- Ripple XRP price rebounds the strongest but fails to break the barrier at $0.7.

- The SuperTrend indicator sell signal prevails as overhead pressure begins to mount.

- Ripple’s network growth diminishes, hampering sustainable price recovery.

Ripple price recoiled from the dip to $0.52, but the recovery lost momentum under $0.7. A minor retreat secured support at $0.62, allowing for another approach toward $0.65. At the time of writing, XRP trades at $0.64 amid an impending bearish move.

Ripple’s sluggish price action has also affected most crypto assets, including Bitcoin and Ethereum. The bellwether cryptocurrency topped out at $35,000 before confirming support at $32,000. Similarly, Ether hit a barrier at $2,000 before setting above the support formed at $1,850.

How Long Will Ripple Price Struggle To Nurture The Uptrend?

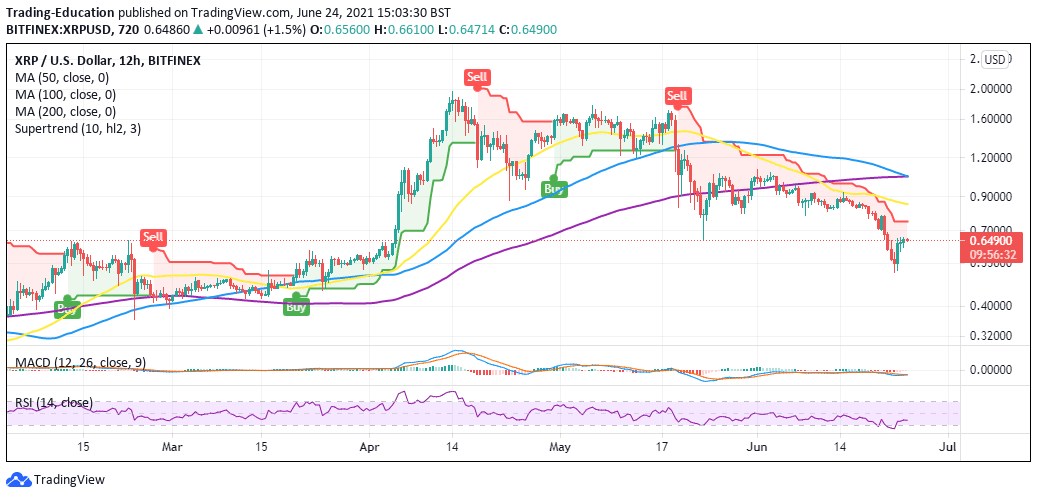

The 12-hour chart shines a light on the deteriorating technical picture starting with the SuperTrend indicator’s sell signal. This is a technical chart tool that follows the trend of an asset like a moving average. However, it uses the true average range to account for the prevailing volatility. Buy or sell signals are flashed to allow investors to enter or exit at various positions.

It is worth mentioning that when the SuperTrend closes the day above the asset’s price and turns red from green, a bearish signal occurs. On the other hand, a daily close under the price shows that buyers have the upper hand. As for Ripple price, the trend is mainly in the bears’ hands, a situation that may invalidate attempts to lift above $0.7 and close the gap to $1.

The 12-hour SuperTrend Indicator remains in the red

The same 12-hour chart illustrates a levelling Moving Average Convergence Divergence (MACD) indicator. Realize the lack of a bullish or bearish signal, which implies that consolidation may take precedence in the near term.

Subsequently, the Relative Strength Index (RSI) rebound from the oversold region stalled under the midline. A reversal to the oversold area will affirm a growing bearish grip. However, a continued levelling motion ascertains the consolidation price action.

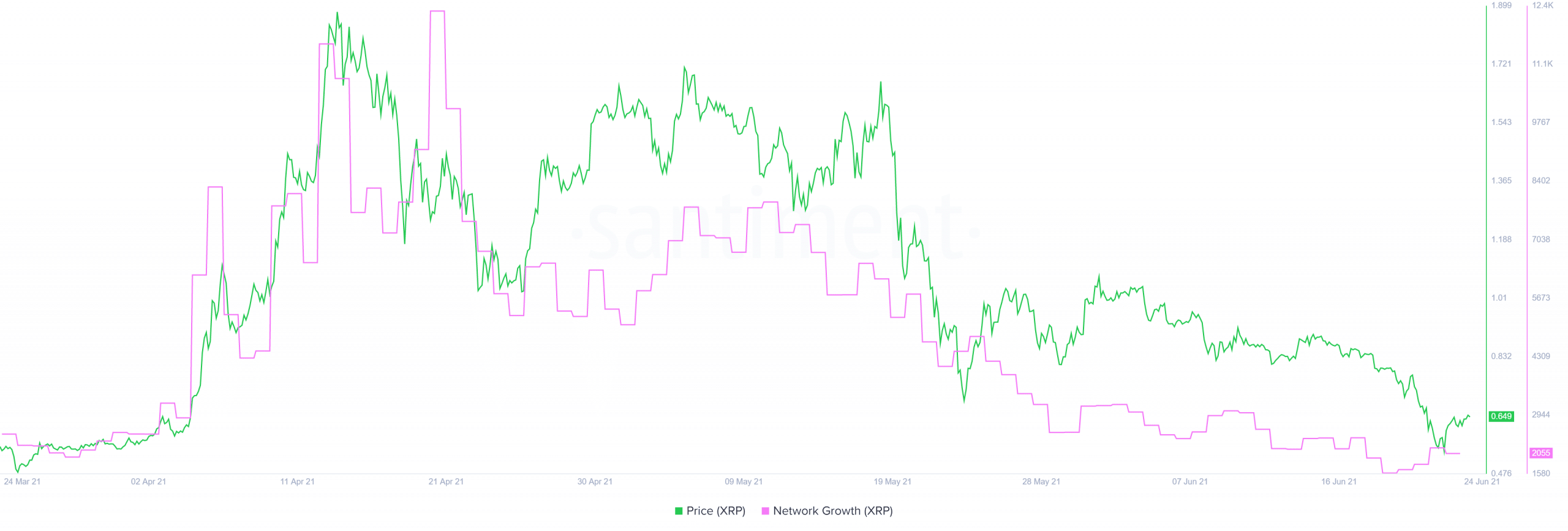

According to on-chain data by Santiment, Ripple’s network growth has fallen dramatically from a three-month high of 12,400 recorded on April 20. Notice that this metric tracks the number of new-created addresses on the XRP Ledger each day.

Ripple declining network growth flashing a bearish signal

At the time of writing, only 2,055 addresses have joined the protocol, emphasizing the reduction in new user uptake. A persistent decline infers that the project is losing traction and often negatively impact the token value. Therefore, losses are likely to continue if recovery fails to occur in the near term. On the other hand, sustaining the uptrend would be challenging, thus giving way to consolidation.

Looking to buy or trade Ripple XRP now? Invest at eToro!

Capital at risk