Idea of the Day

The Aussie moved below the 0.90 level yesterday on the back of the latest comments from RBA Governor Stevens, which came outside the Asia session. In essence, he repeated the same tone that has been heard before, but the timing gave the comments an outsized impact on the Aussie. He also mentioned the 0.85 level, which was a first. The RBA has been pretty vocal in its desire to see a weaker currency, which it believes will support a re-balancing of the economy. The price action in the wake of the better than expected employment data yesterday also showed that many view the Aussie as a ‘sell on rallies’. As the Swissie has recently showed (strengthening to 7 month high vs. EUR), what a central bank wants, a central bank does not always get. It depends on the underlying fundamentals. For the Aussie, these continue to suggest weakness in the bigger picture (rate cuts, valuations, re-balancing in China) and for now, the RBA is doing its best to help it along its way.

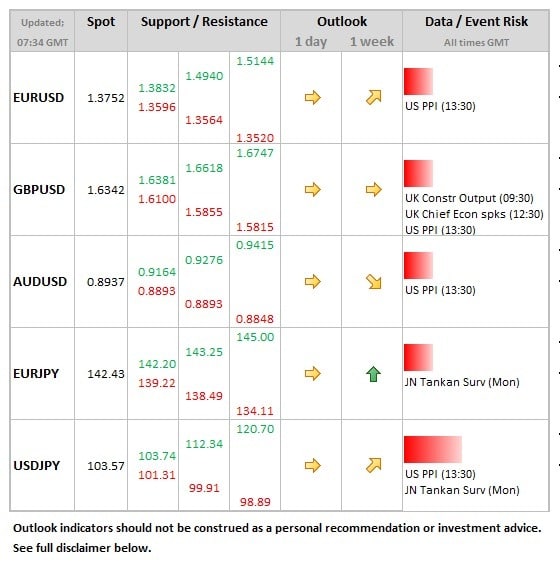

Data/Event Risks

USD: PPI data is seen flat on the MoM measure, after a small 0.2% decline seen in October. Data usually has to be way off expectations (0.5% or more) to have a noticeable impact on the dollar.

GBP: BoE Chief Economist Spencer Dale speaks at lunchtime. This should not have a major impact on sterling, but worth keeping one ear on the speech just in case there are any fresh hints on policy or the economy.

JPY: The Tankan survey is released on Monday. This is the major (quarterly) survey on the Japanese and can have a notable impact on the yen if it does change perceptions of the economy. The survey has been improving over the past 3 quarter and expectations are for further gains in Q4. Strong numbers would increase the perception that ‘Abenomics’ is starting to have an impact on the economy, helping stocks and weakening the yen.

Latest FX News

EUR: Stalling yesterday, but after 7 straight sessions of gains on EURUSD, this is perhaps not surprising. The balance is when the market is going to think that the temporary factors pushing the euro higher have run their course, which is likely to be before the year end.

AUD: Stevens comments pushing the Aussie below 0.90 and making an attack of the year’s low at 0.8848 is certainly in the picture before the remainder of the year. Holding steady during the Asia session.

JPY: A new high for the year at 103.92 for USDJPY, with EURJPY high at 142.83.

Further reading:

EUR/USD Dec. 13 – Little Movement Ahead of US Inflation Data