- Gold price remains on the backfoot as the Fed’s rate hike bets strengthen after upbeat US NFP.

- Russian aggression provides room to the gold buyers being a safe haven asset.

- Risk catalysts and Fed’s meeting minutes will be key to watch.

The gold forecast remains neutral as the price fell early in Monday’s trading, but no further selling followed the bearish tick. After falling to a 4-day low earlier in the day, XAU/USD quickly reversed course and traded around $1920 just before the European session.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

Upbeat US jobs data

Friday’s US jobs report strengthened bets that the Fed will treat stubbornly high inflation with more vigor than it has in the past. As a result, the markets have already priced a rate hike of 100 basis points for the next two policy meetings. Due to this, the yield on two-year US Treasury bonds, which are highly sensitive to rate hike expectations, reached three-year highs and became a headwind for the non-yielding yellow metal.

As market expectations increased for a series of Fed rate hikes, the dollar got off to a good start on Monday. As a result of the NFP report, US bond yields rose to a yearly high, while 10-year bond yields rose, weakening investor demand.

Russian saga

As a result, investor sentiment improved, and XAU/USD acted as a safe haven, despite talks of additional sanctions against Russia. The recent massacre in Bucha has been blamed on Russian forces by Ukraine. Johnson Boris, the British prime minister, promised to intensify sanctions and military and humanitarian assistance for Ukraine. Christine Lambrecht, the German Minister of Defense, said that Russia should be banned from importing gas into Europe. However, a lack of confidence regarding Ukraine limited bullish market movement, while gold continued to be a safe-haven asset.

What’s next for the gold outlook?

Meanwhile, the stagnant price dynamics in US dollars were another factor favoring goods denominated in dollars. The mixed fundamentals call for caution when it comes to directional bets on XAU/USD. Awaiting the minutes of the Fed’s monetary policy meeting due Wednesday, investors may also sit on the sidelines. The price of gold might gain some momentum as a result of new geopolitical headlines, along with the movement of US bond yields and the US dollar.

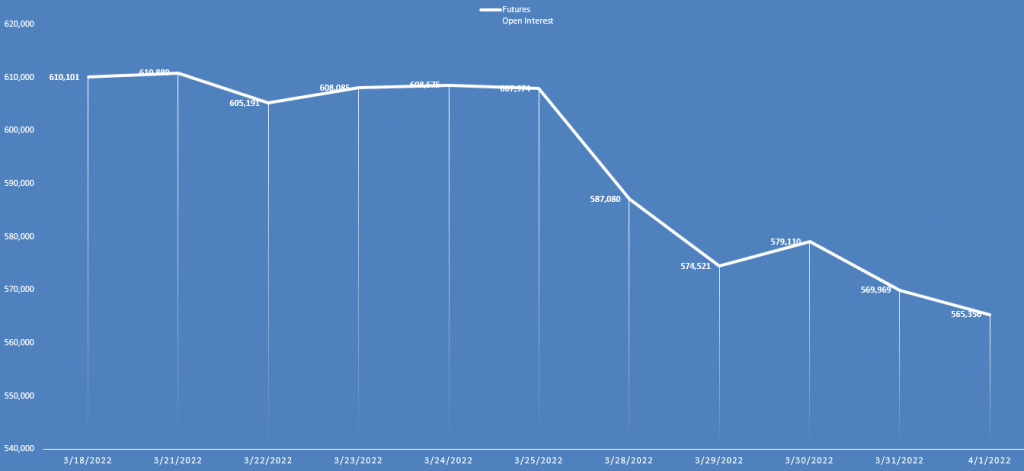

Gold forecast via daily open interest

The gold price fell on Friday, while the daily open interest also fell sharply. The price dropped due to profit-taking while new sellers didn’t enter the market.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

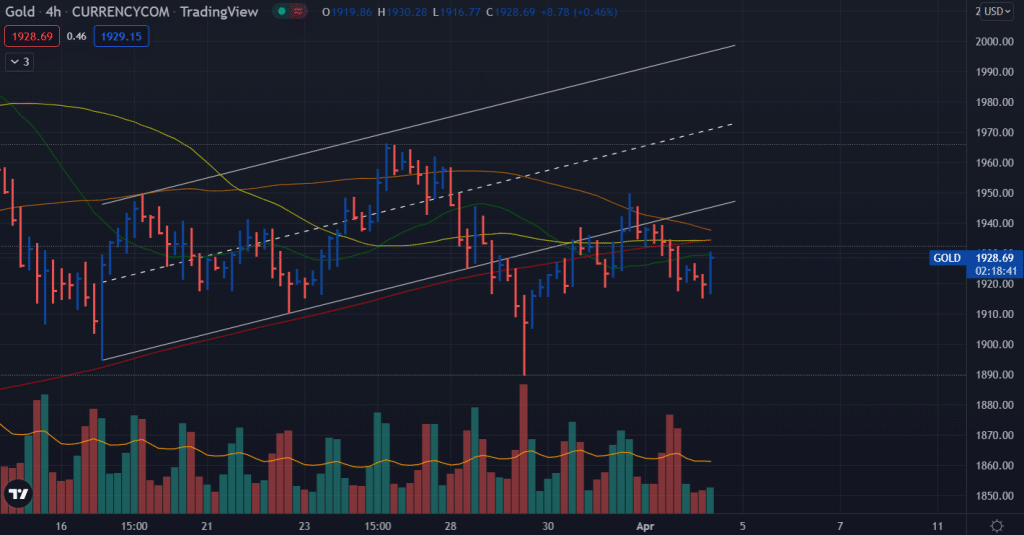

Gold technical forecast: Bulls attempting a breakout

The 4-hour chart shows that the price lies below the key SMAs after breaking below the flag pattern. Although the metal tested the broken structure but could not hold the gains. The bearish outlook will change only if the price closes above the key resistance of $1,950.

On the downside, the bears will attempt a breakout of the $1,900 level to test the previous swing lows around $1,892 ahead of $1,875.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money