Quantitative Easing is a policy meant to lower long term interest rates and reignite the economies after the Global Financial Crisis. The vast amount of money created by the Fed, the BOE, the BOJ and most recently the ECB has not inflated prices. The worries about inflation or even hyperinflation never materialized, at least not in the developed world.

However, money that went from central banks to bonds not only raised bond prices and lowered yields (the intended consequence) but also crowded out / released money to look for other assets: stocks and also prices of homes in various places.

The Fed usually saw this as a wealth effect: more money in American consumers’ savings related to bonds, stocks and the value of their homes has a secondary positive effect and turns into more spending.

Well, the American consumer is certainly not what he or she used to be. In addition, there is a worry about valuations.

Richard Fisher, the recently retired President of the Dallas Fed, said in early 2016 that the Fed “front-loaded a tremendous rally to accomplish a wealth effect”:

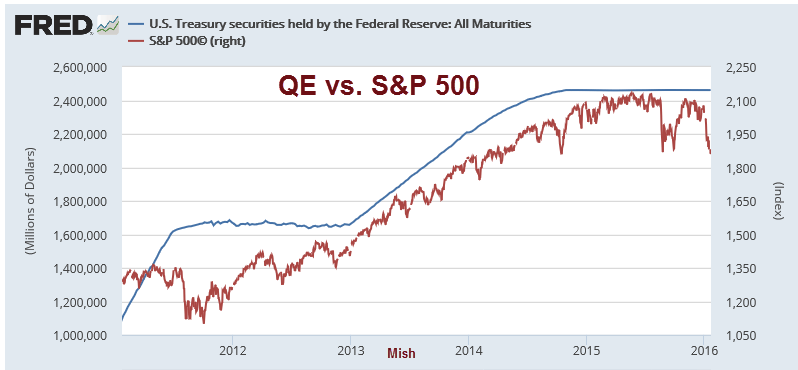

Fisher’s interview is embedded below, but before that, we can see a clear and simple correlation between the size of the balance sheet of the Fed and the S&P index in the past few years, courtesy of Mish:

It is easy to see the clear correlation between the rise of the Fed’s balance sheet during QE3, the slowdown during the taper period (December 2013 to October 2014) and how the index is capped once QE ended in October 2014.

Once the Fed raised rates in December, we have seen significant downside in stocks, with only a few corrections. In September, the Fed reacted to the August crash in Chinese stocks and postponed the hike.

Will it hint about postponing the March hike because of markets once again? Here is the preview:

Fed decision: hard to keep it balanced – 4 scenarios

And here is Fisher talking about what the Fed did to stocks: