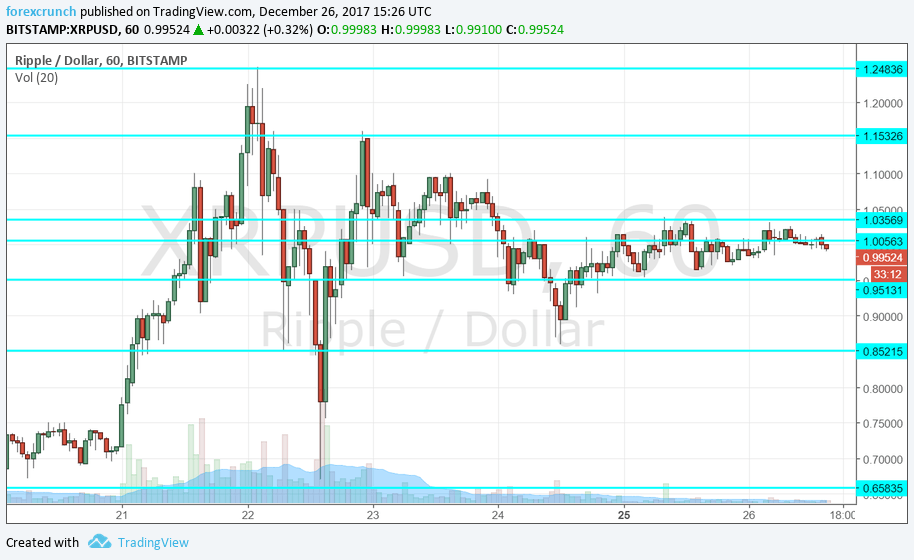

XRP/USD is currently trading at 0.993, just under the very round one dollar level. Ripple rolled over alongside other crypto-currencies in the crypto crash seen on Friday, just before the long Christmas weekend.

And like other cryptocurrencies, the long weekend allowed some time for a rest and consolidation. For Ripple/USD, we see a convergence around parity. This convergence is currently limited by resistance at 1.0357 and support at 0.9510. So, the current range is over 8 cents which may sound narrow, but this 8% range offers opportunities as well.

Update: Ripple Price: 3 reasons why XRP/USD rallies while the rest reel

Above this range, the next line of resistance awaits at 1.15, the initial peak after the big crash on Friday. And beyond this line, the high of 1.25 that was recorded just before the big fall is also a round number in addition to being the all-time high.

Looking down, we find 0.8521, a low point during around Christmas Eve. It is followed by 0.66. This was a level of support before the rush to the upside and also a swing low in the big plunge.

What’s next for this interesting digital currency? Contrary to Litecoin, where this consolidation has an upside bias, with Ripple, things look more biased.

More: Can cryptos can cause bankruptcy for brokers?

Here is how it looks on the one-hour chart: