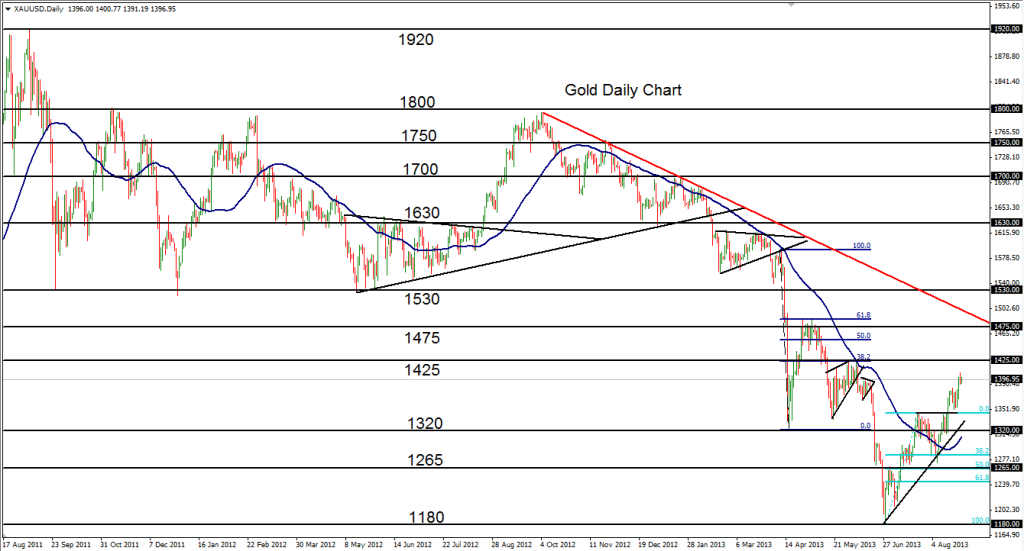

August 26, 2013 – Gold (daily chart) has maintained its recovery of the past two months after rising from its late June multi-year low at 1180. The clear bullish trend of this two-month period has seen a well-formed advance that broke out above successively higher key levels, including 1265, 1320, 1345 and, most recently, 1385. This short-term uptrend thus far has provided some indication that gold has potentially bottomed out and may be seeking to recapture the lofty levels enjoyed before the sustained plunge that began last year. The next significant resistance objective immediately to the upside resides around the 1420-1425 zone. With continued bullish momentum that breaks out above that resistance, further upside targets reside around 1475 and then the major 1530 resistance area that served as strong historical support before the breakdown in April. Key support within the context of the bullish recovery currently resides around the noted 1345 level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.