Summary:

- Japan’s gross domestic production expanded at an annual pace of 2.5% in the third quarter

- Revised GDP estimates higher than previous estimates of 1.4%

- GDP lifted by increased activity in exports and business spending

- Business spending rose 1.1% from the previous quarter

- Private consumption remained weak, falling 0.5% and unchanged from previous estimates

- Net exports contributed 0.5% to the GDP data

Economic activity in Japan accelerated in the third quarter, according to official data released last week. Data showed that Japan’s economy expanded at a faster than expected pace, rising 2.5% in the third quarter.

This was higher than the previous estimates and the gains came as capital spending from businesses surged amid rising optimism about an upturn in the global economy and trade.

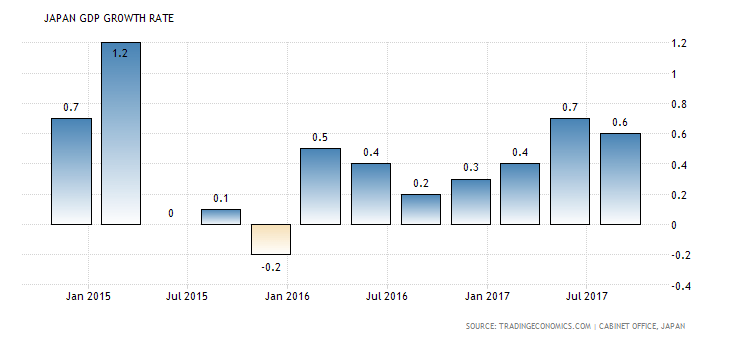

Japan GDP Growth Rate: Q3 2017 – 0.6%. Source: Tradingeconomics.com

The increase of 2.5% annual GDP growth rate in the three months ending September was upbeat and allayed fears of a slowdown in the economy. Japan’s economy, which is the third largest, continued to grow marking a winning streak of steady growth for seven straight quarters. The increase in the economic activity comes amid Japan’s PM Shinzo Abe and BoJ’s Kuroda’s efforts to revive the economy and to re-inflate inflation.

Previous estimates put Japan’s economy growing at a pace of 1.4% in annualized terms. The economy was seen expanding at a pace of 0.6% on a quarterly basis which was higher than the previous estimates of a 0.5% increase on the quarter.

Part of the gains in the economic expansion was also attributed to the efforts taken by Abe to end years of sluggish growth. Considered to be one of the most aggressive monetary policies, growth was also fueled by the BoJ’s monetary stimulus program.

Exports were seen rising as well as corporate profits which posted record growth. The GDP data was seen fueled by the increase in capital spending as well.

According to the GDP data, private sector capital spending was seen rising 1.1% from the previous quarter. This was more than double of the 0.2% increase in capital spending that was recorded in the second quarter.

Growth came as exports increased during the July through September period contributing nearly 0.5% to the GDP. Despite the increase in exports and capital spending, private consumption continued to remain sluggish. Lack of strong wage increases was blamed as private consumption was seen falling 0.5% from the previous quarter in Q3. This was unchanged from the previous estimates.

Economists are hoping that the external demand will remain one of the key drivers of Japan’s economic growth. However, private consumption is expected to remain weak in the fourth quarter as well. This is based on the estimates that household spending was weaker than expecting in October.

The Bank of Japan remained on the sidelines for the most part of 2017. The central bank initially surprised the markets by cutting interest rates to -0.10% in January this year. Since then central bank officials were seen standing on the sidelines.

The BoJ also changed its approach by announcing that it would keep purchasing the Japanese Government Bonds (JGB’s) in order to keep yields on the short end bonds close to zero. This comes amid consumer prices in Japan staying weak for the most part.

Wage growth continues to remain a key part of the inflation puzzle. Despite unemployment levels in Japan remaining steady, wage growth was weak for the most part of this year. This in turn was seen affecting the consumer spending which has also been subdued for the most part.

The BoJ is expected to continue to toe the line in the short term with no changes expected to monetary policy as long as inflation growth remained muted.