Credit rating agency Moody’s delivered its decision regarding Spain at long last, and it surprised by not downgrading the nation.

While the outlook remained negative, EUR/USD jumped on the news. But will it last? There are reasons to believe it would backfire.

While markets were waiting for a decision by the end of September, another rating agency, S&P, already downgraded the euro-zone’s fourth largest economy, and this was felt in Spanish bonds and the euro.

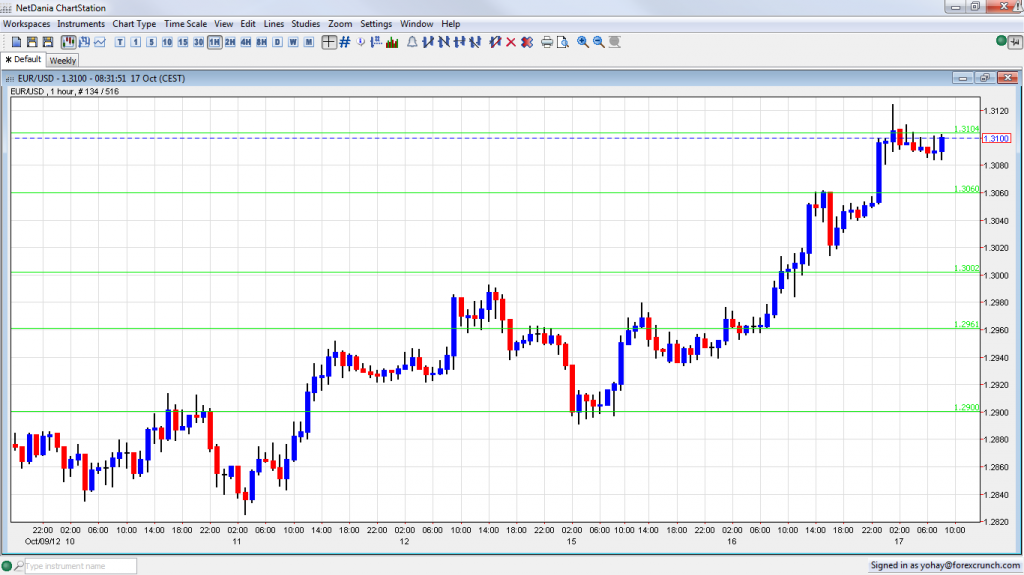

The decision by Moody’s to keep Spain’s bonds above junk status was a pleasant surprise: it pushed EUR/USD above the 1.3060 resistance line that capped it until then. The pair temporarily breached the 1.31 line, but it is now floating under it. Very important resistance appears at 1.3170. Support is at 1.30, followed by 1.2960.

For more lines and events, see the euro to dollar forecast..

Why could it backfire?

A higher credit rating could turn into lower yields for Spain, and this may encourage the country to avoid a bailout request. After Spain announced that it already achieved 88% of its funding needs for the year, motivation is lower.

But, the main driver for lower yields was the promise of ECB intervention, which can come only on the back of a bailout request and conditions. So, at some points the markets might lose patience and sell Spanish bonds, raising the yields.

After the move by Moody’s the chances of hearing an aid request in the EU Summit (October 18-19th) are very low. There is another factor that could delay such a request: regional elections in Galicia and the Basque Country, held on Sunday.

Many analysts expect a move by Spain only in November, and it is unclear if Spain could really opt only for a “precautionary program”, which would easier conditions, or a “full adjustment program” – the path Greece, Ireland and Portugal took.

Further reading: Spanish Crisis: Catalonia is Drifting Away