NZD/USD retreated throughout most of the week, but then made a breakthrough to challenge high resistance. Can it continue after closing above 80? There are no events scheduled in New Zealand in the upcoming week, so the outlook leans to the technical analysis of NZD/USD.

The positive results of the EU Summit lifted the kiwi and changed the whole picture. The leaders decided on direct bank recapitalization and bond buying, although conditions apply and implementation will not be swift. Despite these holes, markets rallied and the kiwi enjoyed its position as a risk currency.

Update: The kiwi continues to make headway against the US dollar after Friday’s big spike. NZD/USD was trading at 0.8036. The markets are waiting for the release of Commodity Prices on Tuesday. Commodity Prices hit a three-month high in June, but still posted a decline of 2.4%. The kiwi continued to maintain its position above the 80 line, as NZD/USD was trading at 80.22. USD/NZD is steady, as the markets wait for the ECB interest rate announcement and the US releases key employment data on Thursday. The pair was trading at 80.28. The kiwi is up slightly, as NZD/USD was trading at 80.54.

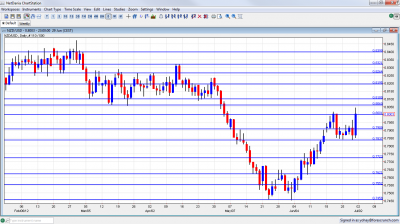

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

NZD/USD Technical Analysis

Kiwi/$ traded in a range and found support at 0.77840, a new line that didn’t appear last week. From this point it started a rally on Friday, topping 0.80 once again and getting closer to the 0.8060 line. It eventually closed at 0.8003.

Technical lines, from top to bottom:

0.84 was resistance back in February 2012. 0.8320 was a wing high in April, just before the big dive.

0.8260 capped the pair during March, and is stubborn resistance. 0.8185 was resistance in the past and is now weaker.

The 0.8080-0.81 region supported the pair during March and April and will be a tough barrier if 0.80 is broken. 0.8060 was resistance in October and support beforehand. It was also tested in January and in March. It has renewed strength after capping the pair in June 2012.

The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance. Another round number, 0.79, is key resistance, after being a very distinct line separating ranges. It proved its strength also in June 2012.

0.7840 provided support for the pair several times during June 2012 and also worked as resistance back at the end of 2011.

0.7723 supported the pair back at the beginning of 2012 and also worked in the other direction in June 2012. 0.77 provided support in December and now switches to support.

0.7620 provided support in May 2012 and is resistance once again, although weaker than in previous weeks. 0.7550 is resistance once again, even after the breakdown. It was a very distinct line separating ranges and had a similar role back in January.

Below, 0.7460 is significant support after working as support at the end of 2011 and also in May and June 2012. This is key support. 0.7370, which was the trough in December is low support. This is a significant line if 0.7460 breaks.

0.7308 is minor support after working as such at the beginning of 2011. 0.72 worked in both directions during the past few years.

0.71 is the last line, after being a distinct trough in March 2011.

I am neutral on NZD/USD

The relative strength of the New Zealand economy and calm in Europe boost the pair. However, the mood in Europe might change, and also the US Non-Farm Payrolls may pour cold water on risk.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.

- For the Swiss Franc, see the USD/CHF forecast.