In the latest dollar storm, the biggest loser has undoubtedly been the euro. And what about other important currencies?

The team at Goldman Sachs analyzes cable and Aussie, and sees interesting technical patterns.

Here is their view, courtesy of eFXnews:

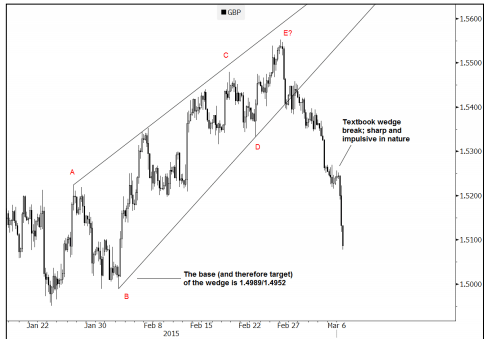

GBP/USD so far looked like a textbook wedge breakout, notes Goldman Sachs.

“Wedges are often corrective structures and therefore counter to their underlying trends. In this example the rising wedge was a bearish pattern and eventually resulted in a sharp move lower. The target derived from this pattern comes to ~1.4989-1.4952 (lows from Jan./Feb. ’15),” GS projects.

On a long-term charts, GS also thinks the market has potential to go even far below 1.50.

“Last year’s high (1.7192) failed at multi-decade resistance 1.6750-1.7178 where a number of historical peaks and troughs have converged since ~’96. It’s now worth considering whether the market can eventually move back down to the broader range lows,” GS notes.

“The past three major cycle troughs (in ’92, ’01 and ’09) were all set between 1.4168 and 1.3503. So while further confirmation is likely needed, it seems feasible that GBPUSD could eventually go far below 1.50/1.48,” GS argues.

Turning to AUD/USD, GS notes that while it came very close to testing the trend across the highs since Sep. ’14, the fact that it’s not yet broken its downtrend (which is now around 0.7857) is important because it implies that the underlying structure is still skewed lower.

“It’s now beginning to look like a bear flag type continuation pattern,” GS adds.

Under this set-up, GS projects that the current break below the base of the pattern could be what’s needed to develop momentum that will result in a target of ~0.7450.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.