The price of crude oil has recovered since the crash under $47. And after stabilizing just around $50, the price of the black gold opened the week with a weekend gap to the upside, reaching a high of $51.20.

There are good reasons for this specific rise in prices. USD/CAD is already some 200 pips off the highs. Is there more room to the downside?

Emerging OPEC deal

The main driver for higher oil prices stems from an ongoing chatter of an extension of an OPEC / non-OPEC deal. The members of the oil cartel convene later this week and it already seems that they will extend the deal by nine months, through March 2018. The current deal was only for six months.

The emerging agreement between OPEC members come after Saudi Arabia and Russia agreed on an extension. Russia is the largest non-OPEC producer and Saudi Arabia is the de-facto leader of OPEC. So far, the Kingdom picked up the slack for other OPEC members. Some are exempt and others just fall short of fulfilling their quotas.

US shale production reaching its limits?

But there is another reason for the rise in oil prices. So far, the United States picked up production each time prices were rising. Output has risen from a trough of 8.7 million barrels per day (mbpd) to around 9.3mbpd at the moment. Recent weeks have seen gradual and steady rises in output. However, the US may have reached its limits.

However, the US may have reached its limits.In the past week’s Inventory report, the level of production leveled out and even dropped a bit. This may be a one-off but may also mark a limit.

The US dearth of investment following the big crash in oil prices in late 2014 means it will be hard to ramp up new wells. At the peak of production, output reached 9.6mbpd. Yet some of the rigs paid off only when the price of oil was at sky high levels.

If the US does not pick up the slack, oil prices could continue even higher.

USD/CAD

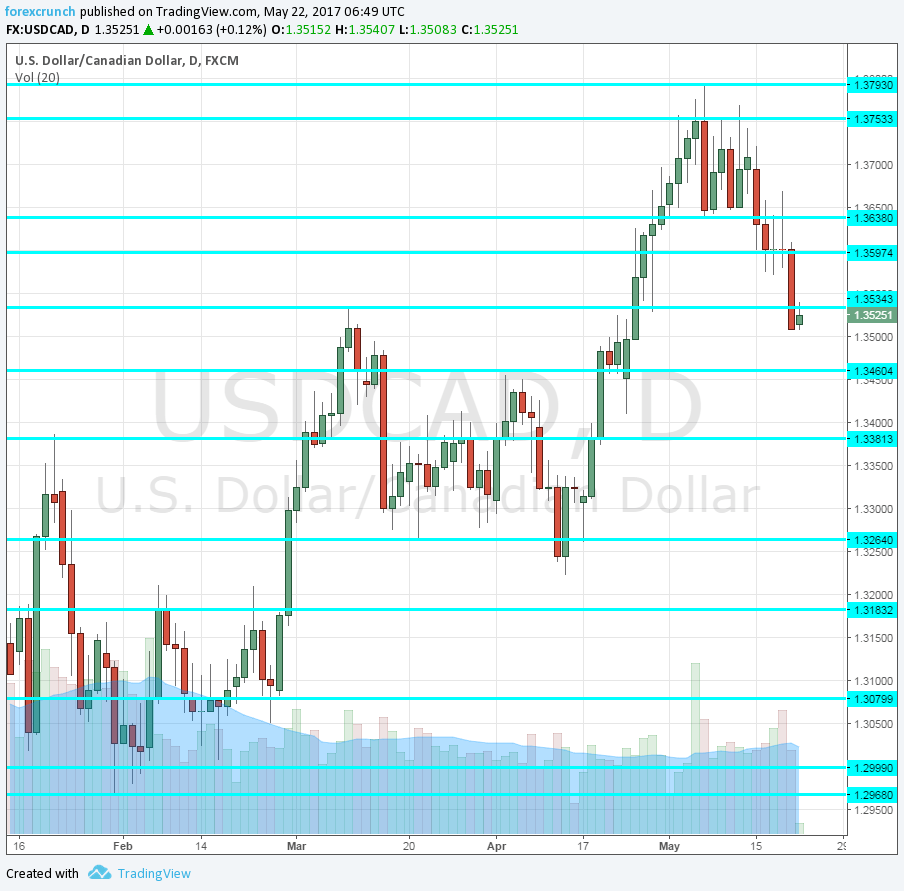

Dollar/CAD is currently trading at 1.3525. The pair slipped under support at 1.3540. Further support awaits at 1.3460, a veteran line on the chart. The next levels are 1.3380 and 1.3250.

Resistance awaits at 1.36 and 1.3640, levels that the pair visited recently. The cycle high of 1.3790 is the ultimate cap.

More: CAD: Has Peak Negative CAD Sentiment Been Reached? What’s The Trade? – Nomura