- The XAU/USD could return higher if it stays above the weekly pivot point.

- The US data should bring sharp movements today.

- After its strong growth, a temporary retreat was natural.

The gold price experienced a strong rejection after reaching yesterday’s high at $1,935. The metal is trading at $1,924 at the time of writing.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

Gold turned to the downside ahead of last night’s FOMC Meeting Minutes. The US Factory Orders reported a 0.3% growth versus 0.7% growth in the previous reporting period, while Wards’ Total Vehicle Sales were reported at 15.7M, beating the 15.3M forecasted.

Today, the US is to release high-impact data, so the fundamentals should drive the rate. The ADP Non-Farm Employment Change could be reported at 226K versus 278K in the previous reporting period.

Furthermore, the Unemployment Claims could jump to 247K the previous week. ISM Services PMI is expected to increase from 50.3 points to 51.3 points, while JOLTS Job Openings may drop from 10.10M to 9.93M. Poor US data could help the yellow metal to develop a new bullish movement.

The US will release the Non-Farm Employment Change, Unemployment Rate, and Average Hourly Earnings tomorrow. The economic figures should bring high action and sharp movements.

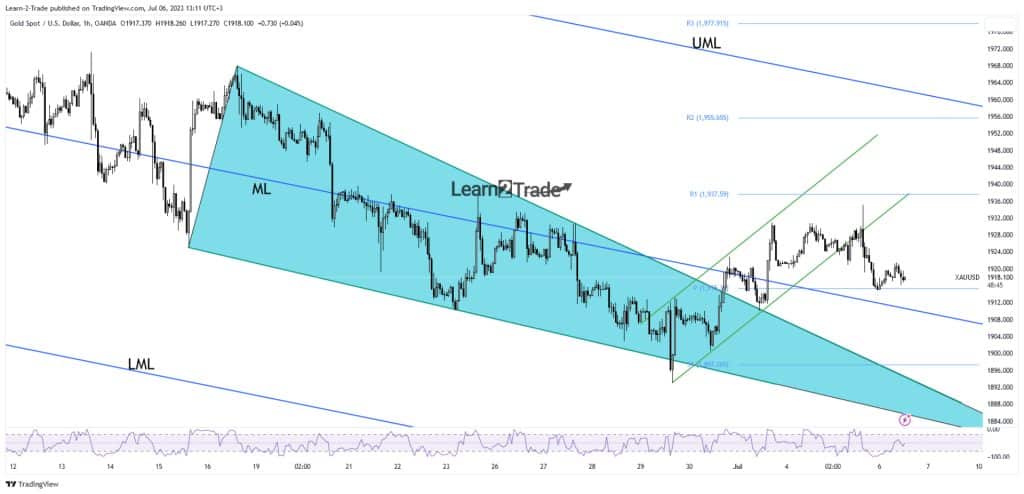

Gold price technical analysis: Strong support at $1,915

The XAU/USD escaped from the up channel indicating exhausted buyers. The price found support on the weekly pivot point of $1,915, and it tries to push higher.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

As long as it stays above this level, the yellow metal could develop a new bullish movement. The median line (ML) of the descending pitchfork represents dynamic support.

Escaping from the major Falling Wedge triggered a higher potential swing. After its strong growth, a minor retreat or accumulation was probable. The price could retest the near-term support levels before jumping higher.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money