Data/Event Risks

Follow a live blog of Draghi’s press conference.

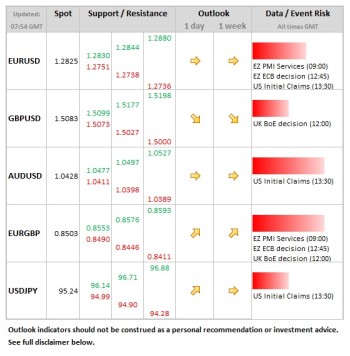

- EUR: The ECB meeting today is not expected to yield any changes in policy, but once again it is the press conference which will catch the attention. EURUSD rallied nearly 1 big figure last month as the ECB President steered a steady path in his rhetoric, but this may not be the case this month, with the recent run of data for the Eurozone having been on the soft side and events in Cyprus having caused more uncertainty on the financial front.

- GBP: Only 8% of those surveyed by Bloomberg are expecting the Bank of England to announce more quantitative easing today, this compares with 23% at last month’s meeting. The minutes to the last meeting reflected reservations on the part of those members (six of them) not voting for further QE, especially with regards to the credibility issues and possible impact on the currency of expanding bond-buying. Steady policy would see only a modest rally (20 pips or so on cable).

Idea of the Day The Bank of Japan it to undertake “massive JGB purchases” (their own words from translated statement) in order to end deflation, with the new Governor Kuroda going all out in terms of policy measures. As well as doubling the amount of bonds purchased every month, the BoJ adopted a number of other measures, including purchasing longer maturity bonds and also targeting the monetary base. The yen has weakened significantly, the currency having been doubtful that the Bank of Japan would be able to deliver. But never forget that the Bank of Japan has consistently disappointed expectations in beating deflation on a sustained basis. That will be the battle in the coming months, between a determined central bank and more doubtful markets. For now, yen weakness is likely to remain in place, but we’re not going to see anything along the lines of the depreciation seen between November and March. Latest FX News

- GBP: Holding steady ahead of the Bank of England decision today. EURGBP has recovered in recent sessions back above the 0.85 level. Cable remains below the recent peaks, with next focus the potential for a move back below the 1.50 level. Update: UK Services PMI Rises to 52.4 Points – GBP/USD Rebounds

- JPY: The Bank of Japan delivered and USDJPY has rallied. A close above the 95.22 level would be key in putting USDJPY back into the bull channel in place since the middle of November, but breached to the downside at the end of last month.

- EUR: Holding relatively steady, but as we’ve pointed out before, this should not surprise given that the divergence in data surprises between the US and Eurozone has ended, leading to more steady EURUSD exchange rate.

- USD: The dollar’s positive correlation to data surprises (gaining when data stronger vs. expectations) is at its highest since early 2010 (using dollar index DXY), when comparing on a rolling 3-month basis. We’ve seen the impact of this during this week, with the weaker than expected data pushing the dollar lower (by 0.5%). This serves as further confirmation (not that it were needed) of new FX market dynamics that are at work.

Further reading: 5 Most Predictable Currency Pairs – Q2 2013