The Canadian dollar has been under a lot of pressure from the US dollar following Trump’s Triumph. USD/CAD reached new highs and seemed unstoppable. However, as the dust settles from the US elections, the loonie returns to one of its fundamental drivers: oil prices, albeit in a somewhat limited fashion.

There is mounting speculation that the OPEC members will reach an agreement to cut or cap oil output. Sources in Vienna report “progress” between the technical teams. This follows the Algiers Agreement. Back in September, the Saudis were eager to cut a deal, totally changing their stance.

That agreement was a general one, with the details awaiting the official OPEC meeting at the end of November. Even Russia, a large non-OPEC producer is ready to get on board. While the deal is not done yet, the nature of it can be soft and implementations questionable, oil prices are on the move.

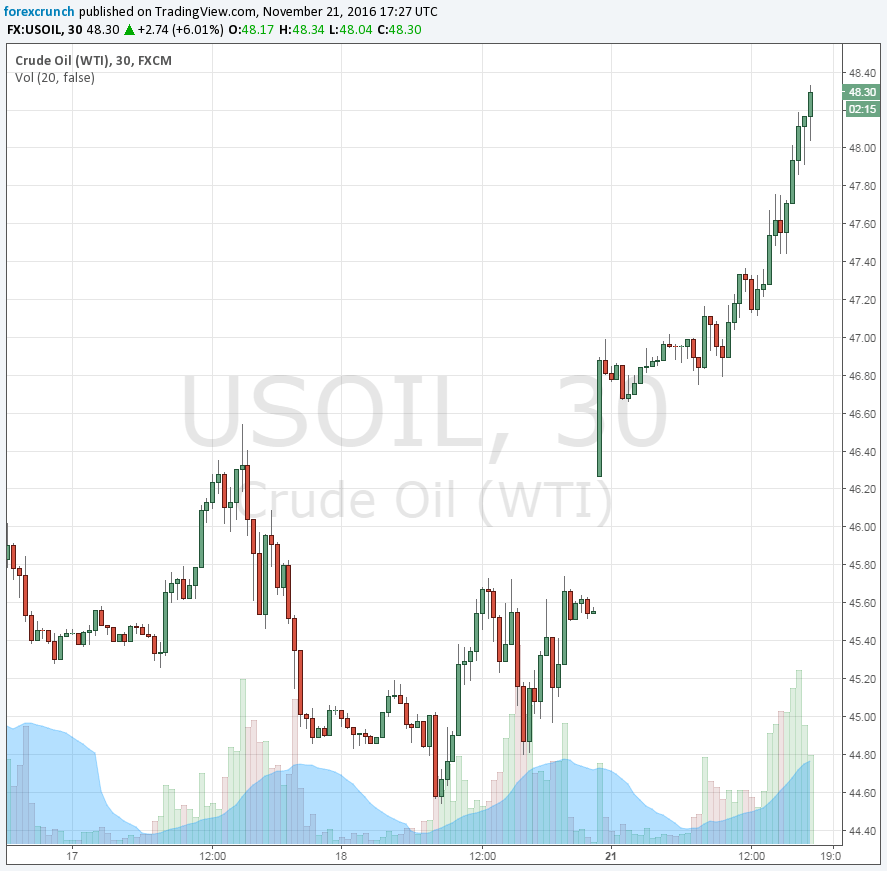

WTI Crude Oil is enjoying a leap of over 5% to 5.48% at the time of writing, edging towards the highs of August, at $49. $52 is the double-top resistance level. Even if the black gold is not breaking its cycle highs, the big move helps the loonie.

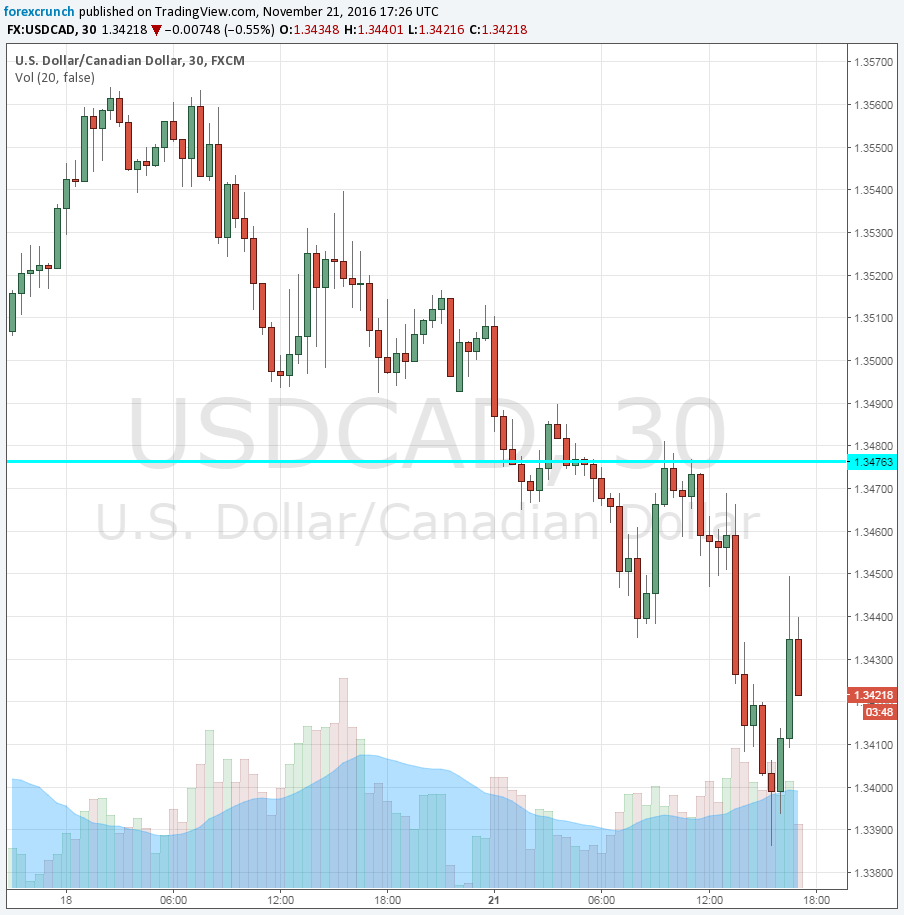

USD/CAD is extending its descent and trading around 1.3428. It had already dipped below 1.34. Support awaits at 1.3360. Resistance is at 1.3480.

Oil can be a slippery slope for the Canadian dollar: the rise in WTI is not followed by a rise of the same magnitude in the C$. And what happens if Vienna reports difficulties in the talks? In that case, the slump in CAD could be worse than the one in oil. The Canadian dollar does not look strong, to say the least.

The charts below speak for themselves.

More: CAD: A ‘Trump Slump’ For The Loonie; Where To Target? – CIBC

This is the drop in USD/CAD:

And this is the leap in WTI: