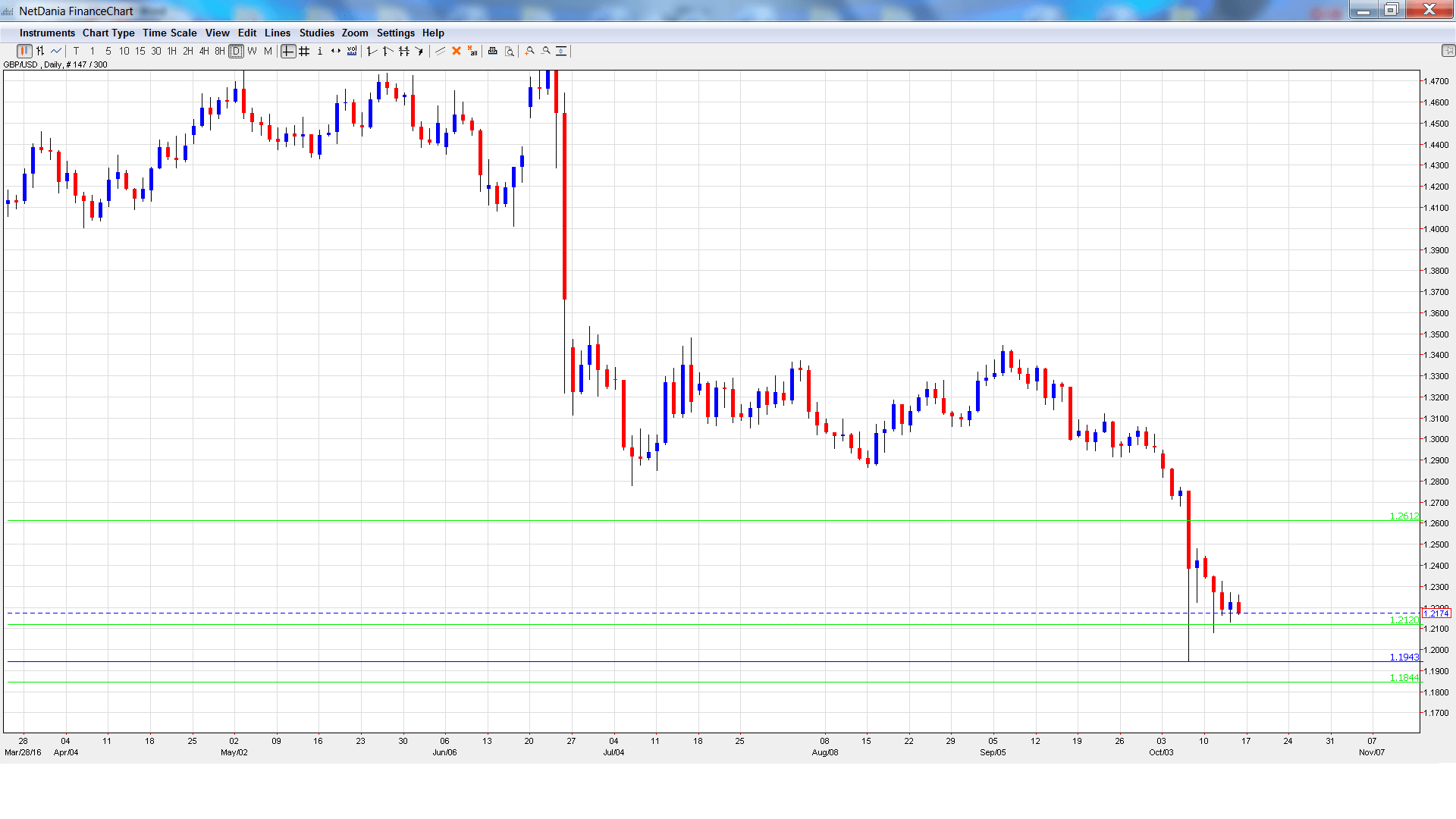

GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Rightmove HPI: Sunday, 23:01. This indicator provides a snapshot of the level of activity in the UK housing sector. The indicator bounce back in October, posting a gain of 0.7%. This marked its strongest reading in three months.

- CB Leading Index: Monday, 13:30. This index has little impact on currency movement, as most of the data was already released. The indicator improved to 0.0% in July and has failed to post a gain since April.

- CPI: Tuesday, 8:30. This is the most important inflation indicator and should be treated as a market mover. CPI has been improving, having posted two straight readings of 0.6%. The upward is expected to continue in September, with an estimate of 0.9%.

- PPI Input: Tuesday, 8:30. This indicator looks at inflation in the manufacturing sector. The indicator posted a weak gain of 0.2% in August, shy of the forecast of 0.6%. The estimate for September stands at 0.4%.

- RPI: Tuesday, 8:30. This index is similar to CPI but also includes housing costs. The indicator posted a strong gain of 1.8% in August, matching the forecast. The markets are expecting good news from the September report, with a forecast of 2.0%.

- Average Earnings Index: Wednesday, 8:30. This key indicator measures wage growth. The indicator posted a gain of 2.3% in July, beating the estimate of 2.1%. Another reading of 2.3% is expected in August.

- Claimant Count Change: Wednesday, 8:30. This is one of the most important releases and an unexpected reading can have a strong impact on the movement of GBP/USD. In August, the indicator rebounded with a small gain of 2.4 thousand. The estimate for the September report stands at 3.4 thousand. The unemployment rate has been pegged at 4.9% for four months and no change is expected in September.

- 10-year Bond Auction: Wednesday, Tentative. The yield on 10-year bonds has been dropping, and fell to 0.69% in September. Will we see an improvement in the October yield?

- Retail Sales: Thursday, 8:30. Retail Sales is closely monitored as it is the primary gauge of consumer spending. The indicator disappointed in August, posting a decline of 0.2%. The markets are expecting a turnaround in the September report, with an estimate of 0.3%.

- Public Sector Net Borrowing: Friday, 8:30. After a rare surplus in July, the UK posted a large deficit of GBP 10.1 billion in August. The deficit is expected to narrow to GBP 8.6 billion in the September release.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.2434 and quickly touched a high of 1.2444. It was all downhill from there, as the pair plunged to a low of 1.2080, testing support at 1.2120 (discussed last week). GBP/USD showed some improvement and closed the week at 1.2174.

Live chart of GBP/USD:

Technical lines from top to bottom

With GBP/USD continuing to post sharp losses last week, we begin at lower levels:

1.2620 was a cushion back in 1985.

1.2400 is next.

1.2120 was the low point in September 1984.

1.1943 is next.

1.1844 is the final support line for now.

I remain bearish on GBP/USD.

GBP/USD has not recovered from the recent “flash crash” and Brexit jitters could push the pound below the symbolic 1.20 level this week. The US economy continues to improve, buoyed by a red-hot labor market. A December rate is currently priced at 60%, while the BoE is moving in the opposite direction, with a rate cut likely next month. So, monetary divergence continues to favor the greenback.

Our latest podcast is titled Bold BOJ vs. Fearful Fed

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.