The New Zealand dollar found it hard to rise against the surging USD despite good data at home. Can it recover now? Central bank action and retail sales are the key events. Here is an outlook for the events moving the kiwi, and an updated technical analysis for NZD/USD.

New Zealand enjoyed an excellent jobs report: the unemployment rate fell even though the participation rose. These excellent news were not enough though, as speculation of QE tapering in the US are on the rise once again, after a surprisingly good Non-Farm Payrolls report.

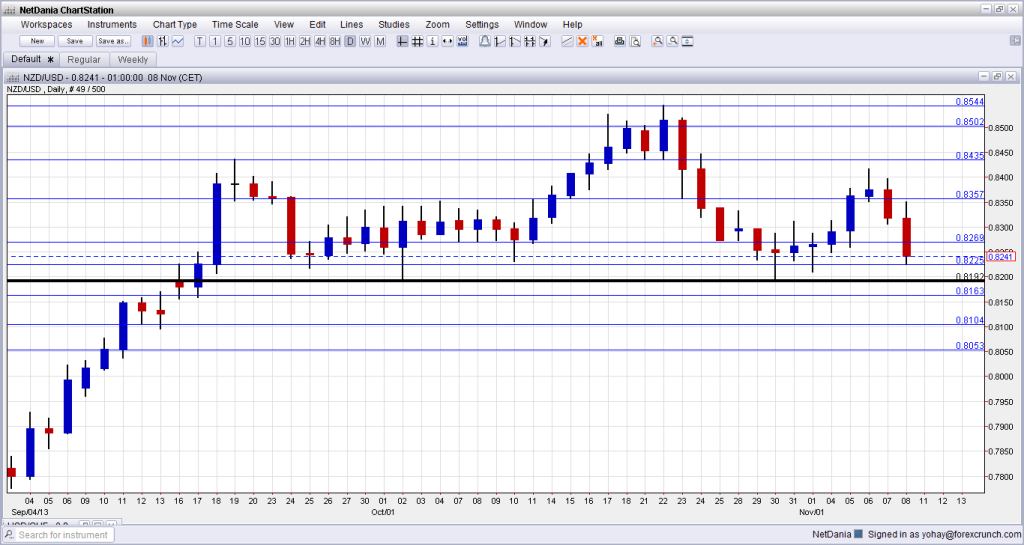

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- RBNZ Financial Stability Report: Monday, 20:00. The central bank publishes a quarterly report about the stability of the financial system as well as a look into economic forecasts. This might provide another opportunity for the RBNZ to complain about the exchange rate, but also release a bullish outlook for the economy.

- FPI: Monday, 21:45. The Food Price Index is important for New Zealand, as the economy depends on exports of food. No change was seen last month.

- Graeme Wheeler testifies: Wednesday, 00:00. The governor of the RBNZ goes to parliament in Wellington to testify. He usually releases statements regarding the economy, the value of NZD, etc. We can certainly expect action in the markets.

- Business NZ Manufacturing Index: Wednesday, 21:30. This private sector has a similar system to that of the PMIs, where a score above 50 represents growth and below represents contraction. After a relatively lower number of 54.3 last month, we can now expect a small rise in October. Manufacturing isn’t a major sector in NZ, but the publication still has some impact.

- Retail Sales: Wednesday, 21:45. As with other publications in New Zealand, this one is released only quarterly, thus creating a bigger a bigger market impact. The data for Q3 is now published. Q2 saw a strong rise of 1.7% in the volume of sales. A more moderate growth rate of 0.9% is now predicted. Core sales are also expected to rise, but at 1.4%, less than 2.3% seen in Q2.

* All times are GMT.

NZD/USD Technical Analysis

NZD/$ began the week climbing over the 0.8270 line (mentioned last week) before continuing to higher ground and temporarily breaking back into the uptrend channel. From there, the drop began and the pair eventually found support at 0.8225.

Technical lines, from top to bottom:

The year-to-date high of 0.8676 is the top line. It stands in the distance. Below, the peak in April, at 0.8585 is the next line of resistance.

October’s high of 0.8544 is close by. At the moment, it is only weak resistance. The round number of 0.85 is also watched.

0.8435 was the peak in September – a peak that triggered a big downfall. After it was broken again, the line switched to support. It is a clear separator.

0.8360 worked in both directions at the beginning of the year: in March as resistance and in April as support. Also more recently, it worked as yet another clear separating line. Below, 0.8270 provided some support during October, and it also worked as resistance in March.

0.8225 was an important line in previous years, and also worked as support recently. 0.8160 capped the pair in August and worked as support in March. The round number of 0.81 worked as resistance in July.

Lower, 0.8050 was a peak back in June and works as support before the very round number of 0.80.

Broken uptrend channel

Since September, NZD/USD traded in an upwards channel, with uptrend resistance having a clearer role than support. As the chart shows, NZD/USD broke below this line. Another attempt to break back didn’t last too long.

I am bullish on NZD/USD

Domestic data is certainly supportive of the kiwi dollar, with unemployment standing out. In addition, rate hikes are expected next year. Now that the a “Dectaper” is priced in in the US, the worst seems to be behind us.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.