The New Zealand dollar had a generally positive week, but never went too far.. The inflation report and the milk auction stand out. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

The Food Price Index came out on the positive side with +0.5% but the manufacturing index dropped a bit. In the US, data was quite mediocre. The good news from China helped the kiwi, but it lagged other commodity currencies.

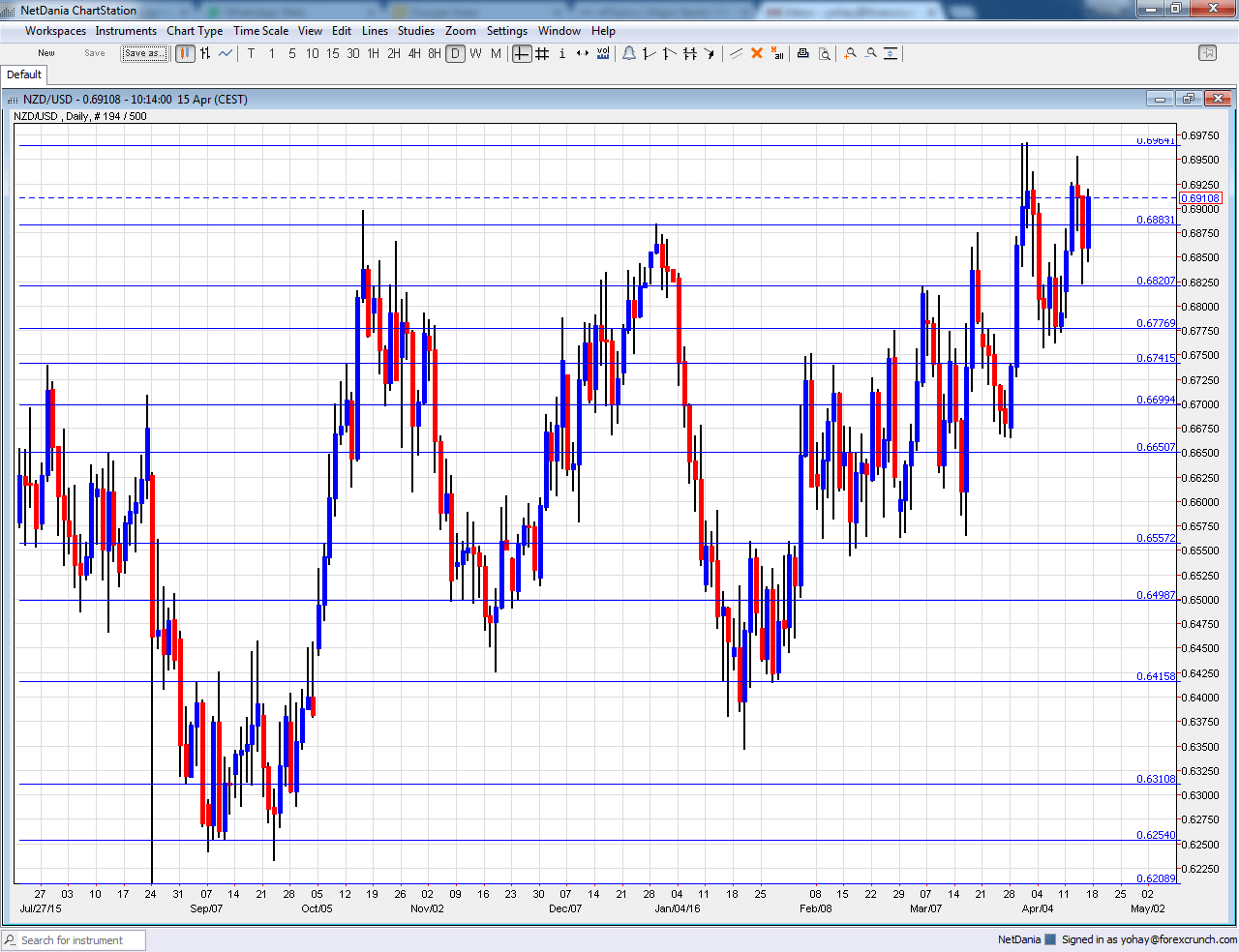

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- CPI: Sunday, 22:45. Inflation figures are published only once per quarter in New Zealand, making every release very important. Prices dropped 0.5% q/q in Q4 2015 and perhaps we see a small bounce this time. Also watch out for the year over year figures.

- GDT Price Index: Tuesday, during the European afternoon. This bi-weekly auction of milk always moves the NZD. Prices have been all over the place lately. A rise of 2.1% was seen after a drop beforehand.

- Visitor Arrivals: Wednesday, 22:45. Tourism also plays in role in the local economy. The number of visitors fell by 1.6% in February and could now be more stable in March.

- Credit Card Spending:Thursday, 3:00. With retail sales, like inflation, published only once per quarter, the measure of the usage of plastic cards certainly provides an insight on the kiwi consumer. A significant year over year rise of 7.2% was recorded in February and a more moderate rise is on the cards now.

NZD/USD Technical Analysis

Kiwi/dollar initially struggled with the 0.6820 level mentioned last week, but made a move to the upside before retreating.

Technical lines, from top to bottom:

0.7160 worked as support when the kiwi was trading on much higher ground in 2014. Also 0.7075 served as support back in mid 2014.

The round level of 0.70 is already in sight. The low of 0.6940 allowed for a temporary bounce.

The round 0.69 level has switched positions to resistance. 0.6860 was a low point as the pair dropped in June 2015. 0.6820 is worth noting after it capped the pair in March 2016.

It is followed by 0.6780 that capped the pair in recent months. The round level of 0.67 that works nicely as support. Another line worth noting is 0.6640, which capped the pair in November.

The post crisis low of 0.6560 is still of importance. Below, the round 0.65 level is of high importance now, serving as support.

I remain bearish on NZD/USD

The USD is re-emerging and the kiwi is not at its best to mitigate the situation. Prices, either in the form of official CPI or in the more up to date milk prices could dampen any rally.

In our latest podcast go on a Euro-trip