Canadian economy has been significantly affected by the decline in metal ore and petroleum prices and there’s very little the Bank of Canada can do about it. The BOC may have come to the realization a low rate policy may have its place stimulating the domestic economy, but has very little effect on commodity export demand. Through its NAFTA partnership, the bulk of Canadian trade, over 75% of exports and over 55% of imports is within NAFTA. Further, trade within NAFTA isn’t just about commodities, although it does play a significant part. Many major industrials have manufacturing facilities in Canada. This is particularly true of the US automobile industry. A weaker Canadian Dollar goes a long way creating demand from both US industrial partners as well as the US consumer.

In its most recent statement and policy decision, BOC Governor Stephan Poloz noted that “…The dynamics of the global economy are… …diverging… …and shifting terms of trade… …China continues its transition to a more sustainable growth path and the expansion in the United States is on track… …The protracted process of [Canadian] reorientation towards non-resource activity is underway, helped by stronger U.S. demand, the lower Canadian dollar, and accommodative monetary and financial conditions…”

With respect to the strategic natural resource sector, Governor Poloz noted specifically that, “…National employment remains resilient despite job losses in the resource sector…” Indeed, Canadian employment reports have been good and that may be attributed to US growth as well as growth in the Canadian housing sector.

Guest post by Mike Scrive of Accendo Markets

Lastly, and importantly, Governor Poloz referenced the weak Canadian dollar in a positive light: “…Total CPI inflation remains near the bottom of the Bank’s target range as the disinflationary effects of economic slack and low consumer energy prices are only partially offset by the inflationary impact of the lower Canadian dollar on the prices of imported goods…” In other words, the BOC expects the economy to be able to tolerate higher prices on imports since the bank is well below its target core inflation rate.

What it all seems to suggest is that the BOC has no choice but to wait out the global commodity situation; it’s well able to do so with low inflation and a weak Loonie, particularly against the US Dollar. Lastly, although the Fed has signaled that it expects to continue to increase rates in 2016, it may find it too risky to do so. Most economic data, manufacturing in particular has been tepid and with the exception of one seasonally adjust employment report, the recent data and downward revisions to the previous report indicate that employment is not as strong as first thought.

The point of the matter is that the BOC will likely maintain its current policy for several months to come.

Although New Zealand is also a participant in its share of free trade agreements, it doesn’t have one so nearly as strong as NAFTA. New Zealand’s largest trade partner is China at 19.95% of exports and 16.94% of imports. Australia follows at 17.51% of exports and 12.18% of imports; third is the US at 9.40% and 11.61% of imports and fourth is Japan at 5.86% of exports and 6.67% of imports. Four of the above five leading economies are experiencing slowing growth. Only one, the US economy, has at best moderate growth.

