- Gold continues bearishness on Monday after it sharply fell on Friday.

- Fedspeak to further provide impetus to the market.

- Technical consolidation may prolong after an abnormal fall and correction in gold.

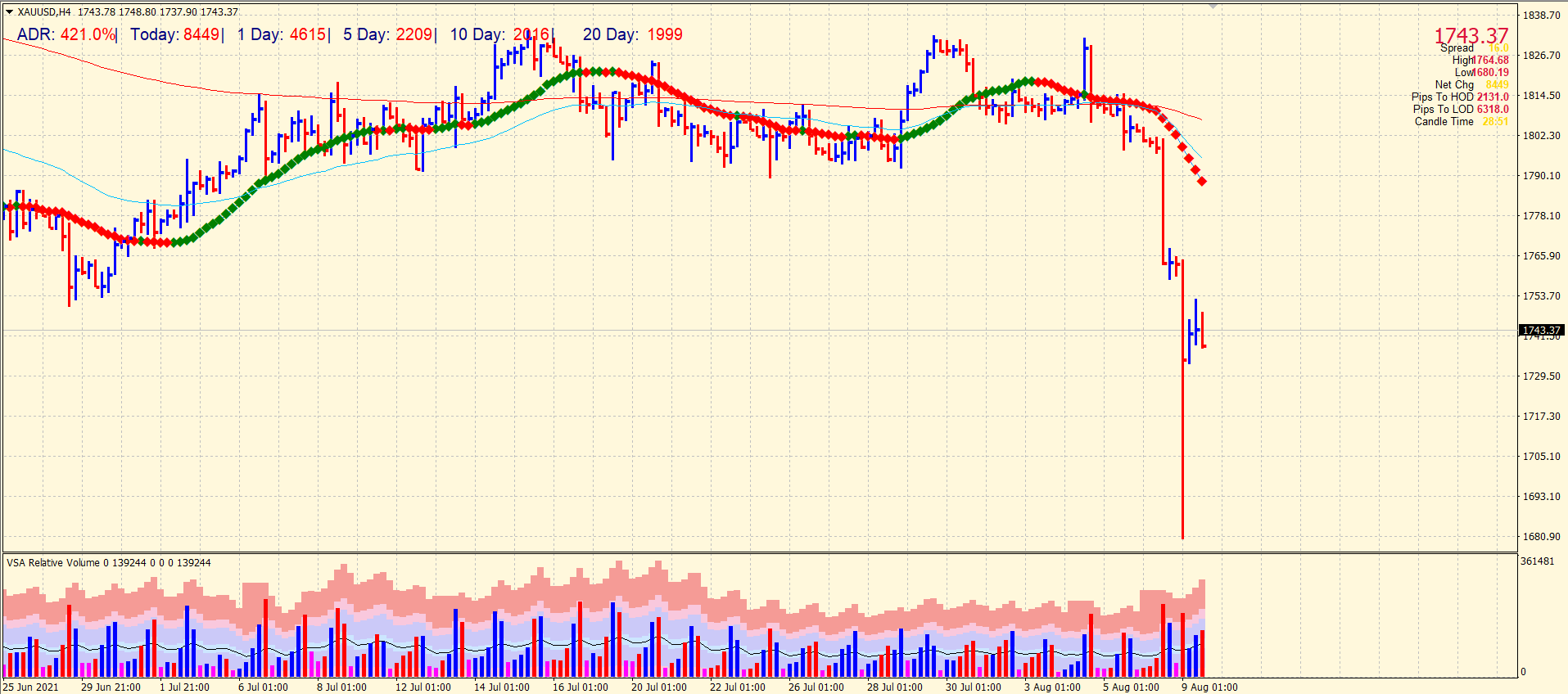

The gold price forecast is largely bearish at the moment. Friday was gold’s worst day of the week, and it continued its decline into the Asian session on Monday. The XAU/USD pair fell sharply to its lowest level since March at $1,677 but rebounded and last traded at $1,744, gaining more than 1% on the day.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

It is most likely that gold prices have risen due to profit-taking despite the absence of fundamentals driving the issue. Furthermore, the pair lost momentum at around $ 1,750, confirming that technical correction is over.

On Friday, a positive US jobs report prompted a surge in the dollar, sending XAU/USD lower. However, investors began adjusting their positions as soon as the US Bureau of Labor Statistics revealed that the number of non-farm employees rose by 943,000 in July. As a result, the dollar index rose to 92.92, its highest level in the last two weeks, indicating an overall strength in the currency.

In addition to June JOLTS vacancies, no other data will be included on the US economic list for the session. The US session will also provide further clues on asset reductions, with Atlanta Federal Reserve President Rafael Bostick and Richmond Federal Reserve President Thomas Barkin speaking.

COVID fears Worldwide

As Beijing scrambles to stop the rise of cases associated with the highly infectious variant of Delta, China’s worst coronavirus outbreak since last year has raised fears of slowing economic growth.

According to the National Health Commission, 94 local symptomatic infections occurred on Monday. Authorities have reacted harshly to the proliferation of the Delta variant, including mass trials and travel restrictions.

An official with the nation’s public health department said last Sunday the country wasn’t coping with the situation when Covid cases reached their highest daily rate.

–Are you interested to learn more about forex signals? Check our detailed guide-

A local news program quoted Francis Collins, director of the National Institutes of Health, saying, “We were never meant to be where we are. We are failing in this regard.”

When he gave his testimony, there were approximately 100,000 new Coronavirus cases every day in the US. A total of 118,999 new cases were reported each day, the highest number since February.

Gold technical forecast: More consolidation to come

Gold price fell below the $1700 mark on Monday, making fresh multi-month lows at $1680. The price is abnormally low behind the key SMAs on the 4-hour charts. The volume is quite high for the last several 4-hour price bars. The current consolidation does not suggest any action for now.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.