- A broad US dollar rebound remains a headwind for gold below $1,790.

- The market sentiment dwindles as virus-linked news battles geopolitical concerns and a Fed rate hike threat.

- As inflation expectations improve, Friday’s US CPI will be crucial. Also, keep an eye on virus-related lockdowns and yields.

In the face of a broad rebound in the US dollar, gold price analysis shows a range below $1,790 and cannot sustain upside potential. Despite low government bond yields, mixed market sentiment is causing investors to seek security and confidence in the US dollar.

–Are you interested to learn more about Australian forex brokers? Check our detailed guide-

Before Friday’s important US inflation data, traders are holding off on all-direction bets on pure metal. In addition, the gold sentiment was not lifted by reports that the ECB is likely to activate its asset purchase program (APP) next week.

A study has shown that coronavirus booster vaccines are effective against Omicron, along with research that a variant of the virus is less harmful than previous versions to promote an earlier sense of risk. Japan’s latest study joins recent restrictions in Germany, France, and the UK, saying that transmission of the strain of COVID-19 associated with South Africa is four times more likely to affect sentiment.

As well, tensions between the US and China over Taiwan have escalated after previous tensions over the Beijing Olympics, which has affected sentiment and gold prices. There were also concerns about Evergrande and Kaisa’s defaults, in addition to China’s risk appetite. Finally, conflicts between the USA and Russia over Ukraine and negotiations between Washington and Israel over Iran went in the same direction.

A four-day recovery in US inflation expectations has prompted market talk of a Fed rate hike and boosted bond coupons, while risk aversion keeps 10-year US Treasury bond yields and the greenback positive.

Despite this, Friday’s US CPI market expectations and new information about Omicron have kept the gold price below the key barrier.

–Are you interested to learn more about MT5 brokers? Check our detailed guide-

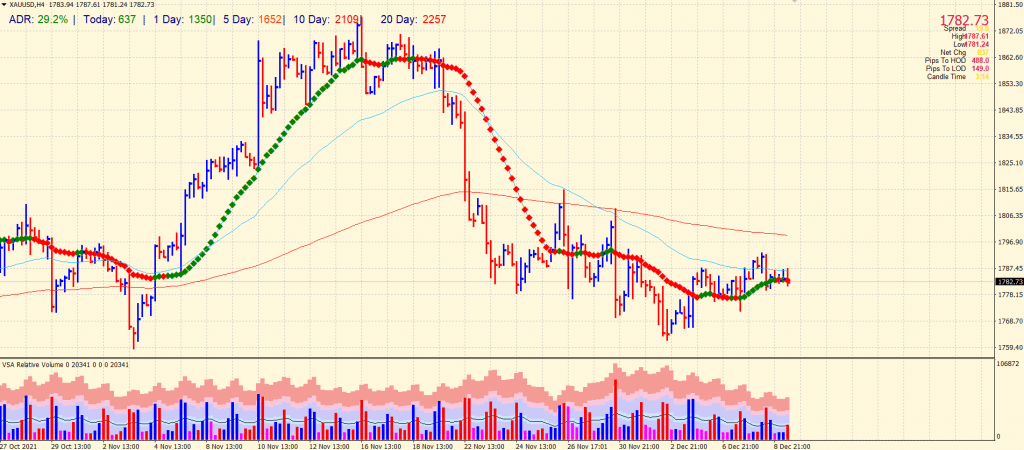

Gold price technical analysis: Rangebound pattern to continue

The gold price is wobbling around the congestion of 20-period and 50-period SMAs above $1,780. The outlook remains slightly negative while the yellow metal consolidates in a narrow range. The previous widespread down bar with very high volume keeps bearish pressure. The price is expected to range between $1,775 to $1,800. Any meaningful breakout of this range will be an opportunity for the traders to capitalize.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.