A slightly better than expected outcome for the manufacturing sector: a score of 51.9 in the ISM PMI, showing stronger growth. The prices component is also higher, rising from 53 to 54.5 points. More importantly, the employment component is up to 52.9 points, indicating hiring, a positive sign for the jobs report on Friday. A separate release showed construction spending down 0.4% instead of a rise of 0.5% expected, yet with an upwards revision.

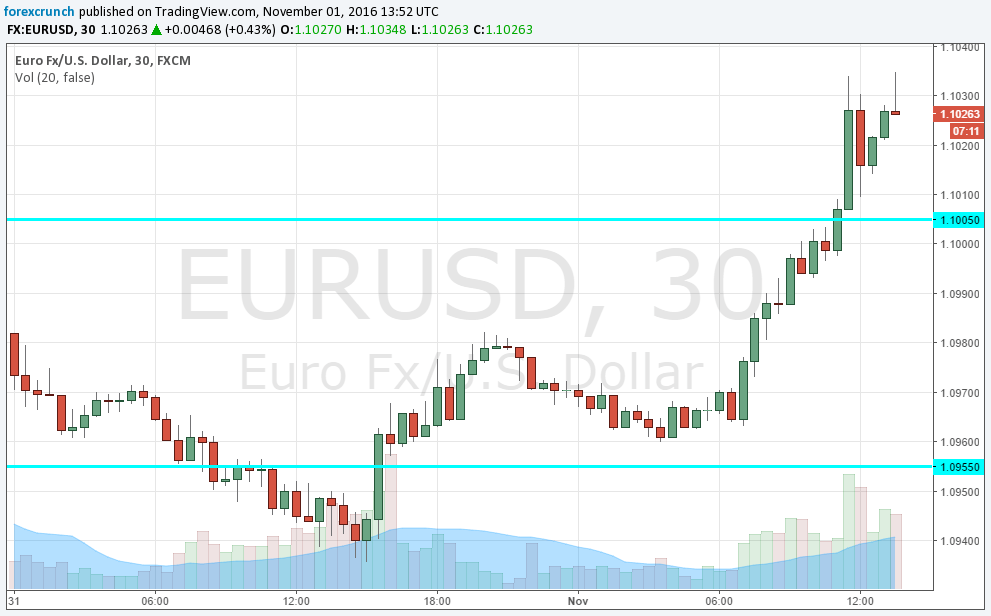

The US dollar remains weak, with losses of a few pips in the immediate aftermath.

The ISM manufacturing purchasing managers’ index for the month of October was predicted to stand at 51.7 points, similar to the 51.5 score seen in September. The sector is small but still important. The publication serves as the first hint towards Friday’s Non-Farm Payrolls.

The US dollar has been somewhat on the back foot amid a poll showing Trump leading over Clinton. The elections are exactly one week away and the prospects of Trump entering the White House send shivers down the spines of many participants.

Earlier, Markit’s manufacturing PMI was revised up from 53.2 to 53.4 points.