- Gold price may tumble below the $1,800 mark.

- The risk flows are improving while Greenback is gaining momentum that may weigh on the precious metal.

- US ADP and ISM figures are important to watch ahead of the NFP report.

The gold outlook is slightly bearish as the US yields are mildly rising while risk flows have improved, weighing on the safe-haven status of the gold.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

In the early European session, gold traded with a slight positive bias, despite no follow-up buying and staying below Monday’s multi-week highs.

It is estimated that the delta variant of the Coronavirus, which currently hovers around $1,816, contributed to a degree to the safe haven of XAU/USD. A disappointing consumer confidence index from the Conference Board on Tuesday came in at 113.8, a six-month low which raised market worries.

Gold traders were inhibited from aggressively betting against it, resulting in their failure to make further profits. A bullish sentiment underlying financial markets was considered a key factor holding back the precious metal.

The risk flow increased the US Treasury yield, providing a bit of support for the US dollar and not allowing commodities denominated in dollars to gain traction. On Friday, investors may decide to stay on the sidelines while the US employment data is released.

A closely watched NFP report may provide new clues about when the Fed may begin lifting its pandemic-era stimulus and raising interest rates. Thus, it will play a crucial role in determining where unforgiving gold is headed next.

Trade could be boosted later in the early North American session by the US economic data released Wednesday, including the ADP Private Employment Report and the ISM-PMI for Manufacturing.

–Are you interested to learn more about forex signals? Check our detailed guide-

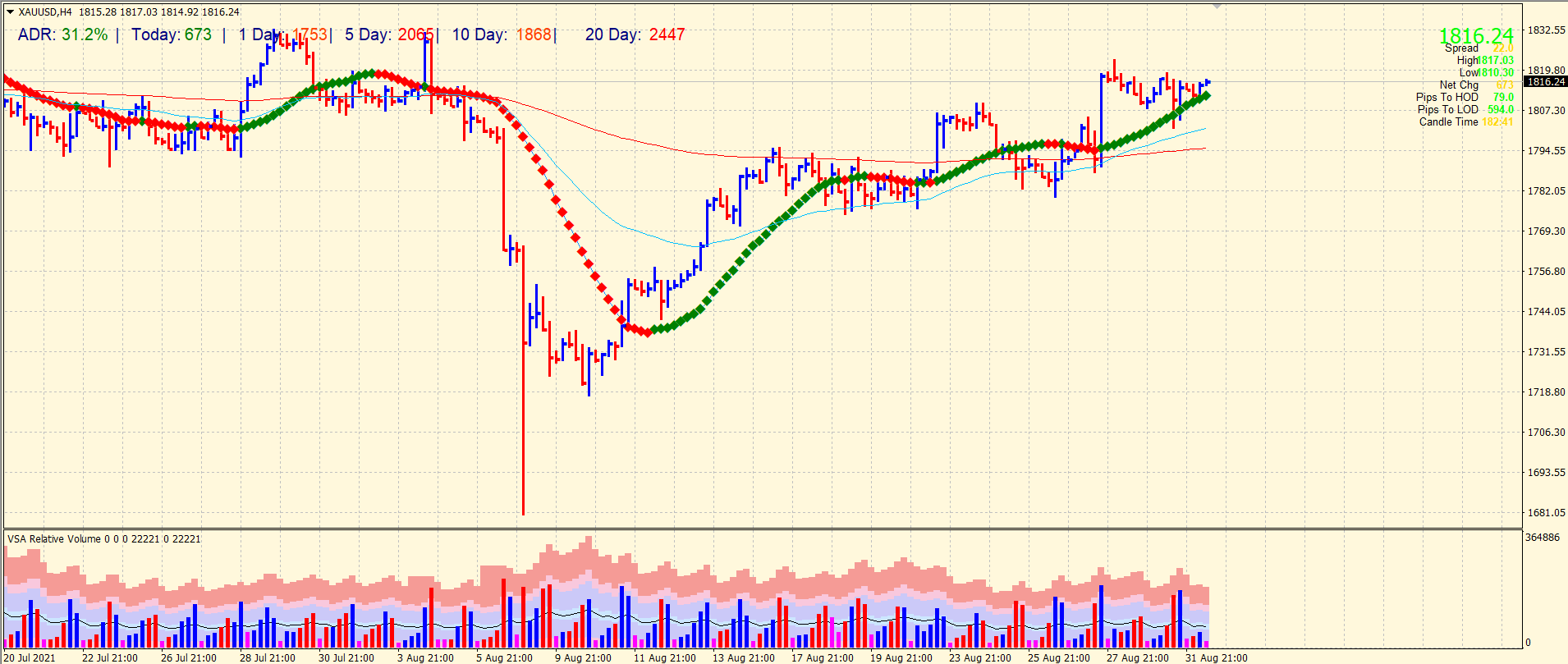

Gold price technical forecast: 200-SMA to provide support

The gold price is consolidating near the tops above $1,800. The price is lying above the 20-period SMA on the 4-hour chart. The average daily range for the asset is 31% so far. The price structure and volume look quite weak at the moment. There may be some due correction that can drag the price under $1,800. The 200-period SMA around $1,794 may provide some respite. We consider it a key level that may determine the directional bias of the market.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.