The New Zealand dollar traded in a narrower range, dipping under 0.70 but recovering as well. The RBNZ sticks out in the first week of the last month. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

The US dollar continued to move higher on the “Trump effect”, but this wasn’t as stark as previously seen. In New Zealand, the trade balance deficit squeezed to 846 million, better than predicted and also credit card spending accelerated. However, core retail sales fell short.

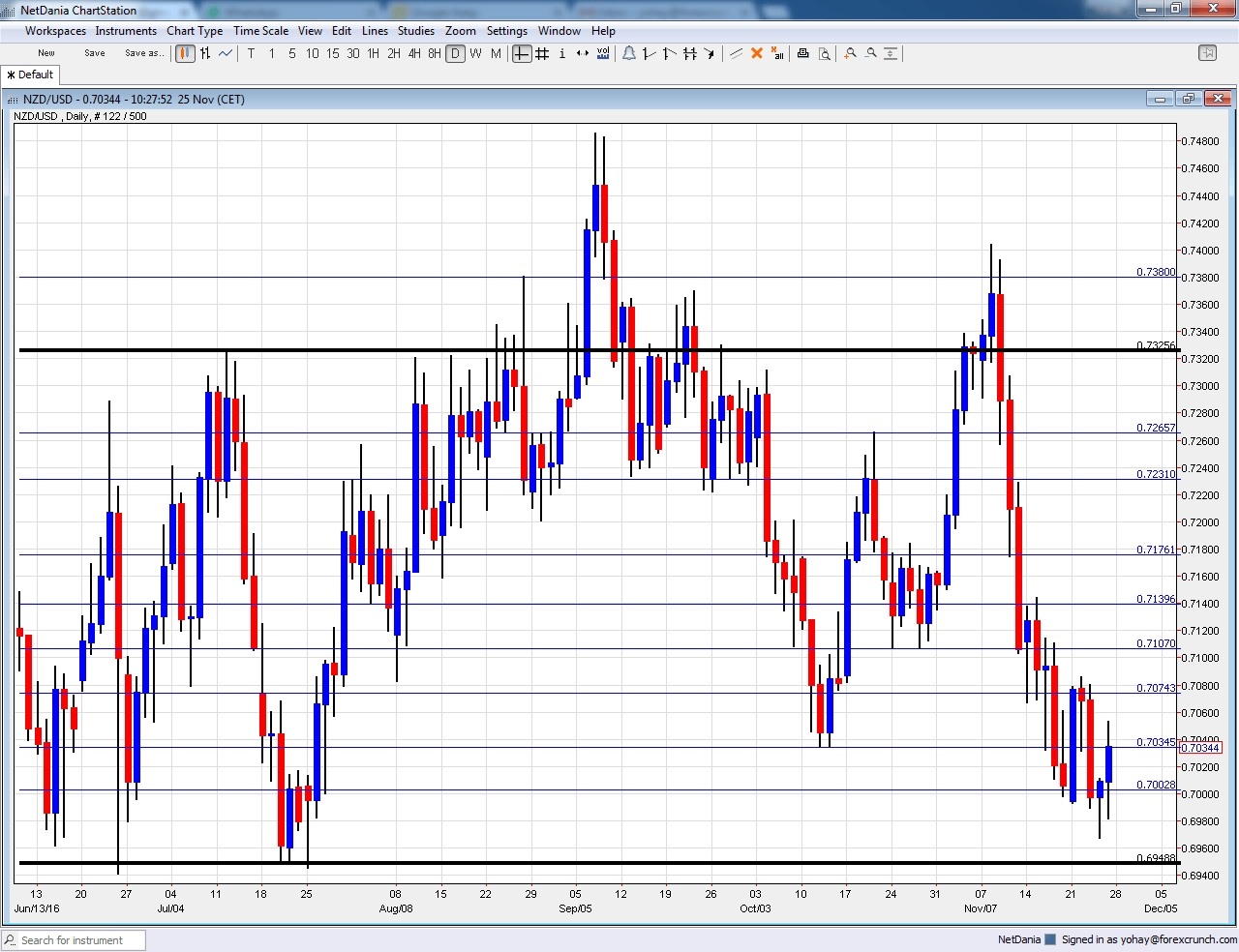

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- RBNZ Financial Stability Report: Tuesday, 20:00. The Reserve Bank of New Zealand publishes this wide-ranging report twice a year. In addition to assessing financial conditions, it also discusses growth and inflation prospects and is accompanied by a press conference.

- ANZ Business Confidence: This survey of around 1500 businesses ticked down in October to 24.5 points, but remains in positive territory, reflecting optimism.

- Graeme Wheeler talks: Wednesday, 00:10. The Governor of the RBNZ will appear in parliament and could take the opportunity to lay out future policy options.

- Overseas Trade Index: Wednesday, 21:45. This indicator, also known as Terms of Trade, has dropped by 2.1% in Q2 2016. We may see a bounce in Q3.

NZD/USD Technical Analysis

Kiwi/dollar was on the back foot, temporarily dipping under 0.70 (mentioned last week). However, it and settled on higher ground.

Technical lines, from top to bottom:

The round number of 0.74 served as resistance and support back in 2015. 0.7330 was an initial high in 2016.

0.7265 was a swing high in October 2016 and works as resistance. 0.7230 served as support in September 2016.

0.7160 is a pivotal line within the range. 0.7140 worked in both directions in the past months.

0.71, a round number, was a double bottom in October. 0.7075 was a swing low in August and had a role afterward as well. It is followed by 0.7035, the low seen in October 2016.

The round level of 0.70 is still important because of its roundness but it isn’t really strong. The low of 0.6940 allowed for a temporary bounce.

I am bearish on NZD/USD

After a pause in the greenback’s strength, the pair could resume its rise now.

Our latest podcast is titled Eyeing OPEC – Critical crude

Follow us on Sticher or iTunes

Safe trading!