- Gold price remains supported above $1793.

- Falling US treasury yields are giving additional support.

- Gold finds strength amid deteriorated risk sentiment stemming from the spread of Covid-19.

The gold price plummeted and then bounced back after falling $20 to a weekly low on Monday, while silver hit its lowest level in 3 months. Stock markets and commodities plunged. The US Dollar rallied, and real Treasury bond rates fell to new all-time negative lows amid the latest spike in Covid-19 diseases and concerns.

–Are you interested to learn more about forex options trading? Check our detailed guide-

The Covid-19 outbreak in Asia is gaining momentum. The number of cases in Indonesia per day is higher than in India. In Singapore, values “‹”‹have reached an 11-month high, and Thailand has the highest cases since the start of the pandemic.

In Tokyo, where the Olympic Games kick off this week, the first cases of infection among athletes in the Olympic Village were confirmed on Sunday.

The UK lifted most of its remaining restrictions on Monday, despite rising new cases to the world’s highest. Prime Minister Boris Johnson remains on self-isolation after contact with the country’s health minister, diagnosed with the coronavirus last week.

Germany, France and Italy are tightening measures against Covid-19 for unvaccinated adults.

New York stock markets opened the week more than 2% lower after the selloff began in Asia and hit Europe led by airline stocks. Oil lost 5% and copper 2.8%.

The yield on major government bonds also fell, with the yield on 10-year US Treasuries declining 10 basis points to 1.20%, the lowest in 5 months.

Real rates on inflation-protected Treasuries fell almost as hard, falling below -1.10% pa, a new all-time low that broke last August’s record when gold hit its current all-time high of $ 2,075 an ounce.

–Are you interested to learn about forex robots? Check our detailed guide-

Real yields in the US have declined, usually implying a rise in the price of gold.

But this morning, the Dollar’s strength likely driven by risk aversion seen in equity markets, has become more of a headwind for gold, and support from more negative yields has dwindled.

After rising for two consecutive sessions, the Dollar Index, a measure of the value of the US currency relative to its major peers, rose 0.3% to nearly a three-month high.

Gold’s failure to post significant gains amid lower real yields in the US suggests that it remains vulnerable to further pullbacks.

Concerns about the Delta strain and its impact on global economic growth are growing. Thus, investors seek refuge in US Dollar and bonds.

Gold price technical analysis: Bulls shy but strong enough!

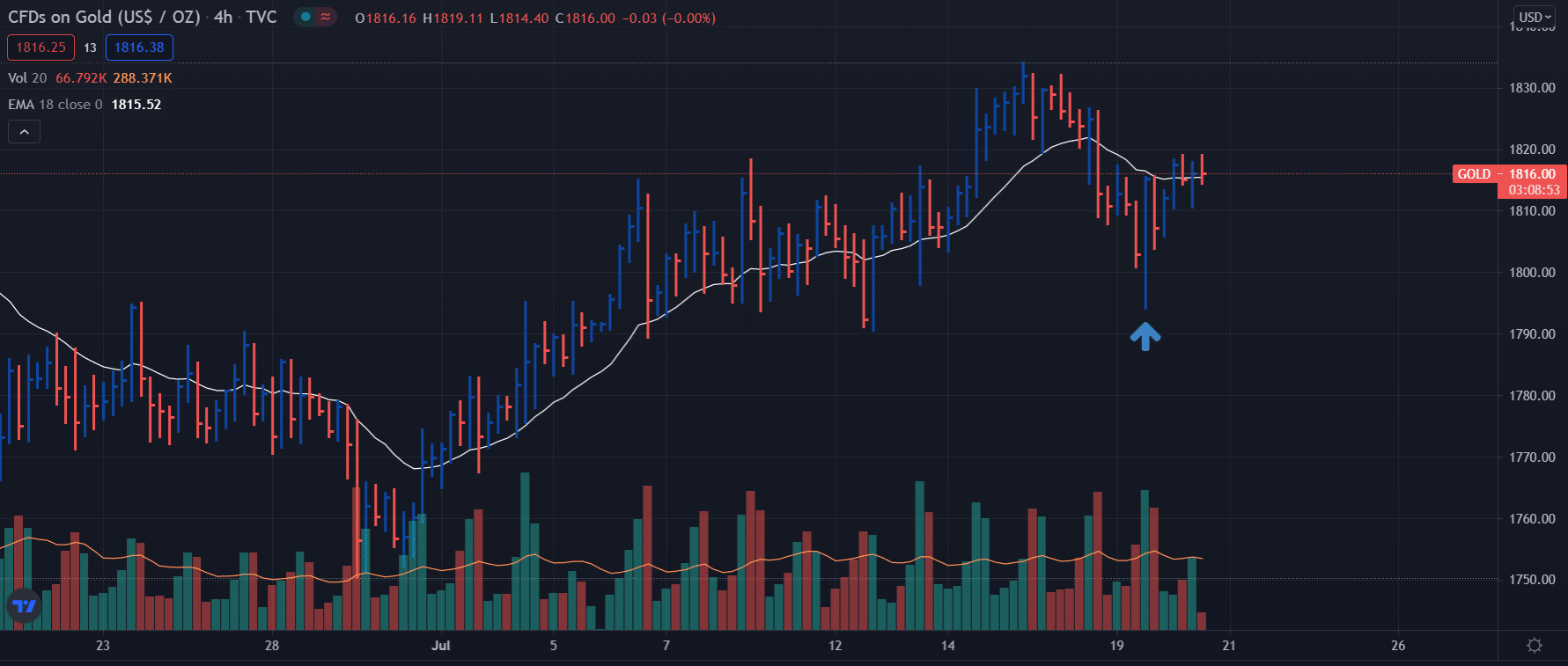

The gold price remains technically stable above $1800. The up bar rising from $1793 with ultra-high volume shows a strong bullish momentum. The volume at the bounce-off level keeps lending support to the precious metal. The price is fairly above the 18-period EMA on the 4-hour chart. The upside target for the metal lies at $1824 followed by $1844.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.