- Gold prices remain under pressure near a weekly low and have declined for three days.

- Even though yields are at multi-month highs, the market struggles to find direction in Asia.

- China is facing an outbreak of the Coronavirus, and the city of Langfang near Beijing has been sealed off.

The gold forecast is strongly bearish as the risk appetite improves while the US yields rise amid the Fed’s rate hike speculations.

–Are you interested in learning more about making money with forex? Check our detailed guide-

While concerns over China over COVID-19 contributed to gold’s recent weakness during Tuesday’s Asian session, the yellow metal broke an intraday low near $1,926, down 1.22% on the day. In addition to mixed concerns over the Russian-Ukrainian crisis and rising US Treasury yields, the bears are also looking forward to tightening monetary policy for the Federal Reserve System (Fed).

Covid outbreak in China

There has been no relief from the latest data on the virus from China, which represents the biggest daily spike in COVID-19 infections. Reuters reported that China reported 3,602 new confirmed coronavirus cases on March 14, up from 1,437 the day before. A virus lockdown has also been announced in Langfang near Beijing by the Dragon Nation.

Russia-Ukraine woes

Sputnik reported on Tuesday that Oleksiy Arestovich, an adviser to Ukrainian President Volodymyr Zelenskyy’s office, had raised hopes of peace between Moscow and Kyiv within just two weeks. However, reports of a Russian drone over Poland and sanctions against Moscow and Russia and Belarus refusing to pay for energy in dollars are challenging sentiment and pushing gold prices lower.

In the Asian session, S&P 500 futures pared gains, while 10-year US Treasury yields were near their highest level since July 2019, at around 2.14% at press time.

Future geopolitical and Coronavirus news could entertain gold traders and immediately draw attention to China’s retail sales and industrial production data for February, which is forecast to increase 3.0% and 3.9% y/y versus 1.7% and 4.3%. In addition, keep an eye out for fresh intraday clues, US PPI President Lagarde’s speech, and ECB President Lagarde’s speech.

Fed’s rate hike speculations

On Wednesday, Jerome Powell is expected to support testimony about monetary policy hikes of 25 basis points. Inflation was supposed to be reined in by the Fed, but recession fears following Russia’s invasion of Ukraine have made it hard for the Fed to raise rates 50 basis points.

Investors were stunned by geopolitical tensions between Russia and Ukraine as the US said China was ready to support Russia militarily. However, investors are still seeking clarification regarding this issue. If this is true, the US could also impose sanctions on China, and the market could undergo a new wave of risk aversion.

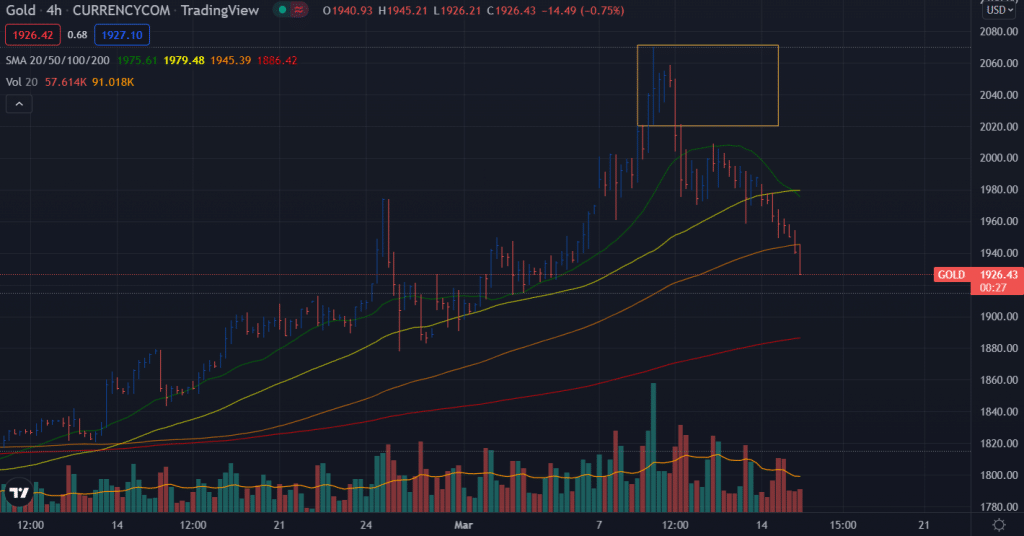

Gold price technical forecast: Bears eying monthly lows

The gold price continues to make new lower lows. First, the key support of $1,950 was easily broken. Now the metal is eying $1,910 and $1,900 levels as next targets. The bearish cross of 20 and 50 SMAs on the 4-hour chart points at further losses. Meanwhile, the 200-period SMA at $1,885 remains an ultimate target.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

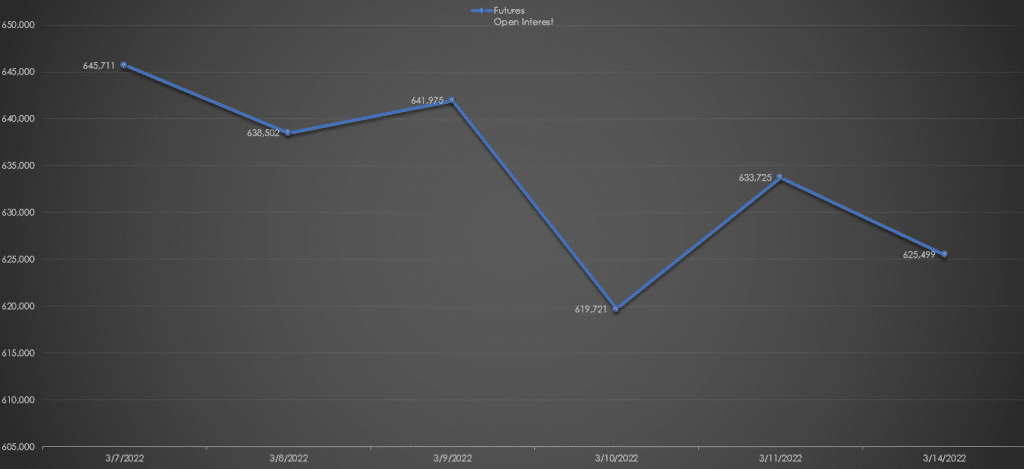

Gold forecast via daily open interest

As the gold price fell on Monday, the open interest declined too. It shows that the metal saw immense profit-taking while new sellers didn’t enter the market. This is an indicator of probable bounce back at any key level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money