- After unexpected volatility, gold is struggling to hold a weekly low.

- Despite the sharp increase in COVID infections, the market sentiment remains relatively resilient.

- US data was weaker while yields rose on disappointing seven-year auctions.

The gold price outlook remains unclear as the price remains choppy, playing within the range. Meanwhile risk sentiment is neutral too. While bears remained in control of the market on Thursday amid higher Treasury yields, the gold price managed to close above the $1,800 mark on Wednesday. However, a low dollar index and cautious market sentiment prevent gold from rising above its price.

–Are you interested to learn more about Nigerian forex brokers? Check our detailed guide-

By Wednesday’s end of the North American session, the 10-year US Treasury yield had risen 7.6 basis points (bp) to a 1-month high of 1.557%, the most in just three weeks. It could be because of disappointment over the weak auction for seven-year bonds.

The Fed’s recent concern about rate hikes may also explain higher yields. Another factor supporting the Fed’s rate hike fears is recent strong expectations of an earlier rate hike in 2022. In addition, inflation reached a monthly peak no later than 2.53% last month.

While daily Covid cases have risen, the rapidly spreading South African variant of the virus, Omicron, is expected to be less severe, which should keep the market calm during the end-of-year Christmas season. However, the Reuters news agency reported that, on average, around 900,000 cases are diagnosed every day between 22 and 28 December, with countless countries posting new all-time highs in the last 24 hours, including the United States, Australia, many countries in Europe, and Bolivia.

Data show that US home sales in November fell short of expectations from + 0.5% to -2.2% m/m, while Good Trade Balance posted a record deficit of -97.8 billion against -$ 83.2 billion.

Technically, bright metal is clinging to the 50-day moving average (DMA) amid an upcoming bullish cross on the daily chart. The average economic data for the US was mixed and did not have a significant impact on metal prices. Weekly US unemployment claims data will provide new trading incentives this week. However, year-end flows will be more important in the future.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

Gold price technical outlook: No clear direction

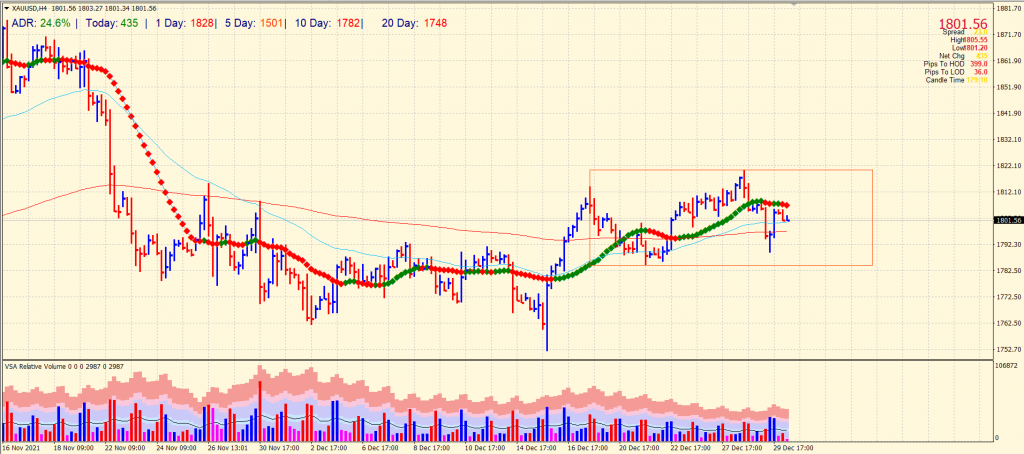

The gold price briefly fell below the $1,800 mark but recovered back. However, the price is still below the 20-period SMA on the 4-hour chart. The average daily range is 24% so far, which is lower than usual. Overall, the price is wobbling within the rectangular pattern, showing no clear directional bias. Volume data is also mixed.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.