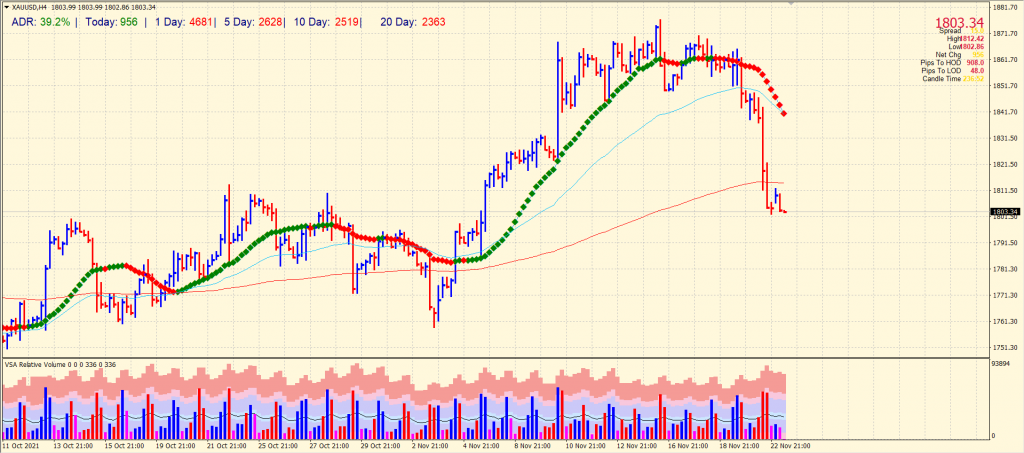

- The price of gold plummets after Powell is renominated as Fed Chair by Biden.

- This Wednesday, US inflation data will be released.

- To determine direction, $1,800 remains the key level.

The gold price plummeted overnight after US President Joe Biden reappointed Jerome Powell as chairman of the Federal Reserve.

–Are you interested to learn more about forex signals? Check our detailed guide-

In recent weeks, Leal Brainard has been mentioned as possibly having a seat, which has contributed to the market’s expectation that Mr. Biden would do so. However, in light of Ms. Brainard’s cautious attitude, the markets were restrained to some extent.

After the news broke overnight, those rates were dropped, and Fed Funds futures prices became more aggressive. Assisted by a revaluation of the US Treasury bond market, bars fell sharply against the US dollar. For the first time since February 2020, the yield on the 5-year rate-sensitive bond exceeded 1.3%. The higher Treasury rates and the stronger dollar hurt the non-interest-bearing assets.

As the markets digest Biden’s decision while overriding Brainard’s forward-looking price forecasts, yellow metal prices could experience increased volatility. Furthermore, the Thanksgiving holiday will shorten the trading week in the United States, likely contributing to increased volatility in the broader markets. As a result, the average true range of gold, a technical indicator of volatility, rose overnight to its highest level since September.

As long as the chairmanship has no political implications, the Fed can focus more aggressively on inflation given current levels. US consumer prices increased 6.2% year-over-year in October, the highest in more than 30 years. A major concern of American voters is the increasing price pressure, which makes them a central issue for the Biden administration.

The Fed should gain political weight from the executive branch as a result of this. The Personal Consumption Expenditure Price Index (PCE) will break the boundaries on Wednesday, updating market price information. In October, analysts expect the PCE, which excludes volatile food and energy prices, to rise 4.1%. The PCE increased by 3.6% in the previous month.

Gold could fall more than expected, as the rate hikes are likely to push rates higher. After Biden’s announcement, Fed futures moved from a 17.9% probability on November 19 to a 26.5% probability on November 22 due to the expectation of a 50 basis point rate hike at the June 2022 FOMC meeting. The last FOMC board meeting crossed international borders. Trade logs will be analyzed by traders for evidence of potential balance sheet declines.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

Gold price technical analysis: $1,800 remains the key

The gold price has dipped below the 200-period SMA on the 4-hour chart. However, the yellow metal is consolidating around the key level of $1,800. Any breakout of the level will trigger further selling towards $1,790 ahead of $1,775. On the upside, 200-period SMA around $1,814 will be the immediate resistance before the orderblock at $1,820.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.