The British pound has been rocking and rolling on not-so-high ground. What’s next? Here is the view from the team at CIBC:

Here is their view, courtesy of eFXnews:

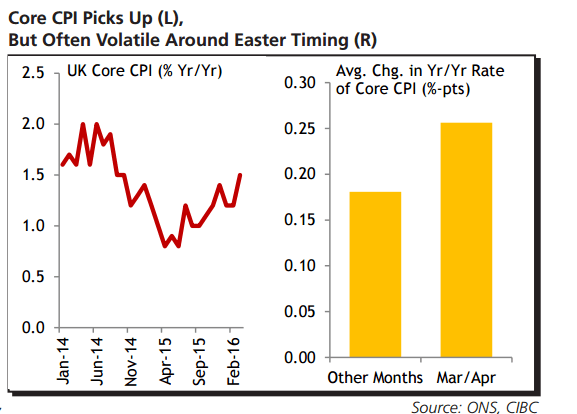

An unexpected uptick in UK CPI, with core inflation reaching a one-and-a-half year high, provided temporary relief for sterling this past week. However, both the upturn in inflation and the respite for sterling could prove temporary.

The uptick in inflation was driven largely by higher air fares than a year earlier-which is influenced by the timing of Easter as the inflation figures in Europe are not seasonally adjusted.

With inflation possibly easing again in April and “Brexit” still very much in the headlines, look for sterling to remain a laggard until after the referendum.

CIBC targets GBP/USD at 1.41 by end of Q2.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.