GOLD was recently crushed, as it moved towards the $1260 support area. The strength in the US dollar was one of the major factors, which took the prices in GOLD lower. There is still more room for downsides, but we cannot deny a short-term correction. GOLD is currently moving higher and heading towards an important resistance area. There is a chance that GOLD might struggle to break the same. However, if it clears the $1165 barrier, then there is a chance of more upsides in the near term. Later during the NY session, the US MBA Mortgage Applications report will be released by the Mortgage Bankers Association, which might causes some moves in GOLD in the short term.

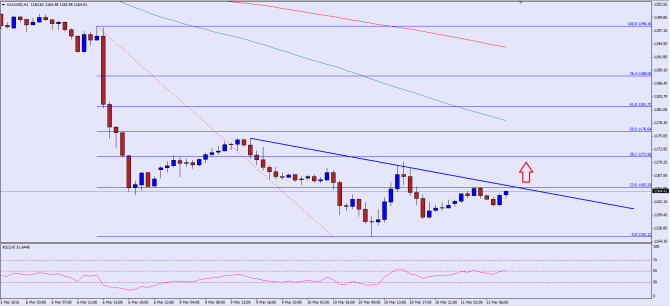

There is a crucial bearish trend line formed on the hourly chart of GOLD, which is likely to act as a swing area moving ahead. GOLD is currently attempting to clear it, which also coincides with the 23.6% fib retracement level of the last leg from the $1198 high to $1155 low. So, GOLD might struggle around $1165, but a break above the same might ignite gains moving ahead. The next level of interest in that situation could be around the 50% fib level, which also coincides with the 100 hourly simple moving average. The hourly RSI is also around the 50 level suggesting a break is near.

If GOLD fails to clear the highlighted resistance area and moves back lower, then a retest of $1155 low is possible in the short term.

Overall, one might consider buying with a break in GOLD if it closes above the stated trend line successfully.

————————————-

Posted By Simon Ji of IKOFX Technical Team: Online Forex Broker

Website: http://ikofx.com/

In the fresh podcast, we talk about the US economy, the Australian and Canadian rate decisions, a potential easing in Japan, the widening gap within oil prices and an update on forex brokers after the SNBomb

Follow us on the iTunes page