The New Zealand dollar had a positive week, enjoying the beat in CPI. The upcoming week features the jobs report among other figures. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

New Zealand’s consumer price index rose by 0.4% in Q4, stronger than 0.3% that had been expected. This limits the scope for rate cuts. Credit Card Spending also saw a solid rise of 0.4%. In the US, Trump’s first week in the White House was quite busy.

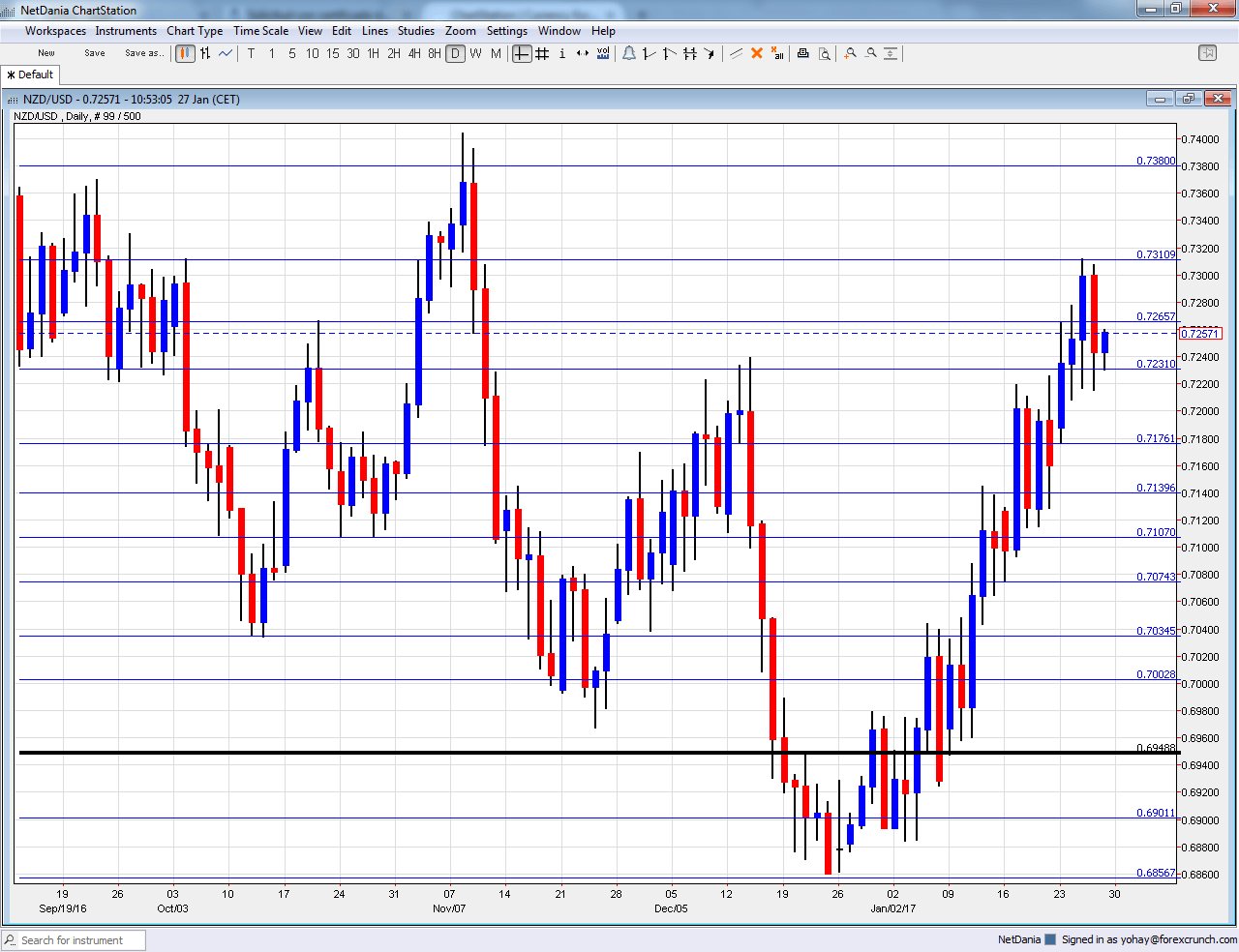

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Trade Balance: Sunday, 21:45. New Zealand saw a wider than projected trade deficit in November, at -705 million. A surplus was last seen in June. Yet another deficit is on the cards.

- Visitor Arrivals: Monday, 21:45. Tourism plays a key role in the New Zealand economy, with inspiration from Lord of the Rings lasting for a long time. A rise of 0.5% was seen in December.

- Jobs report: Tuesday, 21:45. New Zealand is unique in publishing its jobs report solely on a quarterly basis, making the publication a bigger deal than elsewhere. In Q3 2016, employment jumped by 1.4% and the unemployment rate dropped to 4.9%, to the envy of many countries. The labor cost index also advanced by 0.4%. Another improvement is probable, but such a jump in employment seems unlikely.

- ANZ Commodity Prices: Friday, 00:00. As an exporter of commodities, prices certainly matter, albeit the GDT number has a greater effect. An increase of 0.7% was seen in December.

NZD/USD Technical Analysis

Kiwi/dollar advanced above 0.73 but fell short of the 0.7330 level mentioned last week. It then consolidated the gains.

Technical lines, from top to bottom:

The round number of 0.74 served as resistance and support back in 2015. 0.7310 was the high point in January 2017.

0.7265 was a swing high in October 2016 and works as resistance. 0.7230 served as support in September 2016.

0.7160 is a pivotal line within the range. 0.7140 worked in both directions in the past months.

0.71, a round number, was a double bottom in October. 0.7075 was a swing low in August and had a role afterward as well. It is followed by 0.7035, the low seen in October 2016.

The round level of 0.70 is still important because of its roundness but it isn’t really strong. The low of 0.6940 allowed for a temporary bounce.

I am bullish on NZD/USD

The New Zealand economy looks great and we could get another reminder of that with the employment report. In the US, Donald Trump already began messing up.

Our latest podcast is titled Trumping Trade and the Donald Dollar

Follow us on Sticher or iTunes

Safe trading!