The New Zealand dollar remained relatively stable amid stable milk prices. The upcoming week features the quarterly inflation report as well as a speech from Governor Wheeler. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

Milk prices were surprisingly stable in the most recent bi-weekly auction: the GDT Price Index rose by 0.6%. US indicators also experienced stability with CPI coming out exactly as expected. The reaction to Trump’s inauguration has not been seen in full.

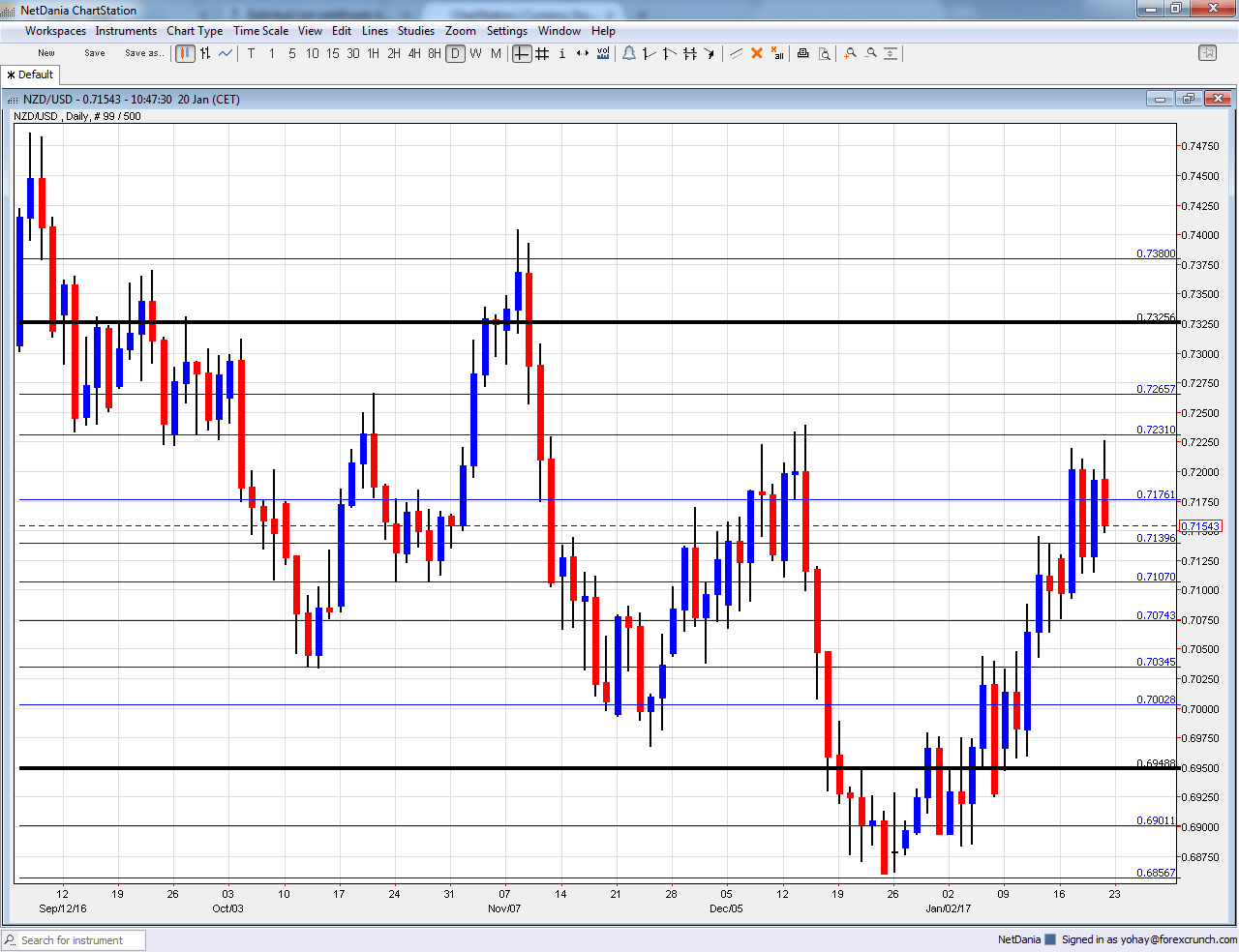

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Credit Card Spending: Wednesday, 2:00. With retail sales published only on a quarterly basis, this gauge of plastic card usage provides a snapshot of consumer activity. Consumption increased by 4.1% in November.

- CPI: Wednesday, 21:45. New Zealand publishes its official inflation data only once per quarter, making every release critical. The Consumer Price Index rose by 0.2% in Q3, a subdued rise. Slightly stronger inflation is on the cards now.

- Graeme Wheeler talks: Wednesday, 23:00. The Governor of the RBNZ will speak shortly after the inflation data is released and will have an opportunity to respond to it. Interest rates are quite low in New Zealand, but striking the right balance between growth and house prices is tricky. Wheeler has a chance to steer the kiwi and will probably try to talk it down.

NZD/USD Technical Analysis

Kiwi/dollar made a move towards 0.7230 (mentioned last week, but could not follow through.

Technical lines, from top to bottom:

The round number of 0.74 served as resistance and support back in 2015. 0.7330 was an initial high in 2016.

0.7265 was a swing high in October 2016 and works as resistance. 0.7230 served as support in September 2016.

0.7160 is a pivotal line within the range. 0.7140 worked in both directions in the past months.

0.71, a round number, was a double bottom in October. 0.7075 was a swing low in August and had a role afterward as well. It is followed by 0.7035, the low seen in October 2016.

The round level of 0.70 is still important because of its roundness but it isn’t really strong. The low of 0.6940 allowed for a temporary bounce.

I am bearish on NZD/USD

The US dollar is likely to rise as Trump enters office as the Trump Train has not been derailed, not yet at least. In addition, Wheeler could dampen any potential rise in the exchange rate.

Our latest podcast is titled Monetary Matters – FED, ECB and BOE movements

Follow us on Sticher or iTunes

Safe trading!