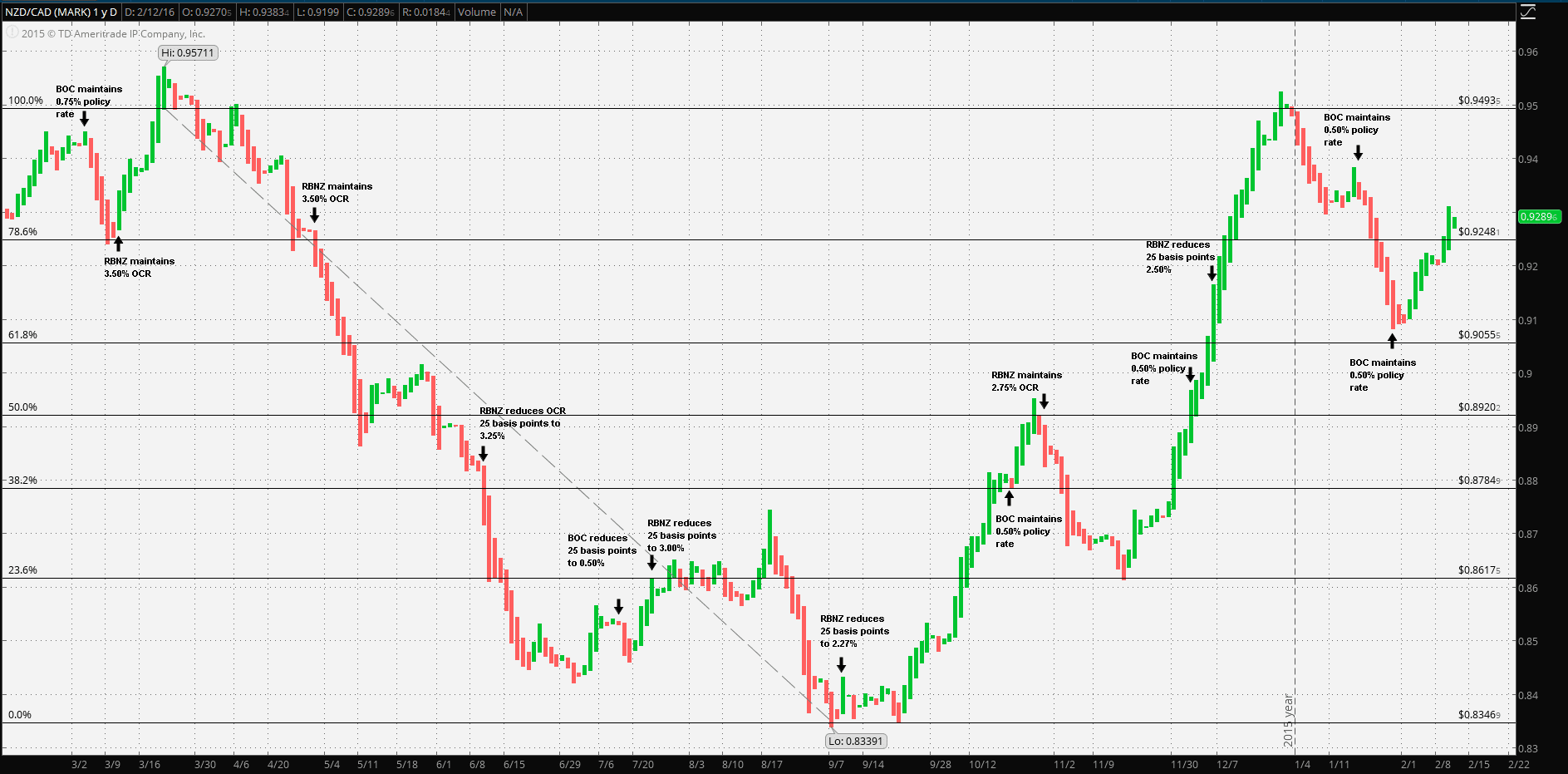

The Reserve Bank of New Zealand was very active in 2015, reducing rates a total of four times, a full percentage point from a January 2015 OCR of 3.50% to its current 2.50%. It should be noted that New Zealand’s main commodity exports are agricultural, particularly dairy products. However, its major export to Australia is crude petroleum. The point is that New Zealand has little to fall back on, unlike Canada. Further, RBNZ Governor Graeme Wheeler noted that, “…Uncertainty about the strength of the global economy has increased due to weaker growth in the developing world and concerns about China and other emerging markets. Prices for a range of commodities, particularly oil, remain weak. Financial market volatility has increased, and global inflation remains low… …particularly around China…”

Governor Wheeler concluded noting that further easing might be necessary. However, does that necessarily mean that the Kiwi is likely to weaken against the Loonie? Perhaps not and for this reason: both the BOC and RBNZ seem willing to hold off further reductions. The BOC knows that it’s better to facilitate trade with the US with a reasonably strong consumer economy. The RBNZ may be following the lead of the RBA which has virtually proved that reducing rates does little good and increases the risk of running high inflation rates on the recovery end of the cycle. Hence, they’ll likely maintain policy. The implicit variable in this equation is the Bank of Japan. The Yen is strengthening in spite of the BOJ’s negative rate on excess deposits. The details of the new policy indicate that the negative rates apply only to reserve deposits above a threshold level; further, lending will offset reserve deposits. The BOJ also noted in the statement that the negative rate policy was far less than other central bank policies.

The point is that Governor Kuroda may be implying that the BOJ may vigorously defend the Yen, hence, a creating a risk for excessive deposits.

It then boils down to where to put excess reserves as economies slow, or if a shock to the system causes a flight-to-quality reaction. This is where the plot twists: The BOC has an overnight rate comparable to the US overnight rate at 0.50%. The RBNZ has an overnight rate of 2.50% with a near equivalent credit rating as does the BOJ. Hence, any further reduction of the BOJ will likely drive capital into the RBNZ, hence strengthening the Kiwi over the Loonie, hence driving the cross higher.

Even if the RBNZ reduces another measured step, 25 basis points, it’s still has one of the better combinations of credit quality and short term deposit rates in the Asia-Pacific region.

Mike Scrive

“CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.“