The euro has traded in tandem with German bonds and often ignored other factors such as economic indicators, the Greek crisis and basically everything that usually moves markets.

However, the team at Bank of America Merrill Lynch finds more evidence that they are topping out. Is this a cue to sell the common currency?

Here is their view, courtesy of eFXnews:

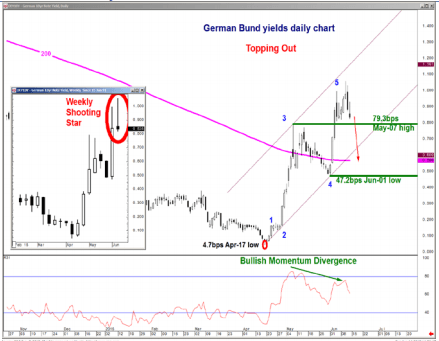

Bank of America Merrill Lynch reiterates its view that Bunds yields are topping out and turning near /medium term bullish.

“Momentum & Elliott Wave analysis are consistent with a yield top (price low), as is the series of daily and weekly candlestick formations over the course of the past week and a half,” BofA notes.

“Finally, futures have held long term trend line support. In the sessions & weeks ahead, we look for a corrective pullback & renewed choppy range-bound activity into the 79.3bps/ 47.2bps range,” BofA projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.