Better than expected manufacturing sector read: a score of 53.2 in the ISM Manufacturing PMI in November. Prices paid stood on 54.4 and new orders at 53.

The reaction in the US dollar is limited: initial strength is followed by some retreat.

The ISM Manufacturing PMI for November 2016 was expected to rise to 52.2 points after 51.9 seen in October. The 50 point mark separates growth from contraction. This survey of purchasing managers serves as a hint towards tomorrow’s Non-Farm Payrolls report, with a special focus on the employment component.

The US dollar was somewhat weaker on the day, with the exception of the Japanese yen, which continued losing ground.

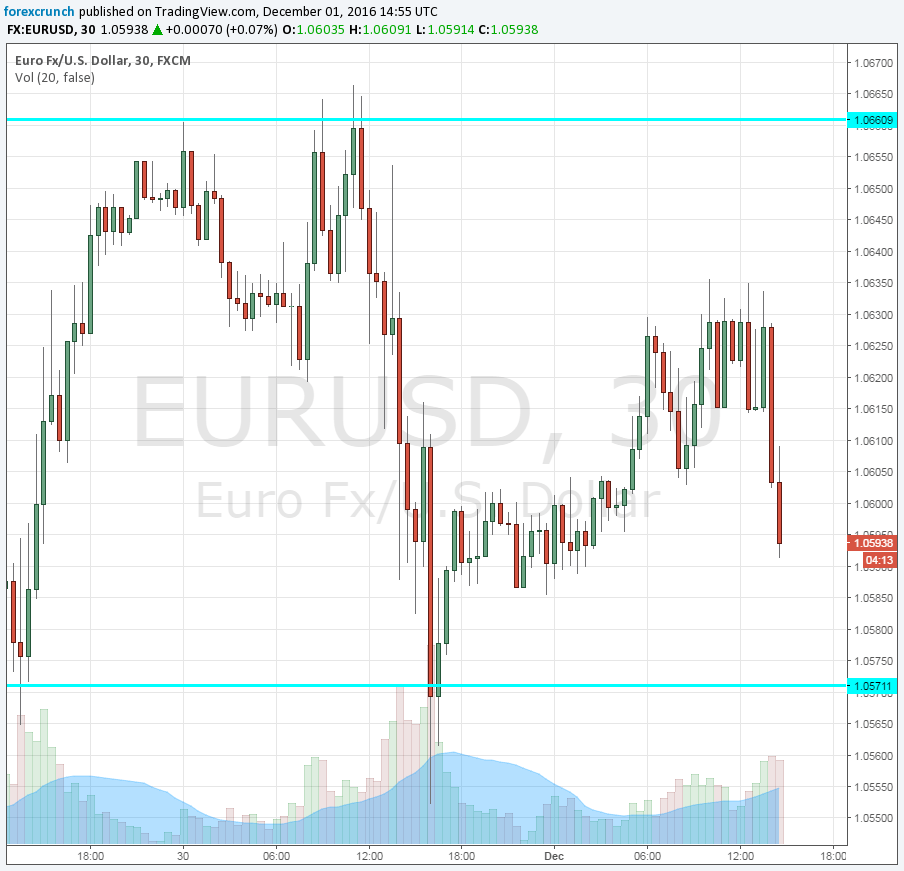

- EUR/USD was trading just around 1.06, above the 1.0570 support line.

- GBP/USD was trading much higher, around 1.2630, enjoying hopes that the UK stays in the single market, paying its way for that.

- USD/JPY traded at 114.70, eying the 115 level.

Earlier, Markit’s final manufacturing PMI stood at 54.1 points, a small upgrade from 53.9 reported earlier.

See how to trade the NFP with EUR/USD