- The US is bracing for a cold snap that could increase demand for natural gas.

- NG prices are on an uptrend every winter.

- Mid-November’s technical chart is showing higher lows, a bullish sign.

No fewer than 148 daily record lows are now forecast to be broken – the prediction of America’s National Weather Services is music to the ears of Natural Gas bulls. NG prices have already been on an uptrend.

Winter is a yearly phenomenon that may have been priced in by traders natural gas – the main commodity for heating homes – yet NG enjoys an uptrend every year.

Prices of futures have already advanced from the lows of close to $2 to a peak of $2.78 in recent weeks. However, that normal seasonal pattern may only be the beginning – as a cold snap may propel the demand for the resource even further.

Winter is coming early

Between November 12 and 14 – just after the long Veterans Day weekend – America is set to endure a broad and brutal cold snap. Temperatures are set to crash from the North East down to New Mexico, and from cold North Dakota to normally-warm Texas. The lone-star state may see the mercury drop to as low as 16 Fahrenheit – equivalent to -9 Celsius – not a typical day in Dallas.

Snow, ice, and winds may keep many Americans in the comfort of their homes and with the heating turned to maximum. As gas bills go up – so could prices of natural gas. The spike in consumption may be exacerbated by the change in temperatures – a drop of some 25-30F in some places – a difference that may cause some to panic.

How are prices positioned?

Natural Gas Technical Analysis

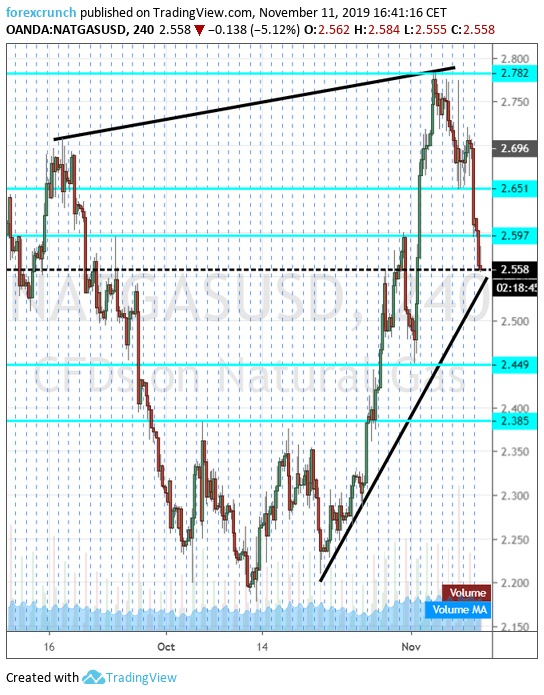

The four-hour chart is showing an uptrend support line closely accompanying the price in mid-October. The fresh fall in prices has stopped close to this line, proving its strength. Apart from higher lows, NG is enjoying a higher high. The $2.70 peak of early October was surpassed by $2.78 in early November.

Resistance awaits at $2.60, which capped it in late October. It is followed by $2.65 which provided support in early November. The $2.78 peak is the next level to watch.

Support awaits at $2.45, which was a swing low in early November. Next, we find $2.38 which was a stubborn cap twice in October. The trough of $2.20 is next down the line.