The New Zealand dollar had a terrible week, reversing the gains seen beforehand, as Trump’s Triumph hurt it hard and the RBNZ’s rate cut did not help. The upcoming week features retail sales among other events. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

The Reserve Bank of New Zealand cut interest rates to 1.75% as expected and the door remains open for more cuts. This does not bode well for the kiwi. In the US, Trump’s victory in the elections was a shocker that left commodity currencies bleeding and the kiwi was not spared.

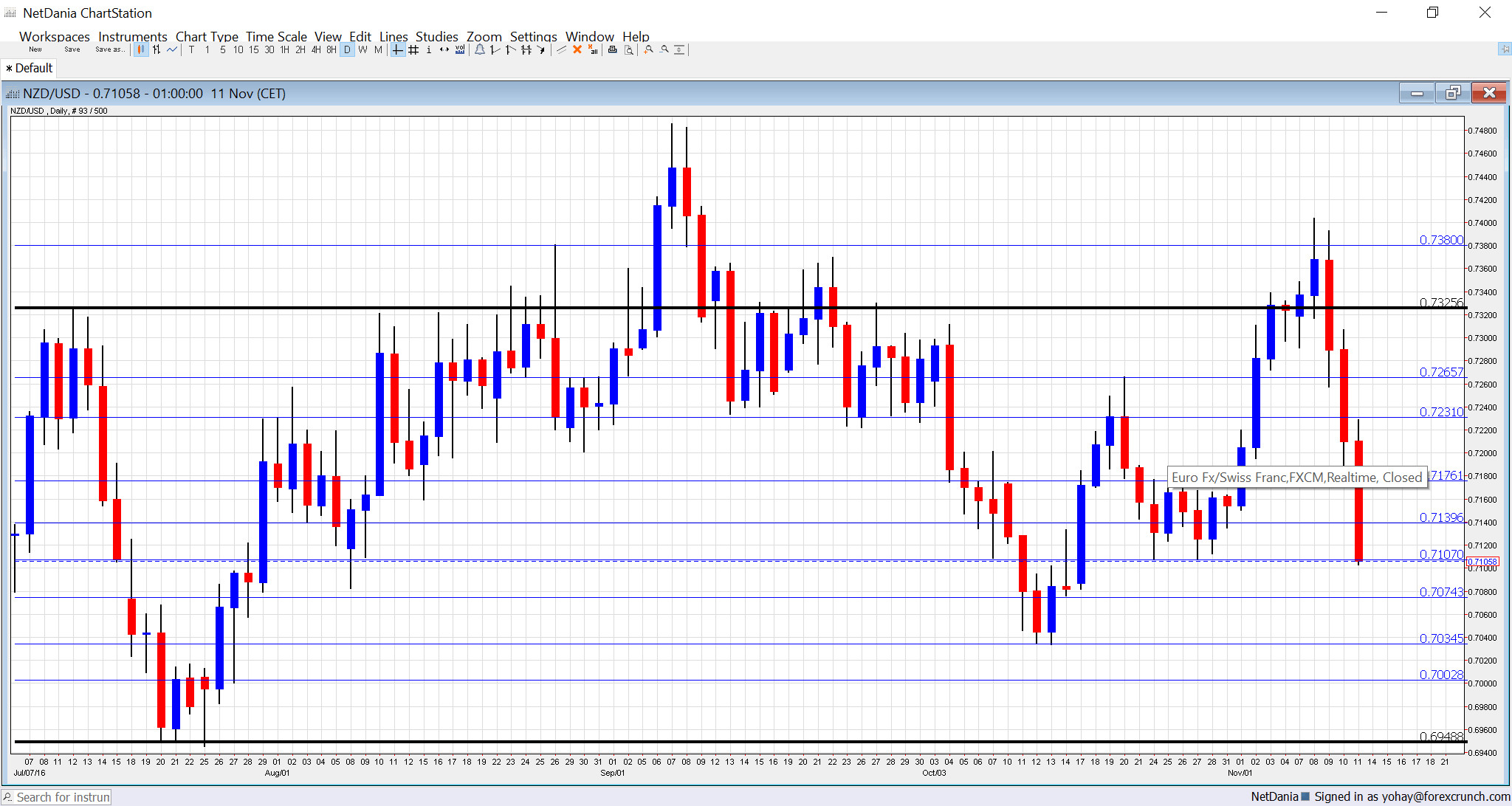

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Retail Sales: Monday, 21:45. The volume of retail sales is released only once per quarter in New Zealand, making every publication quite a big deal. After a leap of 2.3% seen in Q2, a slowdown to a gain of 0.8% is on the cards. Core sales are predicted to rise by 1.1% after 2.6% last time.

- GDT Price Index: Tuesday, during the European afternoon. The Global Dairy Trade reflects prices of milk, New Zealand’s prominent export. A leap of 11.4% was recorded last time, boosting the kiwi. A drop cannot be ruled now.

- PPI: Wednesday, 21:45. Similar to other NZ data, producer prices are published only once per quarter. PPI Input advanced by 0.9% in Q2. PPI Output saw a gain of 0.2%. Slower rises are projected.

NZD/USD Technical Analysis

Kiwi/dollar had a turbulent week. It was rejected at resistance, at 0.74 (mentioned last week) before collapsing and ending the week at support around 0.71.

Technical lines, from top to bottom:

The round number of 0.74 served as resistance and support back in 2015. 0.7330 was an initial high in 2016.

0.7265 was a swing high in October 2016 and works as resistance. 0.7230 served as support in September 2016.

0.7160 is a pivotal line within the range. 0.7140 worked in both directions in the past months.

0.71, a round number, was a double bottom in October. 0.7075 was a swing low in August and had a role afterwards as well. It is followed by 0.7035, the low seen in October 2016.

The round level of 0.70 is still important because of its roundness but it isn’t really strong. The low of 0.6940 allowed for a temporary bounce.

I am bearish on NZD/USD

Uncertainty about Donald Trump’s policies could weigh on commodity currencies for another week. In addition, retreats in milk prices and retail sales after excellent numbers last time could add fuel to the fire.

Our latest podcast is titled Trump-time – fiscal, monetary and market implications