The New Zealand dollar reached new highs but eventually retreated to lower ground. NZIER Business Confidence is the highlight of this week. Here’s an outlook for the events in New Zealand, and an updated technical analysis for NZD/USD.

The Chinese rate cut helped the kiwi at first, but as it was accompanied by further easing steps in Europe, the tables turned on the New Zealand dollar, that surrendered the greenback’s strength – a classic “risk off” behavior.

Updates: Chinese CPI posted a gain of 2.2%, slightly below the market forecast of 2.4%. The quarterly NZIER Business Confidence will be released later on Monday. The kiwi dropped below the 80 level after weak US employment figures and last week’s interest rate cut by China’s central bank. The pair was trading at 0.7941. REINZ HPI increased by only 0.3%, after a strong 1.7% gain in June. NZIER Business Confidence plunged to -4 points. It was only the second reading below zero in the past three years. The kiwi managed to shrug off the weak data, at least for the time being. NZD/USD was trading at 79.67. Manufacturing Index fell sharply, but managed to stay just above the 50 line, coming in at 50.2 points. FPI jumped 1.4%. It was the inflation’s index highest increase since last August. NZD slumped following the release of last month’s minutes from the Federal Reserve’s Policy Meeting, which indicated that the Fed was not planning any monetary easing. NZD/USD was trading at 0.7867.

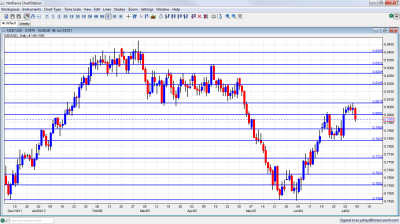

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- NZIER Business Confidence: Monday, 22:00.New Zealand businesses confidence picked up in May climbing to 13 from 0 in April despite discouraging economic data. A rate hike is not expected until halfway through next year an even later in case of worsening conditions in global markets.

- REINZ HPI: Tue.-Sat. The REINZ Housing Price Index climbed 1.7% in May after a 0.3% decline in April. The rise occurred amid increases in Auckland,Christchurch, Other North Island, Other South Island and Sections. On a yearly base the REINZ Housing Price Index rose 6.4% compared to May 2011. This increase coincides with the climb in house sales across NZ indicating improvement in the housing sector.

- Business NZ Manufacturing Index: Wednesday, 22:30. NZ manufacturing activity expanded in May rising to 55.7 after contracting in April. The responders couldn’t point on any particular cause for this increase but a gradual improvement was felt in all aspects.

- FPI : Wednesday, 22:45.New Zealand’s food prices increased in May by 0.3% after a 0.1% decline in April amid a rise in prices of tomatoes, broccoli, non-alcoholic beverages and ready-to-eat food.

* All times are GMT.

NZD/USD Technical Analysis

NZD/$ remained in tight range above 0.80 and peaked at 0.8075, a new line on the chart (didn’t appear last week). However, on Friday the pair fell and returned to the lower range, closing at 0.7970, a weekly slide of 33 pips.

Technical lines, from top to bottom:

0.84 was resistance back in February 2012. 0.8320 was a wing high in April, just before the big dive.

0.8260 capped the pair during March, and is stubborn resistance. 0.8185 was resistance in the past and is now weaker.

0.8075 was the peak in July 2012 and replaces other lines in this region. This is the highest in 3 months. The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance.

Another round number, 0.79, is key resistance, after being a very distinct line separating ranges. It proved its strength also in June 2012. 0.7840 provided support for the pair several times during June 2012 and also worked as resistance back at the end of 2011.

0.7723 supported the pair back at the beginning of 2012 and also worked in the other direction in June 2012. 0.77 provided support in December and now switches to support.

0.7620 provided support in May 2012 and is resistance once again, although weaker than in previous weeks. 0.7550 is resistance once again, even after the breakdown. It was a very distinct line separating ranges and had a similar role back in January.

Below, 0.7460 is significant support after working as support at the end of 2011 and also in May and June 2012. This is key support. 0.7370, which was the trough in December is low support. This is a significant line if 0.7460 breaks.

I turn from neutral to bearish on NZD/USD

New Zealand’s economy remains strong, the European debt crisis and the Chinese weakness outweigh this strength. Also the US situation undermines the kiwi – the job market is too weak to encourage risk taking (buying NZD), but not enough for QE3 that also encourages risk. This is a positive situation for the greenback, and bad for the ultimate risk asset: NZD.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.

- For the Swiss Franc, see the USD/CHF forecast.