The New Zealand dollar enjoyed the second week of modest rises, but things were not really straightforward. The milk auction as well as a speech from RBNZ governor Wheeler stand out. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

The RBNZ’s financial stability report did not rock the boat, but OPEC’s agreement had an indirect and positive effect on the kiwi. Commodity currencies enjoyed the decision on oil. In the US, data was mostly positive, with a beat in GDP as well as other good news, but the consolidation continued.

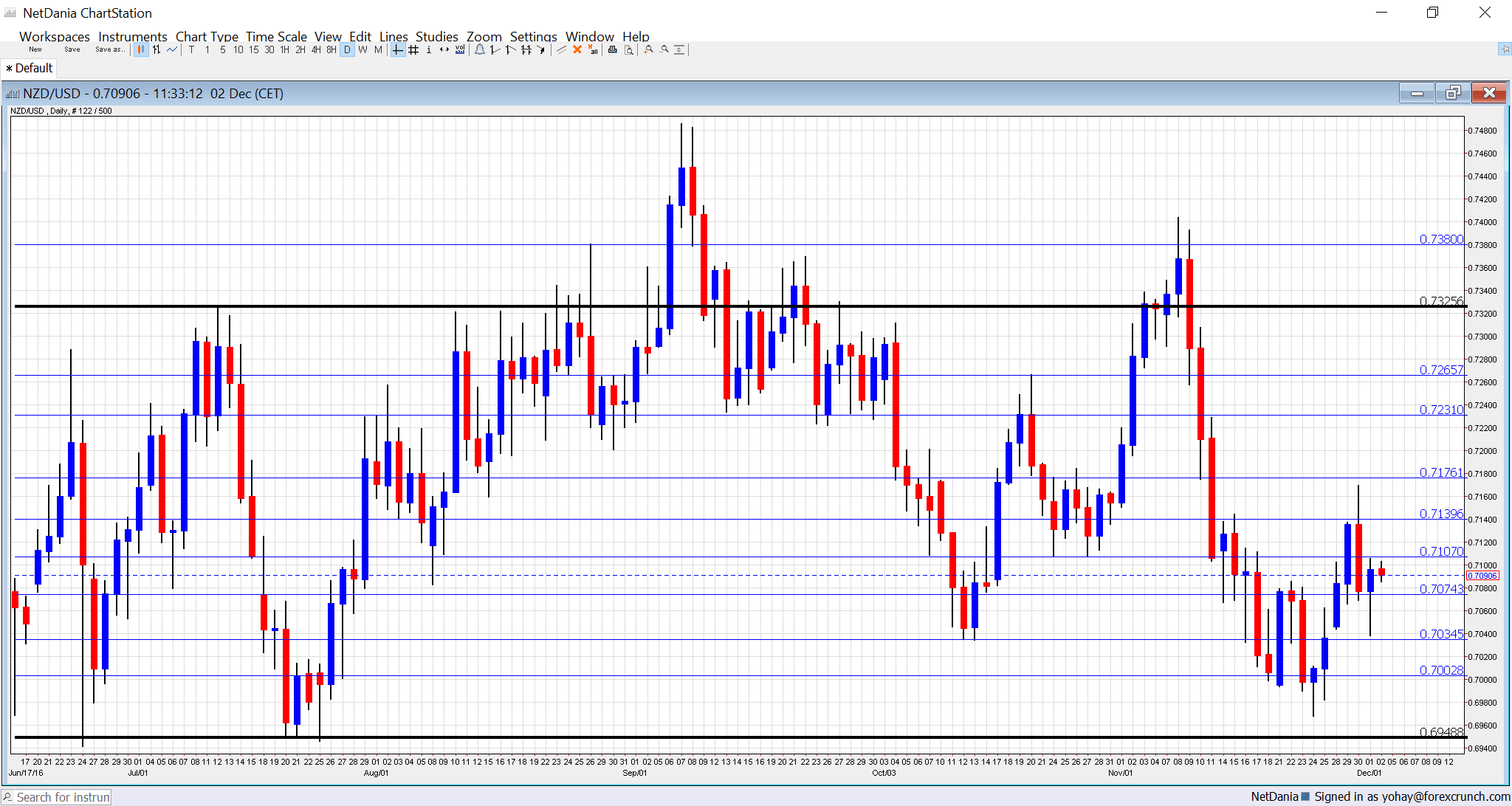

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- ANZ Commodity Prices: Monday, 00:00. While the milk auction is more prominent, also this measure of commodity prices makes its dent on the kiwi. Prices advanced by 0.7% in October. A more moderate rise is projected now.

- GDT Price Index: Tuesday, during the European afternoon. The Global Dairy Trade is published once every fortnight, and always shakes the NZ dollar. The price of milk advanced in the past four auctions, with 4.5% seen last time. Will we see a fifth consecutive rise? Watch out for high volatility around the publication.

- Manufacturing Sales: Tuesday, 21:45. The volume of sales at the manufacturing level rose by 2.2% in Q2 2016. We finally get the publication for Q3, deep into Q4. Another increase is estimated.

- Graeme Wheeler talks: Tuesday, 22:00. The Governor of the Reserve Bank of New Zealand testifies in Wellington and may spell out the prospects for monetary policy action going into 2017. It will be interesting to hear if the Bank intends to cut rates further, extending the trend seen in 2016. Also, the impact of the earthquake will be highly anticipated.

NZD/USD Technical Analysis

Kiwi/dollar stabilized and rallied, but was rejected at the 0.7160 level (mentioned last week).

Technical lines, from top to bottom:

The round number of 0.74 served as resistance and support back in 2015. 0.7330 was an initial high in 2016.

0.7265 was a swing high in October 2016 and works as resistance. 0.7230 served as support in September 2016.

0.7160 is a pivotal line within the range. 0.7140 worked in both directions in the past months.

0.71, a round number, was a double bottom in October. 0.7075 was a swing low in August and had a role afterward as well. It is followed by 0.7035, the low seen in October 2016.

The round level of 0.70 is still important because of its roundness but it isn’t really strong. The low of 0.6940 allowed for a temporary bounce.

I am neutral on NZD/USD

On one hand, the greenback could resume its rises, but the kiwi seems to be better footed to weather this storm, especially as commodity prices are on the rise.

Our latest podcast is titled From the Crude Cut to Draghi’s Drag

Follow us on Sticher or iTunes

Safe trading!