Prices in New Zealand surged by 1% in Q1 2017, above 0.8% expected and a much slower 0.4% that was reported in Q4 2016. Year over year, we also had a beat of 0.2%: CPI is up 2.2% against 2% expected.

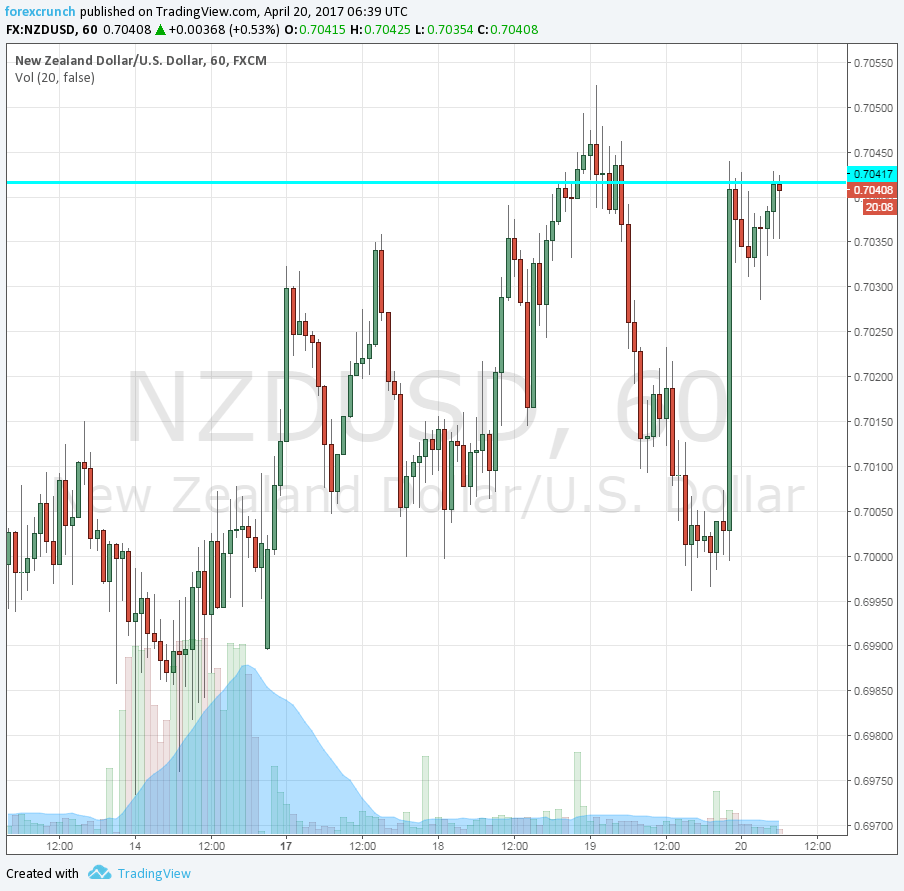

The kiwi did react positively to the news, but it never went very far. NZD/USD reached out to 0.7045 from just under 0.70 ahead of the publication. Looking just a few hours back, the pair had already traded around 0.7050, so this is only a move within the known ranges.

Inflation figures drive the decisions of the central bank regarding interest rates. And, New Zealand publishes its inflation figures only once per quarter, making the rise more impactful.

So why didn’t the kiwi leap higher?

The devil is in the details, as always. The primary price rises came from more volatile items. Energy prices were on the rise in New Zealand, as they were on the up and up elsewhere.

And prices were driven up (an annual rate of 4%) also on a rise in taxes on tobacco and cigarettes. This was no surprise for economists at the RBNZ and elsewhere.

So, core CPI is only up 1.5% year over year, lower than the rises in the US.

NZD/USD levels

At 0.7040, the kiwi is flirting with a level that worked as resistance. A further cap awaits at 0.7090 and 0.7150. Support is at 0.6950 and 0.6880.

More: Elliott Wave Analysis: GOLD and NZDUSD