The New Zealand dollar made a move higher in range but eventually returned to the same area. What will take the kiwi out of range? Trade balance and business confidence are the main events for the week. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

The RBNZ hiked the rates for the second time, as expected. What wasn’t expected was that the central bank maintained its hawkish tone, making another rate hike probable for the next meeting. The concerns about the exchange rate are not that new. In the US, data has been mostly mixed for March, leaving the scene for the upcoming April figures.

[do action=”autoupdate” tag=”NZDUSDUpdate”/]

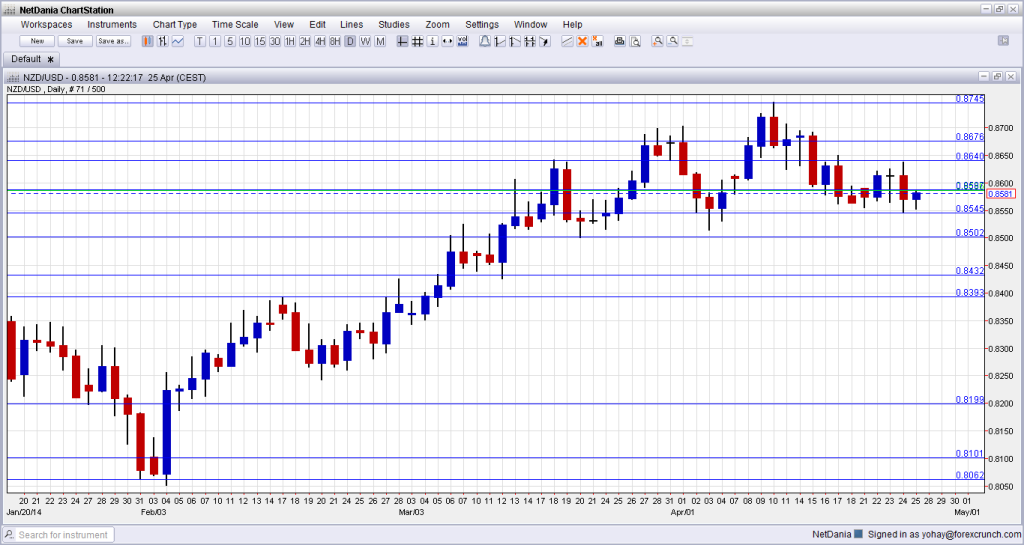

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Trade Balance: Monday, 22:45. New Zealand enjoyed a wide trade surplus back in February: 818 million. This helped the currency. A wider surplus of 937 million is expected now, with rises in both imports and exports.

- Building Consents: Tuesday, 22:45. One of the drivers of the current economic growth is the housing sector. While this figure is somewhat volatile, it still has an impact. In the past two months, the number of consents squeezed on a monthly basis, with -1.7% in February. A rebound is likely now.

- ANZ Business Confidence: Wednesday, 1:00. This important survey by the ANZ bank reached a peak of 70.8 points in February, reflecting the strongest confidence since the ’90s. While it fell since then to 67.3 in March, optimism certainly remains strong among businesses in New Zealand. A similar figure is expected for April.

- ANZ Commodity Prices: Friday, 1:00. The New Zealand economy leans heavily on food exports, making their prices important for the economy. After a minor drop of 0.1% in March, a small rise is expected now.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/dollar made gradual moves higher and eventually peaked at 0.8636, just under the 0.8640 line mentioned last week. A sharp followed and 0.8586 served as a cap.

Technical lines, from top to bottom:

The multi year high of 0.8832 is not that far away. Below this level, we can mark the round number of 0.88 as minor resistance.

The new 2014 peak of 0.8745 joins the chart and will be watched on any upside move.

The 2013 peak of 0.8676 now switches to a pivotal line in the range. The previous 2014 peak of 0.8640 is close by and is still of significance.

It is followed by the stubborn May 2013 high of 0.8586 is another important line. The new April 2014 low of 0.8550 is the next stepping stone on the way down and now serves as important support.

0.85 is around number and could trigger comments by policymakers. A move above this line didn’t hold in early March 2014. 0.8435 was the peak in September and was retested in January. It is a strong double top.

0.8392 served as resistance was a recurring peak between November and February. 0.8335 capped a move higher in December and also had a role in the past. The pair fell short of this line in January 2014.

Below, 0.8280 supported the pair in February 2014 and also in the past. 0.82, worked as support several times: in September, October and also in December. It is somewhat weaker now.

I am bearish on NZD/USD

While the RBNZ delivered as expected, a correction to recent rises cannot be ruled out now. It is both the will of the central bank, and could also come as a result of worries related to China and a potential USD rally in a very busy week ahead that consists of many figures for April.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.