Cryptocurrencies are suffering a sell-off: it’s a Santa rally but just in reverse. Why are digital coins coming down? Here are 5 reasons for the crypto-crash.

Ripple was initially guarded against the fall, holding its ground while bitcoin, Ethereum, bitcoin cash and litecoin were all tumbling down. However, the sell-off has arrived at XRP/USD as well.

Update: Ripple Price: 3 reasons why XRP/USD rallies while the rest reel

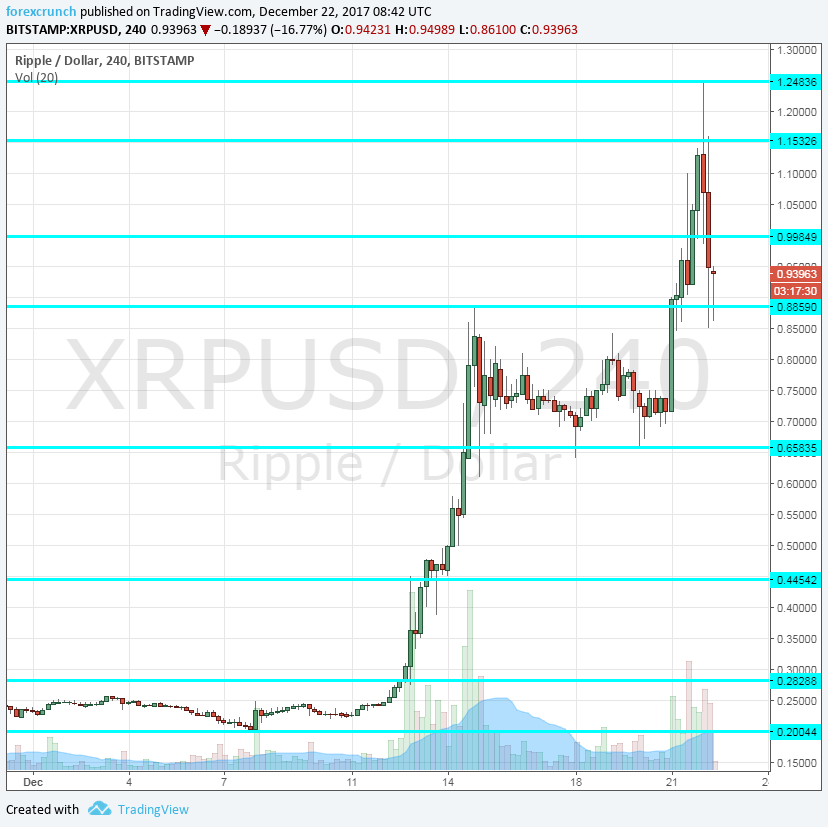

Here is the Ripple/USD chart, with descriptions of the levels following:

XRP/USD support levels

At the time of writing, XRPUSD is trading around $0.91, just two cents above a critical level. 0.89 is where the price of Ripple stalled in mid-December and the battle to hold onto this level continues.

After hitting the high of 0.89 in the middle of the month, XRP/USD traded in a clear range, with support coming in at $0.66. This is a critical cushion if 0.89 fails.

Further below, we find $0.4450, a level that worked as a stepping stone for the pair on its way up and may serve to slow down a downfall.

And before the big rally to the upside, Ripple was trading at a limited yet clear range between $0.20 and $0.28, but from current levels, it would represent a total wipeout.

XRP/USD resistance level

If this cryptocurrency holds onto 0.89 and continues recovering, the round number of $1 could work as a psychological point of resistance.

Further above, $1.15 was a more significant line of resistance in recent days. The last level to watch is the swing high of $1.4 seen just before the big crash.

It is important to note that Ripple enjoyed a boost from banks: Several banks in South Korea and Japan are testing Ripple’s blockchain technology for their use. This could help XRP stabilize while other coins continue crashing.

More: On the Bitcoin Block: 7 Myths about trading cryptocurrencies