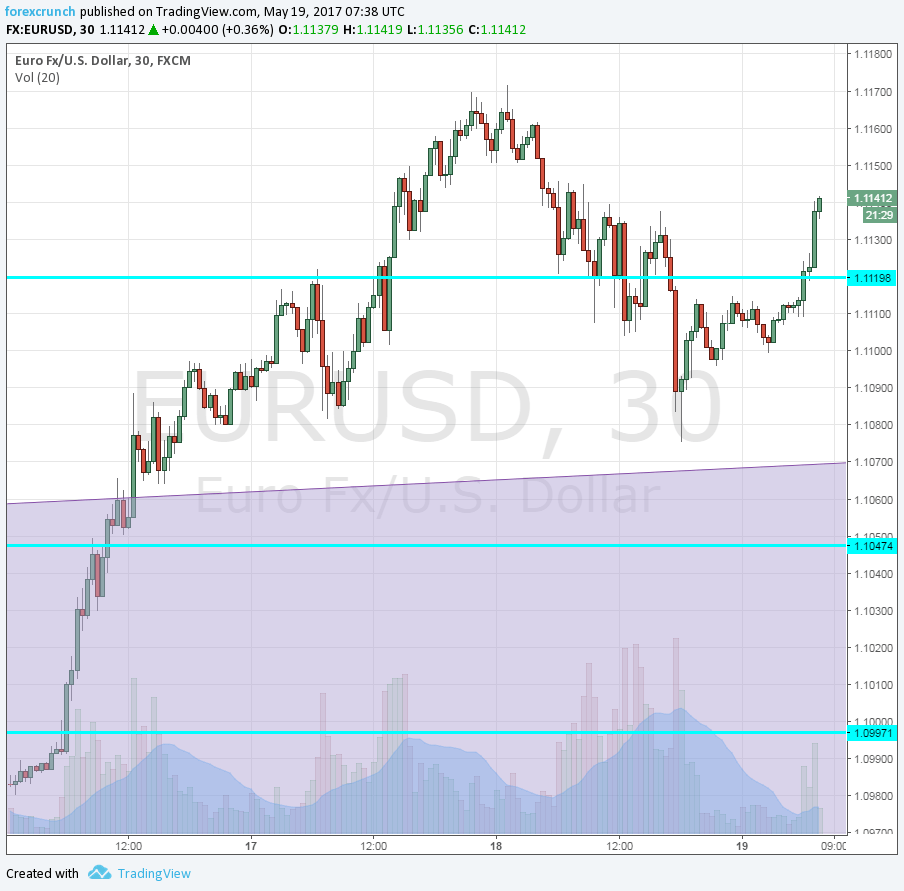

EUR/USD is advancing once again, up some 40 pips on the day, trading at 1.1140. The cycle high has been 1.1170, so there is room to the upside. Further resistance is at 1.13. Support awaits at

The pair is on the rise without any dramatic news pushing it higher. Sure, German PPI beat expectations by rising by 0.4% against 0.2%, but this is not a top-tier figure that will tilt the ECB.

So, when there is no news, the trend remains to the upside. EUR/USD continues enjoying the reasons to rise. On three fronts, the euro has an advantage over the US dollar.

- Political: While the special counsel will take his time with the investigation of Trump and Russia, the affair takes its toll. In the euro-zone, the recently elected president Macron enjoys a honeymoon and German Chancellor Merkel enjoys the support of her own. It’s a picture of chaos in the US and of stability in the euro-zone.

- Economical: Growth in the euro zone was faster than in the US during 2016 and also in Q1 2017. Sure, Europe is behind and needs to catch up, but the trend is what matters.

- Monetary policy: The ECB is getting closer to ending its QE program. They are moving slowly, as always with central banks, but things are looking good. In the US, the chances of a rate hike are lower after the recent weak wages, slowing inflation and mediocre retail sales report. Again, the US monetary policy is ahead of the European one, but the direction of travel is what matters.

Looking at the wider charts, the trend is up. EUR/USD bottomed out at 1.0340 in the very wake of 2017 and is on the up and up since then.

More:

- EUR/USD: 5 Reasons To Stay Bullish; Where To Target? – ABN AMRO

- EUR/USD: 3 Reasons To Stay Bullish For A Run To 1.12/1.13 N-Term – ING