The NZD/USD price is trading in green around 0.7079 (daily high). The bias is bullish as the Dollar Index continues to stay under strong resistance levels. Technically, the pair has confirmed a strong upward movement despite temporary retreats.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

The Kiwi Dollar has taken full control today as the New Zealand Employment Change increased by 1.0%, while the Unemployment Rate dropped unexpectedly lower from 4.6% to 4.0%, far below the 4.4% expected figure.

The NZD/USD pair could resume its rise if the US data disappoints later today. The ADP Non-Farm Employment Change is expected at 695K in July above 692K in June, while the ISM Services PMI could increase from 60.1 to 60.5points.

NZD/USD price technical analysis: Bullish Kiwi still in a broad range

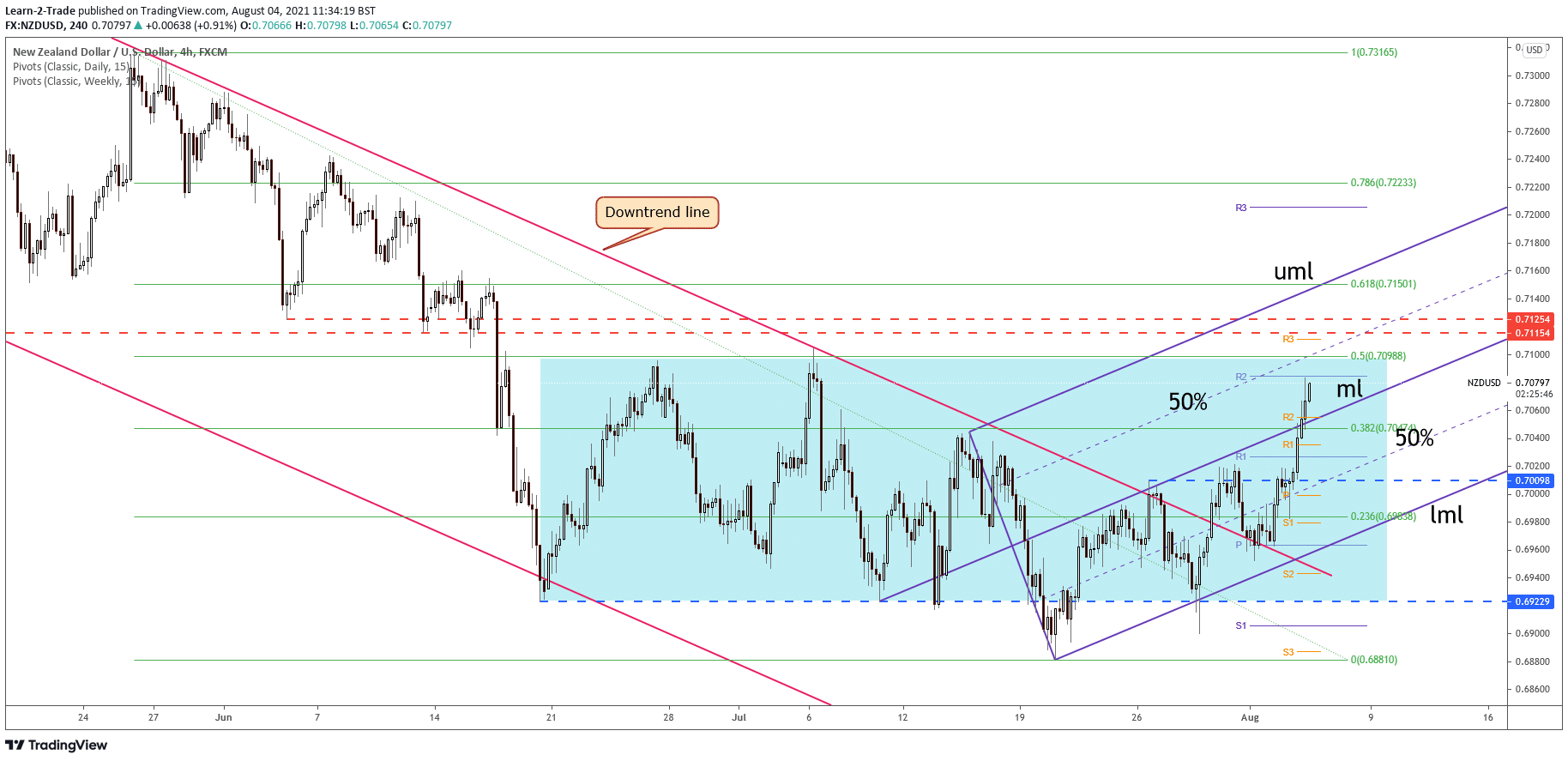

The NZD/USD rallied after registering a false breakdown below the down 50% Fibonacci line and closing above the 0.7009 resistance. Now it is traded above 0.7069 above the ascending pitchfork’s median line (ml).

Technically, the pair could fall a little to test and retest the broken median line (ml). Stabilizing above this broken dynamic resistance signals further growth. It could also retest the 38.2% retracement level before resuming its growth.

The 50% retracement level is seen as a potential upside target. NZD/USD is trapped between the 50% level and the 0.6922. The R2 (0.7084) is seen as an immediate upside target. Jumping and closing above it may announce upside continuation.

Ascending pitchfork’s upper median line (UML) and the 61.8% retracement level are seen as upside targets. Actually, making a valid breakout through the 50% retracement level could validate an upside reversal in the upcoming period.

–Are you interested to learn more about forex signals? Check our detailed guide-

The bias is bullish right now. The sentiment could be changed only by better-than-expected US data. The Non-Farm Payrolls report is seen as a high-impact event on Friday. Some poor economic figures during the week could send NZD/USD far above the mentioned obstacles.

Further upside continuation could be invalidated by a drop and stabilization below the ascending pitchfork’s median line (ml).

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.