The New Zealand dollar was falling quite a bit on growing speculation for a rate cut by the RBNZ. Three events are lined up this week. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

The Reserve Bank of New Zealand published a special assessment of the economy and it seems they are ready to cut. This joins a weaker than expected CPI release, showing prices advanced only 0.4% in Q1. The steady milk prices did not help, nor did the OK US data. All in all, it was a bad week for kiwi/dollar.

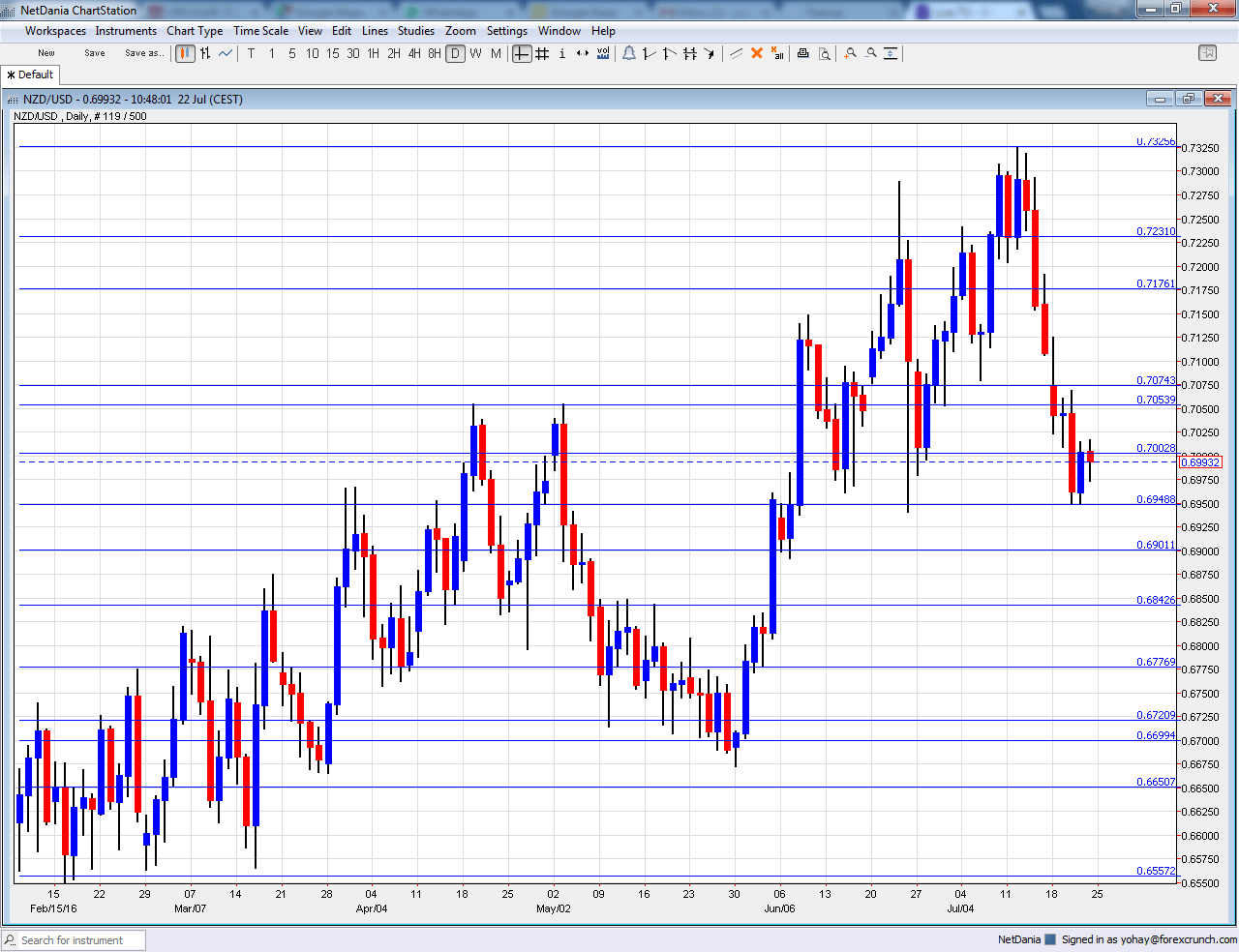

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Trade Balance: Monday, 22:45. New Zealand enjoys 5 consecutive months of surpluses and they surprised markets most of the times. After 358 million in May, June could remain with a positive sign.

- Building Consents: Thursday, 22:45. This indicator has become less volatile of late and provides a good gauge of the housing sector. It slid 0.9% last time.

- ANZ Business Confidence: Friday, 1:00. Business confidedence bounced back from the lows and hit 20.2 points in June. A similar number is on the cards now.

NZD/USD Technical Analysis

Kiwi/dollar had a bad week. After an initial slide to a struggle with 0.7050 (mentioned last week), the pair continued lower.

Technical lines, from top to bottom:

The round number of 0.74 served as resistance and support back in 2015. 0.7305 is the high of 2016 so far.

0.7290 was the pre-Brexit peak and serves as high resistance. The next line is 0.7240 which capped the pair in July 2016.

0.7160 worked as support when the kiwi was trading on much higher ground in 2014. 0.7050 was the high in April 2015.

The round level of 0.70 is still important because of its roundness but it isn’t really strong. The low of 0.6940 allowed for a temporary bounce.

The round 0.69 level has switched positions to resistance. 0.6840 capped the pair during May 2016 and tops the range. 0.6720 is the low seen in May 2016 more than once providing the lower bound.

The round level of 0.67 that works nicely as support. Another line worth noting is 0.6640, which capped the pair in November.

I am bearish on NZD/USD

On one hand, the RBNZ is expected to cut rates. On the other hand, this may already be priced in. However, the US dollar’s strength could tilt the pair lower.

Our latest podcast is titled Oil down, gold up and the upcoming Fed-fest