The New Zealand dollar enjoyed the weakness of the USD dollar to rise nicely. It now faces a busy week with the rate decision standing out. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

New Zealand’s employment report was mixed. On one hand, employment advanced as expected and the participation rate topped 70%, an outstanding figure. However, the unemployment rate rose to 5.2% and more importantly, the labor cost index fell short of projections by increasing by only 0.4% quarter over quarter. In the US, things looked worse with Trump continuing his messy behavior and not providing any fiscal stimulus. The NFP was mixed, but weak wages weighed on the dollar.

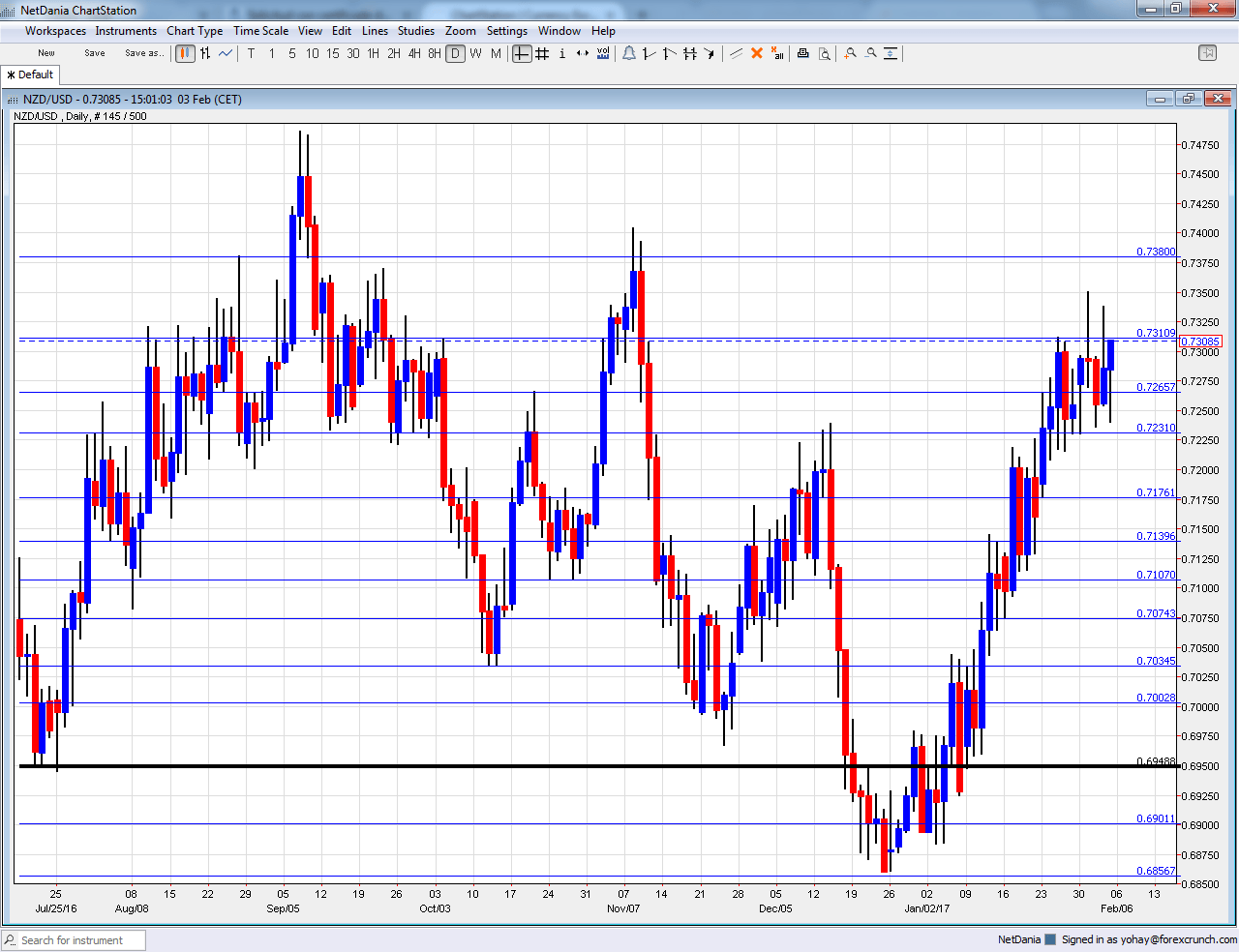

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Inflation Expectations: Tuesday, 2:00. With official inflation figures released only once per quarter, this measure of inflation expectations provides an insight, especially as it comes ahead of the RBNZ decision.

- GDT Price Index: Tuesday, during the European afternoon. The Global Dairy Trade is a snapshot measure of milk prices, New Zealand’s primary export. Prices increased by a modest 0.6% in the previous bi-weekly auction.

- Rate decision: Wednesday, 20:00. The Reserve Bank of New Zealand is expected to maintain the interest rate at 1.75%, a relatively low level for the nation. However, the robust economy could trigger a rate hike in the future. On the other hand, they do not want a stronger exchange rate to dampen the economy too quickly. Any hint about future moves this year will heavily impact the NZD. However, the direction is unclear.

- Building Consents: Wednesday, 21:45. Slightly overshadowed by the rate decision, this is a measure of the housing sector. However, it is quite volatile. A drop of 9.2% was seen in building approvals last time.

NZD/USD Technical Analysis

Kiwi/dollar found it hard to rise above the 0.7310 level (mentioned last week) .

Technical lines, from top to bottom:

The round number of 0.74 served as resistance and support back in 2015. 0.7310 was the high point in January 2017.

0.7265 was a swing high in October 2016 and works as resistance. 0.7230 served as support in September 2016.

0.7160 is a pivotal line within the range. 0.7140 worked in both directions in the past months.

0.71, a round number, was a double bottom in October. 0.7075 was a swing low in August and had a role afterward as well. It is followed by 0.7035, the low seen in October 2016.

The round level of 0.70 is still important because of its roundness but it isn’t really strong. The low of 0.6940 allowed for a temporary bounce.

I am bullish on NZD/USD

While the RBNZ would like a weaker exchange rate, the economy is doing quite well and Trump’s actions in the US certainly hurt the greenback.

Our latest podcast is titled Worrying wages and shining gold

Follow us on Sticher or iTunes

Safe trading!