- Gold fell on Friday but closed the week in green.

- Gold remained supported amid Powell’s dovish comments.

- Delta strain is capping global economic recovery, lending support to the precious metal

Gold forecast weakened on Friday but continued to rally for the fourth straight week, boosted by dovish comments from US Federal Reserve Chairman Jerome Powell and concerns about a slower global recovery.

-Are you interested to find high leverage brokers? Check our detailed guide-

Spot gold fell 0.4% to $ 1,822.51 an ounce after hitting $1,833.65 on Thursday, its highest level since June 16. US gold futures were down 0.6% to $ 1,817.95.

The Dollar expects strong gains towards the end of the week amid continuing concerns that economic recovery will be halted by the Delta virus that has swept the world.

As infection cases with a new coronavirus strain become more prevalent, the COVID-19 curve in the United States is rising again after several months of decline.

Some countries have started tightening restrictions as the more contagious variant of Delta spreads around the world.

US Treasury yields have hovered near multi-month lows after US Treasury Secretary Janet Yellen said that expectations of price increases remain subdued.

Fed Chairman Jerome Powell also reiterated expectations of easing inflationary pressures at a hearing at the Senate Banking Committee on Thursday.

The yield on government bonds in Germany and Italy may decline by the end of the week for the third week in a row.

What to watch next for Gold?

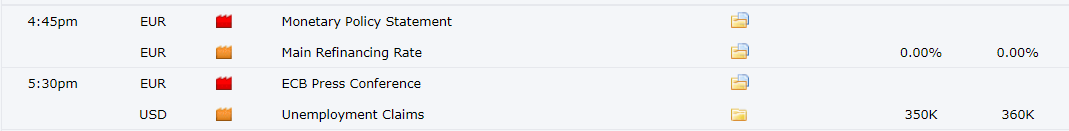

There is no major market more next week. US unemployment claims and ECB press conference can mildly provide some volatility to the gold. However, investors are keenly watching risk sentiment to find the next move of gold.

Gold technical forecast: Will bulls continue to roar?

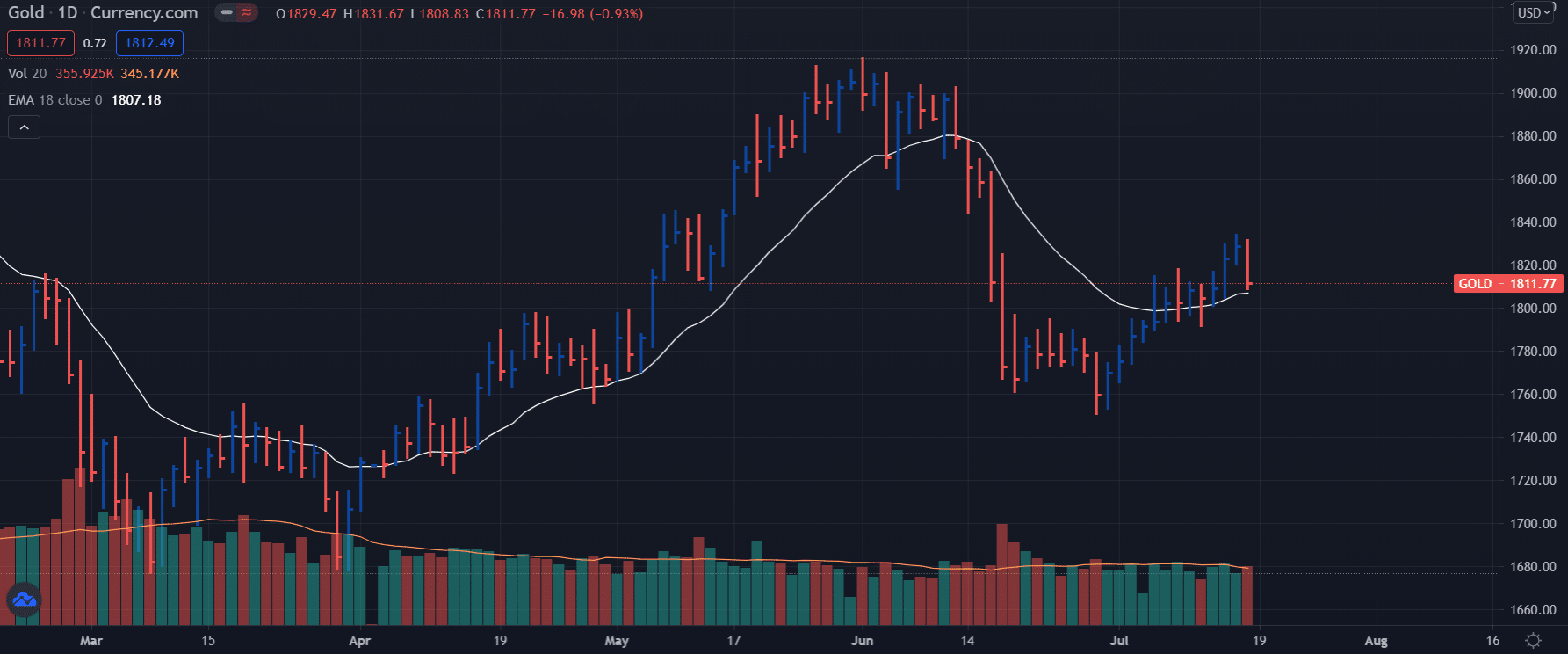

The gold price returned below the key $1816 level. If we observe the daily chart, we can see a bearish engulfing bar that may target $1805 (20-DMA) followed by local lows around $1790. If the coming week shows better risk mode, we can expect a deeper fall towards key support of $1757.

-Looking for high probability free forex signals? Let’s check out-

On the upside, $1816 is a crucial figure followed by $1844 and $1860.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.