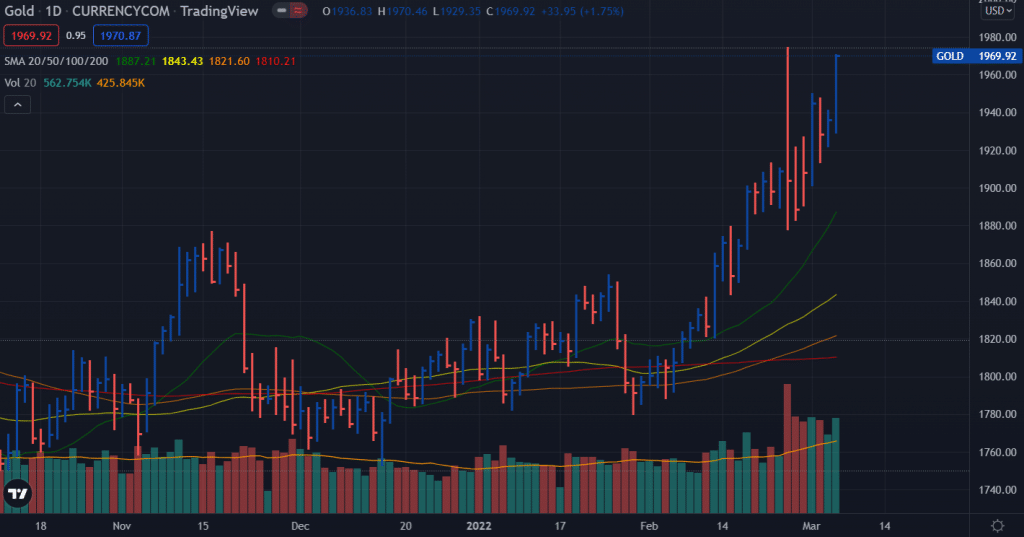

- As the Russian-Ukrainian crisis continues, gold remains in demand.

- The yellow metal is expected to reach $1975 next.

- This week’s action will likely be influenced by US inflation data and geopolitical headlines.

The weekly forecast for gold price is bullish as the deteriorated risk sentiment lends support to the precious metal as a safe-haven asset.

Gold price reacted sharply to changes in risk sentiment throughout the week, ending the week at its highest weekly close since November 2020 near $1950. Russia does not intend to deescalate the conflict with Ukraine.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

The price of gold began the week strongly after the US, EU, UK, and other western countries banned some Russian financial institutions from using SWIFT, the global payment system. However, this week, a second round of “peace talks” was organized between Russian and Ukrainian delegations, alleviating investors’ concerns.

Earlier Tuesday, the Russian military was reported to have increased its presence in Ukraine in an attempt to seize Kyiv, which triggered a surge in safe-haven inflows.

The sharp rise in US Treasury yields resulted from hawkish remarks from FOMC Chairman Jerome Powell on Wednesday, despite a weak market environment. This pushed gold into negative territory.

In his semi-annual hearing on the first day, Powell told the House Financial Services Committee that a 25 basis point rate hike in March would be appropriate. Powell indicated that if the first round of rate increases fails to ease price pressures, a rate hike of 50 basis points may be considered later this year. According to the chairman, sanctions against Russia will not directly affect the US economy but are fueling uncertainty about growth prospects.

After losing some ground on Wednesday, gold regained some momentum on Thursday and Friday, erasing some of Wednesday’s losses. On the second day of his Senate Banking Committee hearing, Powell effectively reiterated his economics, inflation, and politics.

A Russian attack on the Zaporizhzhia nuclear power plant prompted another flight to safety on the week’s last trading day, adding further momentum to the yellow metal.

In the US, data earlier this week revealed that activity in the services sector expanded at a slower pace in February than in January, with the ISM services PMI dropping to 56.5 from 59.9. The ISM services PMI came in below market expectations of 61.

Nonfarm payrolls increased by 678,000 in February, according to a report by the US Bureau of Labor Statistics. This print far exceeded the 400,000 expected by the market. While gold surged above $1950, US 10-year Treasury yields fell by more than 6% daily despite the positive jobs report.

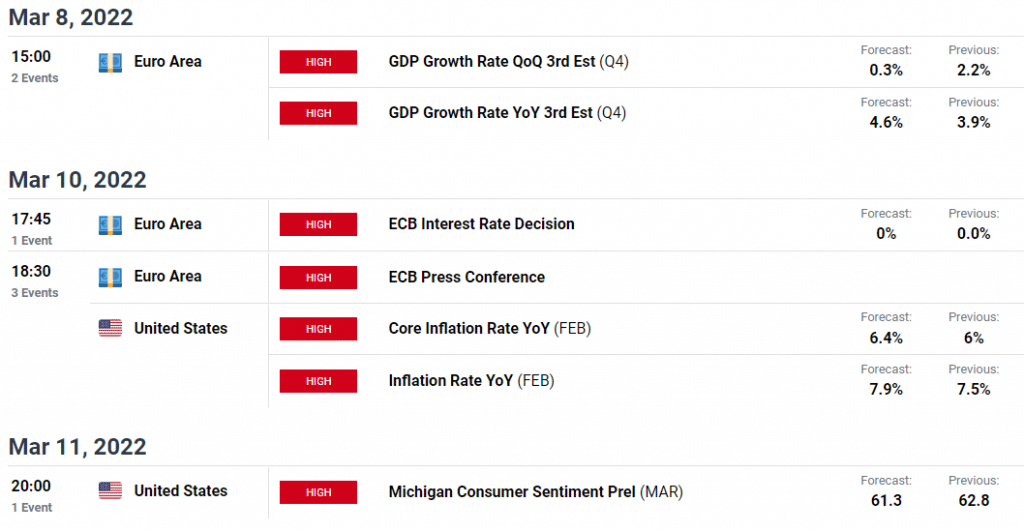

Key data/events for gold next week

There will be no high-level macroeconomic data out of the US on Monday and Tuesday. As a result, gold’s market value will likely remain affected by the Russian-Ukrainian crisis and risk perceptions.

Consumer price index (CPI) data for February will be released Wednesday by the US Bureau of Labor Statistics. In January, the CPI rose to 6% from 6% annually. The Fed’s dovish outlook should remain intact unless inflation surprises the downside. The yellow metal’s growth could be limited by a further rise in US Treasury yields due to a strong CPI.

On Wednesday, the European Central Bank (ECB) will also announce its monetary policy decisions. The ECB’s rate hike rates have already been priced in by the markets. However, there are growing concerns about the potential negative impact of the Russo-Ukrainian war on the Eurozone economic outlook, prompting the bank to adopt a dovish stance. Gold remains attractive in this scenario.

If investors don’t see signs of a de-escalation in the Russia-Ukraine conflict, the yellow metal should remain a traditional safe-haven asset next week. However, XAU/USD’s upside potential might be limited by gold’s inverse correlation with US Treasury yields after the Federal Reserve’s monetary policy outlook was released following inflation data.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

Gold weekly technical forecast: Bulls to roar

The gold price is just shy of multi-month highs at $1,975. However, whether the price will bounce back from the level or break higher is not clear. The widespread down bar with a huge volume closed near the middle of the bar. This bar’s high at $1,975 may hamper the rise. However, any further rise may find a barrier at $2,000 ahead of all-time highs at $2,073.

Alternatively, if the price bounces back from $1,975, the metal will find support at $1,920 ahead of $1,875.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money