The New Zealand dollar continued tumbling down after the dollar continued surging on Trump. The earthquake in New Zealand delayed some publications. The upcoming week features three events. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

Milk prices continued rising, with another +4.5% in the latest GDT Price Index. Retail sales rose by 1.5% in Q3, but the core sales number is still awaiting. This is better than 0.9% seen beforehand. Despite the positive news, the greenback’s sweep on Trump’s Triumph pushed NZD/USD lower.

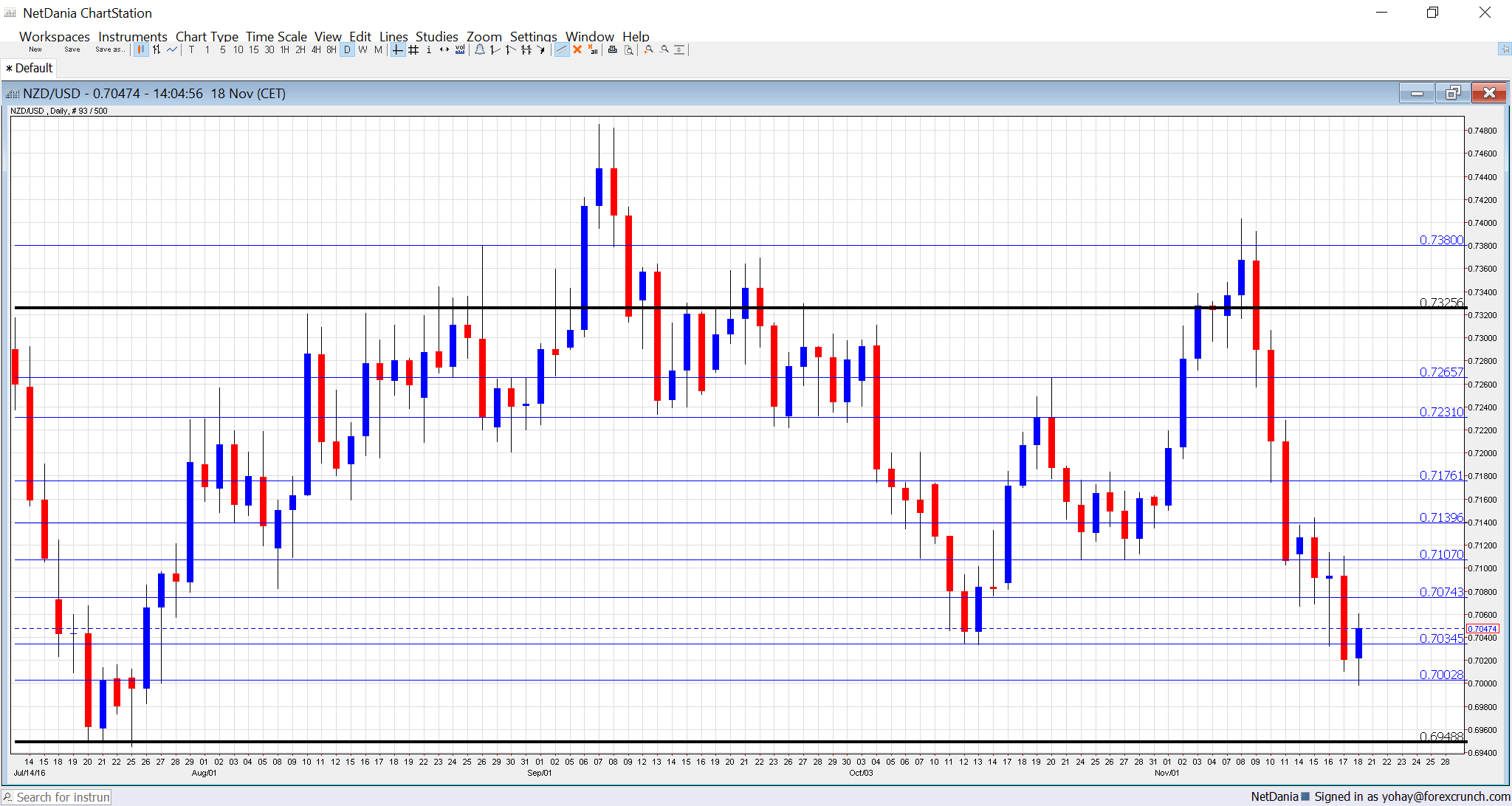

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Core retail sales: Sunday, 21:45. Excluding volatile items, sales rose by only 0.3% against 1.1% expected and 2.5% seen in the previous month. This did not have a strong impact as the headline number was published separately.

- Credit Card Spending: Monday, 2:00. With retail sales published only once per quarter, this measure of spending provides an updated snapshot of consumption. This release could have a more muted effect due to the proximity to the recent retail sales publication. A rise of 8.2% was seen last time.

- Visitor Arrivals: Monday, 21:45. A rise of 3.6% was seen in the amount of visitor arrivals. Tourism plays a role in the economy of New Zealand. Entries have risen by 3.6% in September. Another small increase is on the cards.

- Trade Balance: Thursday, 21:45. New Zealand suffered a wide trade deficit of 1.436 million NZD in September. A smaller number is on the cards now.

NZD/USD Technical Analysis

Kiwi/dollar had a slightly more normal week, initially bouncing off the 0.7070 levels mentioned last week.

Technical lines, from top to bottom:

The round number of 0.74 served as resistance and support back in 2015. 0.7330 was an initial high in 2016.

0.7265 was a swing high in October 2016 and works as resistance. 0.7230 served as support in September 2016.

0.7160 is a pivotal line within the range. 0.7140 worked in both directions in the past months.

0.71, a round number, was a double bottom in October. 0.7075 was a swing low in August and had a role afterward as well. It is followed by 0.7035, the low seen in October 2016.

The round level of 0.70 is still important because of its roundness but it isn’t really strong. The low of 0.6940 allowed for a temporary bounce.

I am neutral on NZD/USD

After the big falls, we could see some stability and the kiwi’s relatively high-interest rate could keep it bid.

Our latest podcast is titled Not all financial assets are Trump-ed equally

Follow us on Sticher or iTunes

Safe trading!