The New Zealand dollar was trading around the 0.70 level once again. Five events await us this week. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

Milk prices continue rising as seen in the latest GDT Price Index: 3.1%. The CPI beat expectations by rising 1% but there were doubts about the details, limiting the kiwi’s rise. In the US, disillusion from Donald Trump weighed on the greenback but not enough to really move NZD/USD.

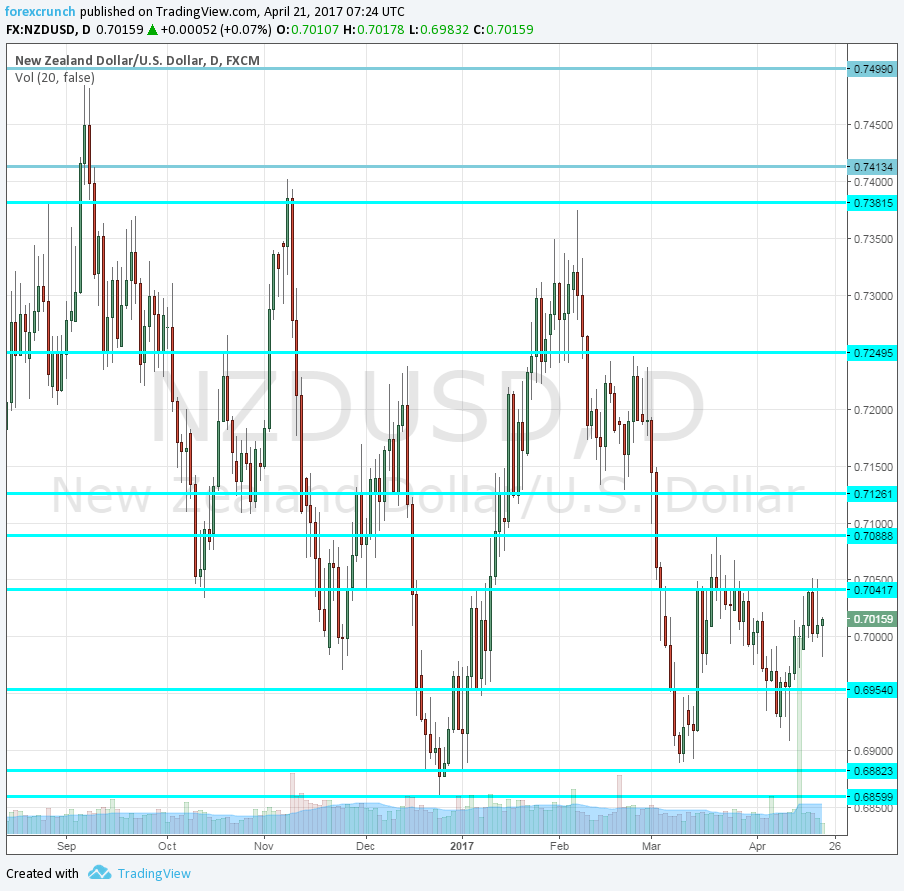

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Visitor Arrivals: Tuesday, 22:45. Tourism is New Zealand’s second sector after dairy exports. A drop of 1.9% was seen in visitor arrivals in February, a disappointment.

- Credit Card Spending: Wednesday, 3:00. Retail sales are published only once a month in New Zealand. This report complements the data with a snapshot of credit card usage. A neat 5.3% rise was recorded in February.

- Building consents: Thursday, 22:45. The number of building approvals is quite volatile but still, serves as a gauge of the housing sector. After a leap of 14%, we could see a slide this time.

- Trade Balance: Thursday, 22:45. New Zeland’s trade balance was nearly fully balanced in February, with a minuscule deficit of 18 million NZD.

- ANZ Business Confidence: Friday, 1:00. This survey of around 1500 businesses has been dropping in the past two months, reaching 11.3 points in March. Will it rise now?

* All times are GMT

NZD/USD Technical Analysis

Once again, kiwi/dollar hugged the 0.70 level (mentioned last week) but it managed to move a bit higher.

Technical lines, from top to bottom:

0.7380 was the high recorded back in February and is our top line for now. Below, we find 0.7250, which capped the pair back twice in mid-February and serves as a double top.

0.7160, which capped the pair back in November is a pivotal line within the range. 0.7125 had worked as a double bottom before it collapsed in early March.

0.7050 served as resistance during the month of March. The very round number of 0.70 is a battle zone.

Further below, 0.6960 worked as support in November and then in January once again. The round number of 0.69 is weak support, and it is followed by 0.6865.

I am bullish on NZD/USD

New Zealand data could remind us that the economy is looking good. The US dollar lost some of its moment.

Our latest podcast is titled French fate and British snaps

Follow us on Sticher or iTunes

Safe trading!