The central bank in New Zealand did NOT follow quite a few of its peers and left the interest rate unchanged. While this was quite expected from the outset, the actual decision came on the background of immense USD strength.

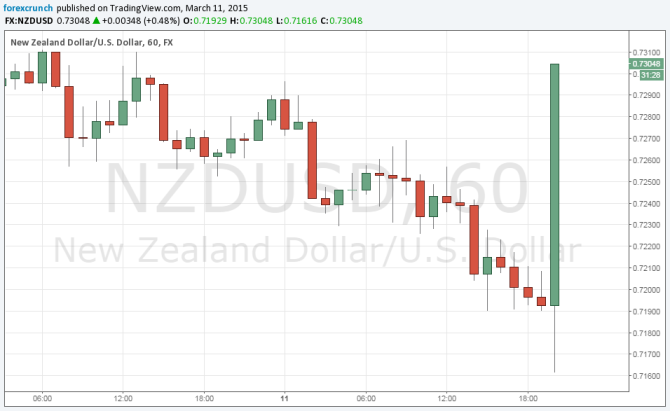

So, the kiwi is shooting higher: NZD/USD is trading around 0.7250, jumping up from below 0.72.

The institution led by Graeme Wheeler decided to keep the rate at 3.50% and said that it foresees a “period of stability for rates”, basically repeating the neutral stance expressed in the previous rate decision.

In their updated forecasts, the member of the Reserve Bank of New Zealand did cut the annual CPI forecast to 0.4% at the end of this year from 1.5% beforehand. However, GDP growth was cut from 3.5% to 3.2% – still very robust growth.

The Bank sees inflation returning to the midpoint of the range in a gradual manner.

Perhaps more importantly, RBNZ governor Wheeler stated that the he is pleased with the level of NZD/USD. This extends the pair’s ride higher – 0.7285 at the time of writing.

In addition, Wheeler said that New Zealand’s situation is different than those who cut rates. He might be hinting at neighbor Australia that surprised with a rate cut in February and maintains a dovish stance, as well as commodity peer Canada that cut the rate in January but maintains an upbeat tone.

They are still concerned over an overheating in Auckland’s housing business. This is also very bullish for the New Zealand dollar.

Update: NZD/UDS is already knocking at 0.73.

Here is the NZD/USD chart showing the clear turnaround: